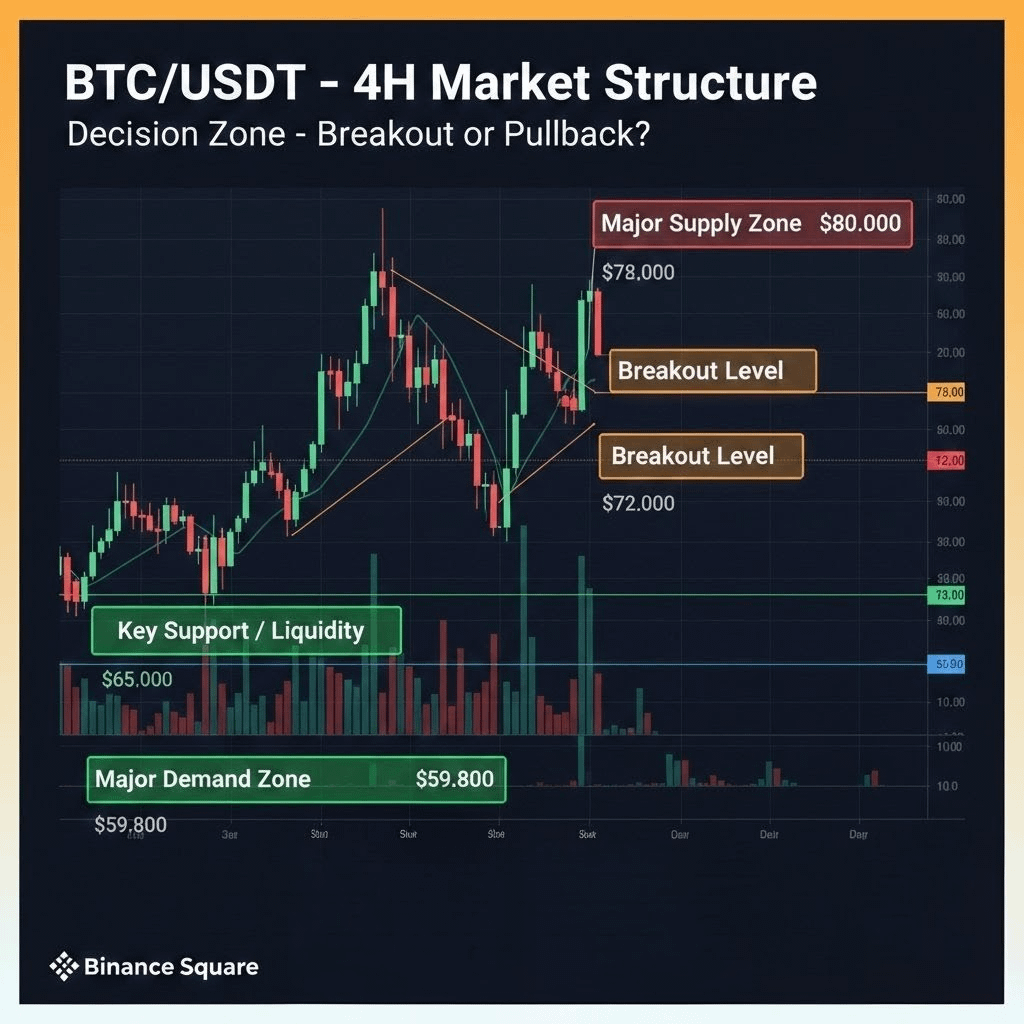

$BTC Bitcoin is currently trading around $68,850 on the 4H timeframe, showing a recovery structure after forming a major swing low near $59,800. That level acted as a strong demand zone where buyers stepped in aggressively, preventing further downside continuation. Since then, price has printed higher lows, indicating short-term bullish structure development. The immediate support zone is now established between $65,000–$66,000, which aligns with recent consolidation and liquidity build-up. As long as BTC holds above this region on 4H candle closes, the probability favors continuation toward higher resistance levels rather than a deep retracement.

$BTC On the upside, the first key resistance is positioned around $72,000, which previously acted as a breakdown zone. A decisive breakout with strong volume above this level could open the path toward the major supply area between $78,900–$80,000. However, if BTC fails to break $72K convincingly, we may see a liquidity sweep back toward $65K before the next expansion move. Traders should closely monitor volume spikes, rejection wicks, and 4H structure shifts. The market is approaching a critical decision point — disciplined entries near support or confirmed breakout strategies offer the best risk-to-reward setups in current conditions.

📌 Not financial advice. Trade with proper risk management.

Disclaimer: I am not your financial advisor.

#cryptotradinganalysisboss #BinanceSquare #TechnicalAnalysis #BTC