$TAO Liquidity Map Signals Unfinished Upside

Liquidity on TAO is clearly stacked above the current price, suggesting that the market still has unfinished business overhead.

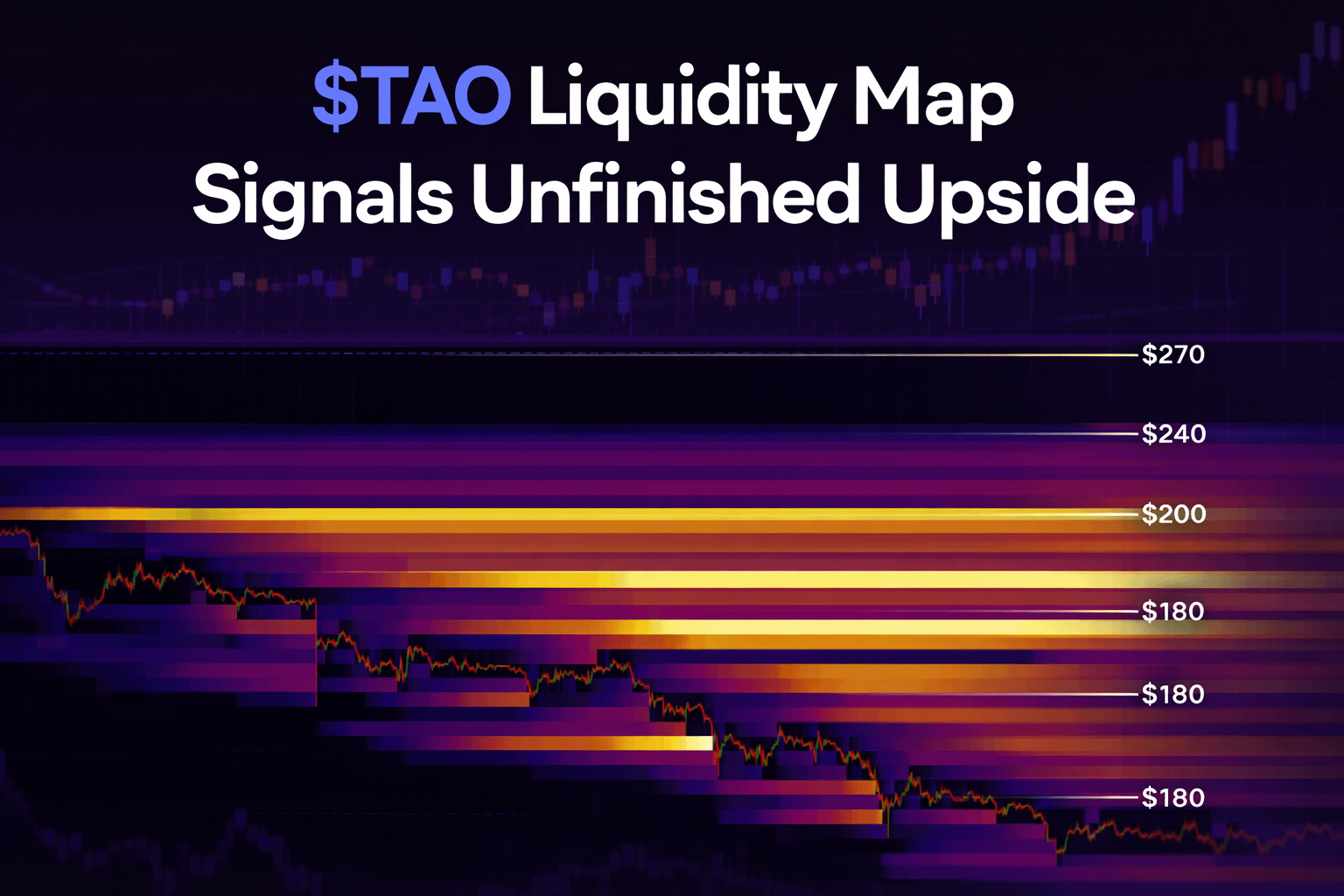

From the liquidity heatmap, the first major magnet zone is visible between $180 and $200. This area represents resting liquidity that price has not yet interacted with. Markets tend to move toward these pools over time, especially when momentum begins to build.

Above that, an even denser liquidity wall sits between $240 and $270. This zone stands out as a high-interest area where a large amount of orders are concentrated. Such structures often act as longer-term objectives rather than immediate targets.

This setup does not imply a fast or easy move. Price may take time, consolidate, or even dip further before attempting to move higher. However, as long as momentum gradually improves and structure stabilizes, the probability of price being pulled into these upper liquidity zones increases.

In simple terms:

Liquidity favors the upside

The move is likely slow and rotational, not explosive

Higher prices remain unfinished business

Patience is key. Liquidity doesn’t disappear — it waits.$BTC

#CPIWatch #CZAMAonBinanceSquare #WhaleDeRiskETH #BTCMiningDifficultyDrop #USNFPBlowout