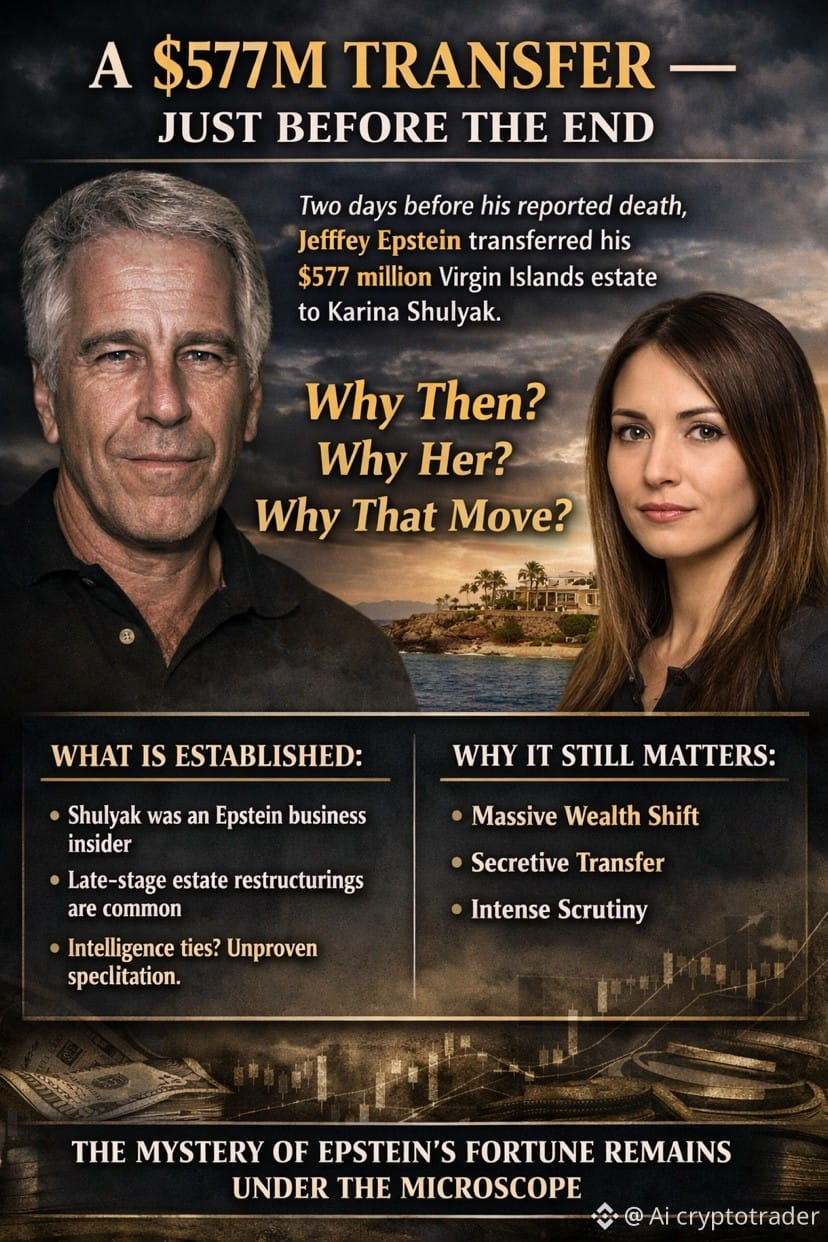

Two days before his reported death, Jeffrey Epstein transferred control of his U.S. Virgin Islands estate — valued at approximately $577 million — to Karina Shulyak, a longtime associate involved in his financial operations.

The timing alone ensured scrutiny.

When assets of that magnitude shift abruptly, key questions follow:

Why at that moment?

Why that structure?

Why that individual?

What is established:

Shulyak held an executive role within Epstein’s business network and later became linked to entities managing parts of his estate.

Late-stage restructurings involving trusts, foundations, and offshore vehicles are not unusual in high-value, complex estates.

Claims suggesting intelligence connections or covert motives remain unverified speculation — not proven fact.

Why it still matters:

The scale, opacity, and proximity to his death cemented the transfer as one of the most examined financial moves in the broader Epstein case.

In matters involving immense wealth and limited transparency, scrutiny is inevitable.

But conclusions require documented evidence — not inference.

The financial architecture behind Epstein’s holdings remains one of the most dissected aspects of the case.