Seasoned traders don’t react to the hype; they react to what the hype does to liquidity.

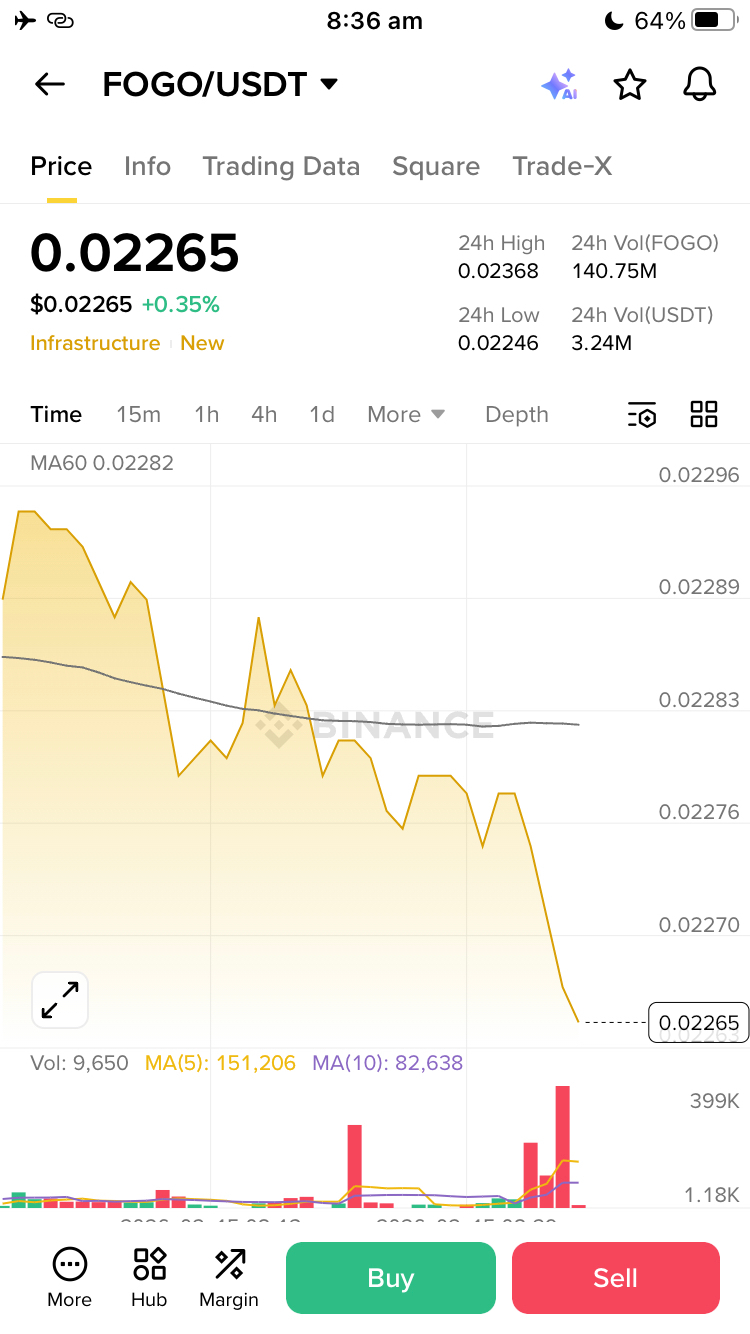

FOGO’s Binance campaign is not just a marketing gimmick; it’s a short-term liquidity driver. In the short term, liquidity drives the market, not the narrative.

Campaigns as a driver of liquidity

When Binance launches a token campaign, two things happen:

Spot trading increases significantly.

Short-term volatility tightens and then increases.

This is not a coincidence. Incentives attract market participants, which tightens liquidity and gets the market moving. This is a natural market reaction.

The question is not whether FOGO goes up.

It’s whether the liquidity sticks around or goes away.

Market structure and the behavior of market participants

Seasoned traders don’t look at price; they look at structure.

If FOGO is making higher lows and the trading volume is only decreasing slightly and not dramatically, then that’s a sign of natural adoption.

If FOGO is going up due to the incentives and then can’t hold the price when the incentives stop, then that’s a sign of distribution.

In retail, it’s typically about chasing shiny numbers and quick wins. For professionals, it’s about more nuanced factors:

- How price and participation hold firm after the incentive window has closed

- How funding continues to shift, provided it is relevant

- How high spenders tend to congregate

- How much time is spent with prices above key VWAP levels

Liquidity events are a good indicator of who is loading up and who is unloading.

Sentiment vs. Positioning

Campaigns create traction on narratives. Social media sentiment rises, participation rates explode, and interest grows.

Sentiment is not enough to launch a lasting trend. Positioning is.

When open interest is rising rapidly while spot prices are stagnant, this is leverage building before a story. It is precarious.

When spot prices quietly consume supply while derivatives are neutral, this is a better sign.

The difference between a campaign-driven price spike and an actual trend is absorption.

Absorption is something that escapes most traders.

The Deeper Angle

The following is something that is usually overlooked:

Campaign tokens often face a “post incentive vacuum.” The incentives provided artificial support to liquidity. When this support is removed, organic demand must pick up the slack. If it doesn’t, expect sharp volatility.

This is the point where seasoned traders truly shine, not in the midst of the hype but in the transition in the market’s liquidity.

It is often the case that the best indicator of price action is felt after the campaign is done.

Risk Framework

FOGO still tracks the broader market. If the dominance of BTC or the macro risk increases, the effects of the campaign can be short-lived.

For low-float tokens, the risks lie in:

- changes in the holdings of the market maker

- the rapid release of the rewards

- the lack of depth in the book

However, by participating in the campaign, the risks of the underlying stock still persist.

Final Reflection

Every time a liquidity event is felt is a test of the maturity of the market.

Is FOGO actually creating underlying demand or is it just a timely rotation of the market’s liquidity? The answer will not be found in the price action but in the action of the market after the campaign is done.