Most traders react to emotion.

Professionals react to structure + psychology.

Let’s talk facts

---

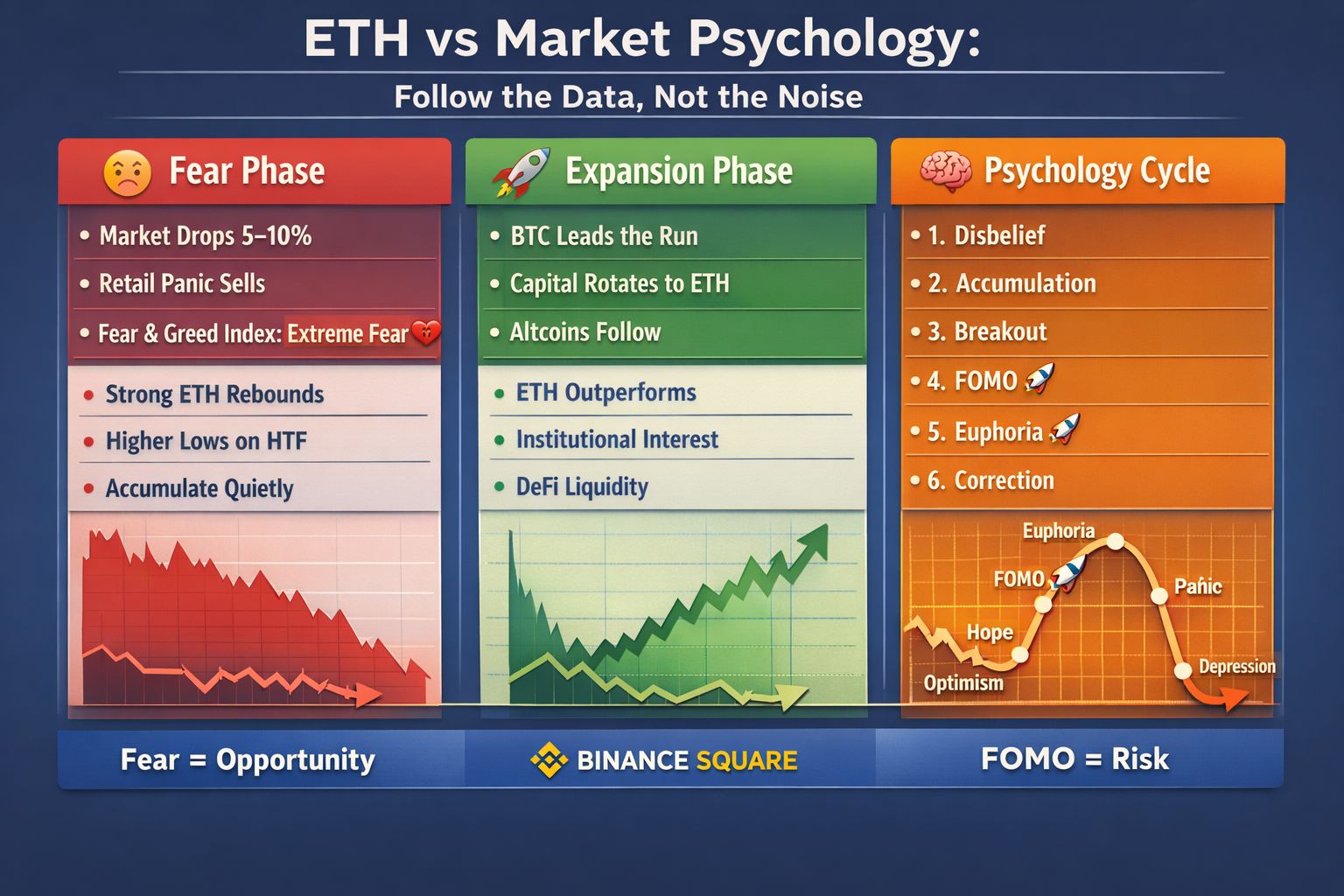

📉 During Fear Phases

When the market drops 5–10%:

• Retail panic sells

• Funding rates reset

• Liquidations spike

• Fear & Greed Index moves toward Extreme Fear

Historically, these zones are where accumulation begins.

ETH repeatedly shows: 🔹 Strong rebounds after fear-driven flushes

🔹 Higher lows on higher timeframes

🔹 Relative strength vs many altcoins

Fear creates discounts.

---

📈 During Expansion Phases

When momentum returns:

• BTC leads

• Capital rotates

• ETH accelerates

• Altcoins follow

ETH often outperforms in the middle phase of market cycles because: 🔹 It’s large enough for institutions

🔹 It’s volatile enough for traders

🔹 It’s foundational for DeFi liquidity

That balance matters.

---

🧠 The Psychology Cycle

1. Disbelief

2. Accumulation

3. Breakout

4. FOMO

5. Euphoria

6. Correction

Most people enter at Step 4.

Smart positioning happens at Step 2.

---

The Bigger Picture

ETH isn’t just a coin.

It’s infrastructure.

When markets panic — it absorbs.

When markets recover — it expands.

Volatility is emotional. Structure is mathematical.

---

💬 Question:

Are you reacting to candles…

or positioning based on psychology + data?

Id love to hear your thoughts every thought matters

#ETH #EthereumNews #Marketpsychology #CryptoPatience o #BinanceSquare