Success in the crypto market isn't about finding a "moonshot" every day; it's about staying in the game long enough to let the math work for you. Here is the professional framework we use to maintain high-probability growth with our quantitative script.

1. The Power of "Calculated" Gains

Most retail traders fail because they chase 100x moves. Professionals chase 3%. Why? Because a 3% move with a high-conviction setup is repeatable, scalable, and keeps your emotions in check.

2. Our Strict Risk Architecture

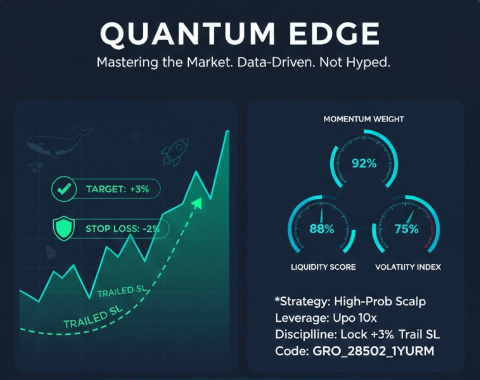

We don't hope; we calculate.

Target (TP): 3% (Price action).

Stop Loss (SL): 2% (Non-negotiable).

Leverage: We recommend a maximum of 10x for those who understand liquidation math.

3. The "Trend-Rider" Rule (Trailing SL)

When our script identifies a High Momentum Surge, we don't just exit at 3%. We evolve:

Once we hit +3%, move your SL to Break-even (+1% or +2%) to lock in profit.

For every 3% additional move, trail your SL up by 1%.

This allows you to catch the "rare" 10%+ moves while your initial capital is 100% protected.

4. Why Trust the Data?

Our script doesn't look at news or hype. It monitors Whale Flows, Liquidity Weights, and Volume Delta. When we post a signal, it means the math has already cleared the noise.

Final Note: We are building a community of real traders, not gamblers. If you are here for "get rich quick" schemes, you are in the wrong place. If you are here for sustainable, data-driven growth—Welcome to the Elite. 🥂

Save 10% on your trading fees using code: GRO_28502_1YURM 🔗

#tradingStrategy #RiskManagement #BinanceSquareTalks #WhaleAlert #scalping