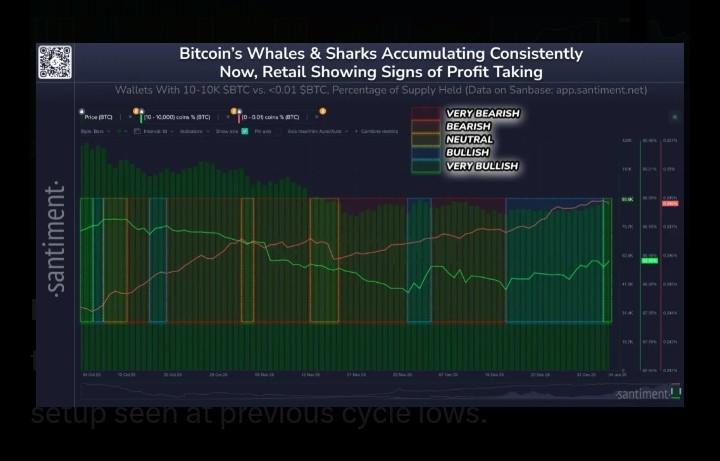

The crypto market remains in a corrective phase today, with Bitcoin hovering around $68,000–$70,000 (briefly reclaiming $70k) and Ethereum near $1,930–$2,050. Sentiment is in the “extreme fear” zone, yet on-chain data shows a clear divergence: smart money (whales) is accumulating while retail investors show capitulation signals.Bitcoin (BTC) Highlights

Whale accumulation remains aggressive — Addresses holding 1,000–10,000 BTC added ~100,000 BTC YTD (+2.1%), while 10,000–100,000 BTC wallets added ~70,000 BTC (+3.1%). Total whale buying in 2026 has reached ~170,000 BTC despite the ~40% drawdown from late-2025 highs.

fxempire.com

Notable large transfers today:

5,000 BTC ($349M) moved from a known whale wallet (“Garrett Jin” / BitcoinOG1011short) to Binance. The same wallet later withdrew ~53.12M USDT (likely proceeds from the sale) but still holds >30,000 BTC ($2.09B).

cryptorank.io

1,651 BTC (~$114M) to Binance from an unknown wallet.

A dormant Satoshi-era wallet (inactive for 14 years) received/accumulated 7,000 BTC ($470M) — one of the most significant ancient-whale moves in recent memory.

tradingview.com

Broader picture: Large whale wallets (≥1,000 BTC) hit a 4-month high in total coins held. $1M+ whale transactions have surged, and on-chain metrics (e.g., Accumulation Trend Score) show broad-based buying across mid-tier whales after the recent capitulation.

Interpretation: Whales are absorbing supply on the dip. Retail fear + whale buying is a classic setup seen at previous cycle lows.Ethereum (ETH) & Staking Milestones

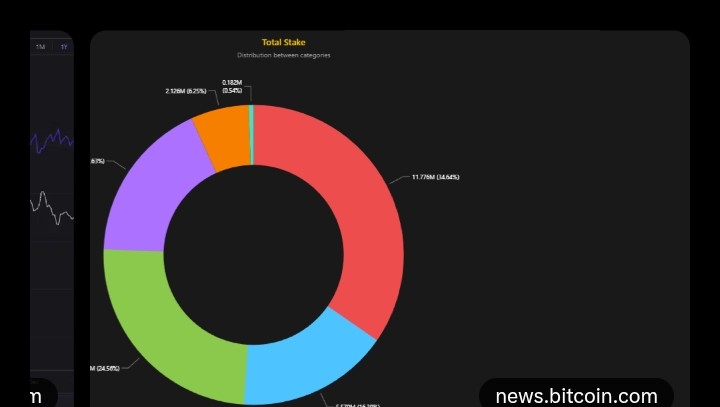

Historic staking milestone — The staking ratio crossed 30% of total supply for the first time. ~36.9–37.2 million ETH is now staked (30.6% of circulating supply, up +0.4% in the past week). This locks up ~$72B+ in value and removes significant sell pressure.

stakingrewards.com

Smart-money flows — Early February saw 220,000 ETH ($429M) withdrawn from exchanges — the largest outflow since October 2025. One whale alone staked $117M worth of ETH. Bitmine and other large entities continue aggressive accumulation and staking.

blog.mexc.com

Validator queue & rewards — High demand persists (though queues have eased from peaks), with current staking APY around 2.8–3.

Interpretation: ETH whales are “buying the dip” and locking tokens via staking, creating a structural supply shock even as price tests lower levels.Other Notable On-Chain Activity Today

Stablecoins — Tether Treasury minted/transferred 160M USDT to Bitfinex; multiple 100M+ USDT and 300M–400M USDC internal/large transfers.

Altcoin focus — Two whales withdrew ~74.4M H tokens (Humanity Protocol) from exchanges in recent months — strong accumulation signal.

Other — Gold-backed PAXG whale “samurai.eth” continued selling (~601 PAXG in the last 24h).

SummaryDespite macro caution and retail capitulation, on-chain data is bullish:

BTC whales are net buyers at scale.

ETH is seeing record staking + exchange outflows.

Large stablecoin movements suggest liquidity is being repositioned.

This classic “whales accumulate, retail fears” dynamic has preceded major reversals in past cycles. Short-term volatility remains high, but the on-chain foundation is strengthening.Charts above show the multi-month trends in staking growth and whale accumulation — both metrics continue their upward trajectory into mid-February 2026.#OnChainlnsights #WhaleActivityAlert #SmartMoneyMoves #CryptoDiscipline