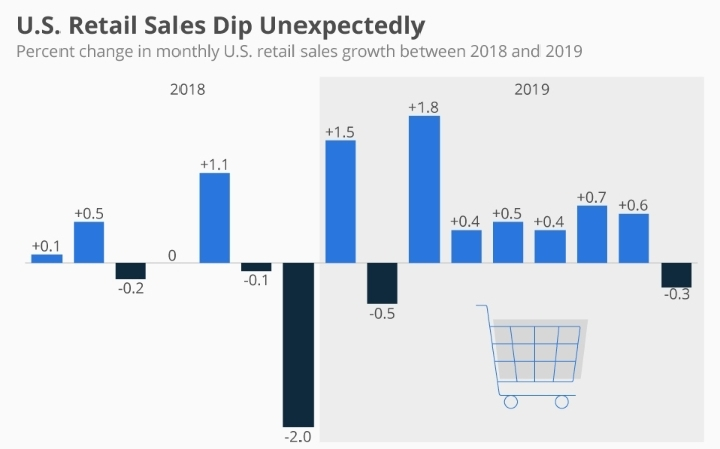

The US Retail Sales report just missed forecasts, and while stocks panicked, crypto traders leaned forward 🪙👀

Why? Because this data feeds directly into the interest-rate + liquidity story — crypto’s favorite fuel 🔥.

🛒 What This Data REALLY Means for Crypto

Retail sales show how strong the consumer is. A slowdown signals:

Economic cooling 🧊

Reduced inflation pressure

Higher probability of earlier rate cuts

And rate cuts = cheaper money 💸

Cheaper money = risk assets wake up

Risk assets waking up = crypto starts stretching 🐍📈

📉 Short-Term Pain, Long-Term Opportunity?

Right after the miss, markets often see:

❌ Risk-off moves

❌ Quick BTC pullbacks

❌ Altcoins shaking out weak hands

But here’s the twist 😈

Retail sales weakness forces policymakers closer to easing, and easing has historically been a tailwind for crypto cycles.

🪙 $BTC , $ETH & Altcoins: What to Watch

Bitcoin: Acts as a macro hedge — volatility first, direction later

Ethereum: Sensitive to liquidity shifts and risk sentiment

Altcoins: High beta = violent moves (both up & down)

This is where positioning matters more than predictions 🎯

🧠 Smart Trader Checklist

✔ Watch upcoming inflation data

✔ Track rate-cut probability shifts

✔ Expect fake moves before real direction

✔ Protect downside, stay ready for upside

🔥 Final Crypto Take

This retail sales miss is not bearish — it’s early-stage macro fuel ⛽

Crypto doesn’t pump on good news… it pumps on liquidity expectations.

Volatility is the entrance fee.

Patience is the edge.

🔇

#USRetailSalesMissForecast #MarketRebound