For years, stablecoins were treated like transit lounges. Capital passed through them, paused briefly, then moved on. They were tools for traders, liquidity buffers between volatility cycles, convenient placeholders before the next allocation. Few people viewed them as destinations. They were part of movement, not permanence.

That framing is beginning to shift.

The change did not start inside crypto. It started in everyday economies where currency instability, inflation pressure, and payment friction forced people to look for something steadier. In many parts of the world, access to a dependable digital dollar is not an experiment. It is a solution. It simplifies pricing decisions. It protects working capital. It creates predictability in places where predictability is rare.

When usage becomes practical rather than speculative, behavior changes. Stablecoins are no longer just instruments of speed. They become instruments of stability. And stability introduces a different type of demand.

Speculative capital is loud. It arrives quickly and leaves quickly. Functional capital is quiet. It accumulates. It stays. It builds habits.

Habits are where infrastructure pressure begins.

If stablecoins increasingly resemble savings rather than trading chips, then the core question shifts. It is no longer about how many tokens are issued. It becomes about where they reside and how they behave while resting. Residence matters more than issuance once balances start to linger.

When money lingers, expectations rise.

Users holding savings expect uninterrupted access. They expect fee consistency. They expect the ability to transfer value without stress during peak hours or during downturns. They expect liquidity to exist even when sentiment fades. That is a much stricter standard than what short term traders require.

Savings behavior is disciplined. It rewards systems that are predictable.

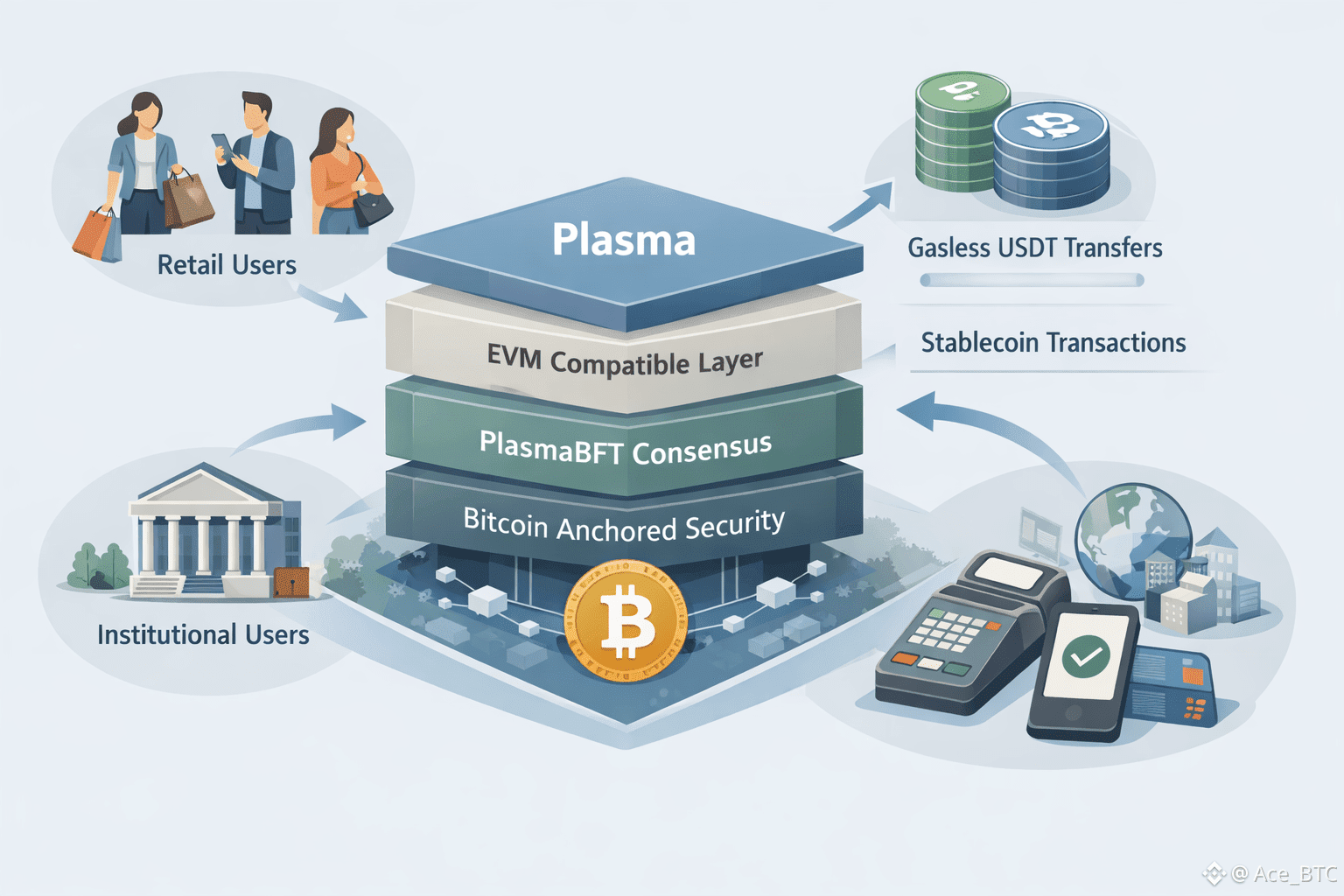

This is where the strategy behind Plasma becomes relevant. Instead of optimizing for viral growth cycles, the network appears structured around sustained financial activity. It seems less concerned with spectacle and more concerned with endurance. That distinction is subtle but important.

Systems designed for excitement handle bursts well. They attract attention, manage spikes, and capture headlines. But savings do not live in headlines. They live in routine. They demand infrastructure that feels ordinary in the best sense of the word.

Ordinary means repeatable. It means dependable throughput. It means settlement that works on quiet Tuesdays as reliably as it works during market euphoria.

In finance, boring is often a compliment.

If stablecoins are gradually taking on characteristics of deposits, then the environment that hosts them must function like financial plumbing. It must be capable of processing countless small, necessary transactions without friction. It must allow capital to sit without fear of congestion. It must support adjacent services that deposits naturally invite.

Deposits rarely remain idle forever. They seek yield. They serve as collateral. They move through payment rails. They finance obligations. A network that wants to host stablecoin balances at scale must be prepared for this cascade of financial behavior.

Plasma’s positioning suggests an awareness of that progression. Building for throughput and settlement reliability is not glamorous, but it is essential if balances begin to behave like long term holdings rather than temporary allocations.

The opportunity is not hypothetical. Across emerging and developed markets alike, individuals and businesses already use stablecoins for remittances, trade settlement, payroll distribution, and inflation protection. Many of these users are not ideologically aligned with crypto. They are pragmatists.

Pragmatic users are demanding. They compare digital systems with traditional banking. They measure reliability against what they are replacing. If onchain dollars are to compete with bank deposits, the infrastructure must match or exceed expectations for access and continuity.

This is not a marketing battle. It is an operational one.

Financial history shows that systems earn trust gradually. There is rarely a dramatic announcement that signals permanence. Instead, balances slowly increase. Transaction patterns stabilize. Volatility in behavior declines. What was once experimental becomes habitual.

The network turns into background infrastructure.

Plasma seems to be preparing for that quiet transition. Rather than predicting explosive displacement of banks, the approach appears grounded in incremental migration. Even a modest percentage of global demand for dependable dollar exposure moving onchain represents enormous scale. Preparing for that scale requires patience more than hype.

Of course, the path is not frictionless. Regulation will influence how stablecoins circulate. Custodial models will evolve. Traditional institutions will adapt. Trust cannot be declared. It must be demonstrated repeatedly.

But infrastructure that prioritizes resilience over theatrics is better positioned to handle scrutiny. When systems are designed for endurance, they tend to age more gracefully than those optimized for rapid attention.

If stablecoins continue evolving from trading tools into digital savings instruments, the networks that host them will be judged by different criteria. Users will look less at token narratives and more at uptime. Less at announcements and more at execution consistency.

Trust accumulates through uneventful confirmations. Through predictable fees. Through liquidity that appears exactly when needed.

Plasma’s bet appears to center on that accumulation. It is building with the assumption that digital dollars may need a home capable of supporting daily economic life, not just market cycles. That assumption may prove conservative. It may also prove strategic.

Financial systems rarely transform overnight. They adjust gradually, almost quietly. But incremental change compounds. What begins as a workaround can become a standard. What starts as a convenience can become infrastructure.

If stablecoins are on that trajectory, then readiness will matter more than charisma.

And readiness is something you build long before anyone notices.

Stablecoins Are Not Just Moving Capital Anymore. They Are Holding It. Plasma Is Building for That Shift.

For a long time, stablecoins were treated like temporary shelters.

Traders parked money there between positions. Liquidity providers rotated through them. Funds flowed in and out depending on market direction. Stablecoins were useful, yes. But they were not considered permanent.

They were part of motion, not part of storage.

That mindset is changing, and the reason is not hype inside crypto. It is pressure outside it.

In many parts of the world, access to a reliable dollar equivalent is no longer a speculative choice. It is a practical necessity. Businesses want predictable pricing. Freelancers want protection from currency swings. Families want insulation from inflation. Stablecoins quietly solve these problems.

And when something solves real problems, it stops being optional.

What begins as tactical usage slowly becomes routine behavior. People do not just pass through stablecoins anymore. They leave balances there. They hold. They plan around them.

That is a structural change.

When balances stay longer, the conversation shifts from transaction speed to financial residence. The key question becomes simple but powerful. Where will these digital dollars live safely and predictably?

Hosting transient liquidity is one challenge. Hosting something that behaves like savings is another.

Savings require different infrastructure. They require steady throughput, consistent costs, and confidence that access will not disappear during stress. Traders tolerate volatility in systems. Savers do not.

If stablecoins are evolving into deposit-like instruments, then the networks supporting them must evolve as well.

This is where Plasma’s positioning becomes interesting.

Instead of focusing on dramatic growth narratives, the architecture appears oriented toward endurance. Toward the assumption that capital may stay. Toward the possibility that digital dollars will need a stable base layer capable of continuous financial life.That is not glamorous work.

There are no fireworks in settlement reliability. There is no viral excitement in fee stability. But these are precisely the qualities that define mature financial environments.

Real financial centers are not built on moments of excitement. They are built on repetition. On thousands of predictable confirmations. On liquidity that shows up without headlines.

If even a small percentage of global dollar demand migrates onchain and behaves like deposits, the scale will be significant. The infrastructure must be able to handle not just peaks, but persistence.Persistence is harder.

When capital lingers, it starts asking for more. It wants yield opportunities. It wants credit markets. It wants seamless payments. It wants integration with business workflows. An ecosystem forms around stored value, not just traded value.

Plasma appears to be building with that lifecycle in mind.

Rather than assuming capital will constantly churn, it seems designed for the possibility that balances remain stable and active. That is a subtle but important difference. Systems optimized for churn often struggle with durability. Systems optimized for durability tend to survive cycles.And cycles will come.

Stablecoins will not replace traditional deposits overnight. Trust builds slowly. Regulation will influence flows. Institutions will respond. Skepticism toward digital infrastructure is rational and healthy.

But behavioral trends are difficult to ignore.

When users adopt stablecoins not because they are speculative, but because they are dependable, the nature of demand changes. It becomes quieter. It becomes steadier. It becomes embedded in daily economic life.

Infrastructure that anticipates this shift stands in a different position than infrastructure chasing temporary spikes.

Plasma’s approach suggests preparation rather than prediction. It is not assuming immediate transformation. It is preparing for gradual accumulation. For the possibility that digital dollars increasingly resemble stored value rather than trading tools.

In finance, the biggest shifts often look small at first. Balances grow quietly. Habits form. Transaction patterns normalize. What once felt experimental becomes routine.

Routine is powerful.

Because once something becomes routine, it becomes difficult to reverse.

If stablecoins are entering that phase, then the competition is not about attention. It is about reliability. Not about promises, but about performance under ordinary conditions.

Trust is earned through uneventful days. Through nights when systems stay online. Through moments when liquidity is available exactly as expected.

Plasma appears to be positioning itself around that principle. Building for stability before scale. Designing for endurance before applause.

If digital dollars continue to mature into a form of global savings infrastructure, they will need environments capable of supporting everyday economic life without friction.

The networks that understand this early will not necessarily be the loudest. But they may be the ones still standing when digital deposits become normal.And normal is where real financial power resides.