Bitcoin at $2.1 Trillion Market Cap: What really moves $BTC still in 2025?

As BTC remains around $2.1 trillion Mcap, volatility seems calmer, but sharper, with movements of 5 to 10% amid macroeconomic news and not in the midst of momentary hypes. A new CryptoSlate Institutional study shows the hidden manipulators behind these increases and falls, mixing on-chain data, sentiment analysis and global economy signals.

The most interesting thing is: They are not just ETF's flows, it is a junction of institutional FOMO and governments amid the maturation of Bitcoin as digital gold.

The study, which brings Glassnode and Santiment metrics, highlights four main catalysts.

• First, macroeconomic pulses: Fed rate cuts or increases now move $BTC by 15-20% in weeks, as lower yields push capital into scarce assets such as Bitcoin, while increases trigger rapid declines of 8-12% in risk assets. At this limit, the correlation with the Nasdaq reaches 0.75, making the volatility of the Stock Market a direct accelerator of $BTC.

• Second, speed of adoption: cash ETF flows have increased by $45 billion in the year, but real capital comes from corporate treasuries, with a massive investment in Bitcoin, in the MicroStrategy style adding more than $500 million in monthly purchases. And also the purchases of the nation-state, as whispers of the US strategic reserves, can trigger more than highs whenever they are landed.

• Third, on-chain analysis: Hash rate peaks (now at 650 EH/s) signal the miner's conviction, correlating with price increases of 10% during the bullish days.

What about the accumulation of whales? When addresses that have more than 1,000 BTC buy more than 50,000 Bitcoin units weekly, this generates an increase of +7%. On the other hand, exchange flows above 20,000 BTC signal 5-8% of red flags, since profit-making floods the market with volatility and liquidations.

• Fourth, sentiment and regulation: The fear/greed rate oscillating rapidly between 20-80 shows all this volatility on the market in its entirety. Pro-crypto bills in the EU and the US (such as FIT21) increase confidence by 12%, while repressions in Asia cut 6-9% of peaks.

The most important thing for you to understand: At US$ 2.1T of Mcap, it is already inevitable to say that Bitcoin is a casino, it has become a store of value and one of the main assets for global liquidity, with 60% of the movements traceable to these factors against 30% in the 2021 ATH.

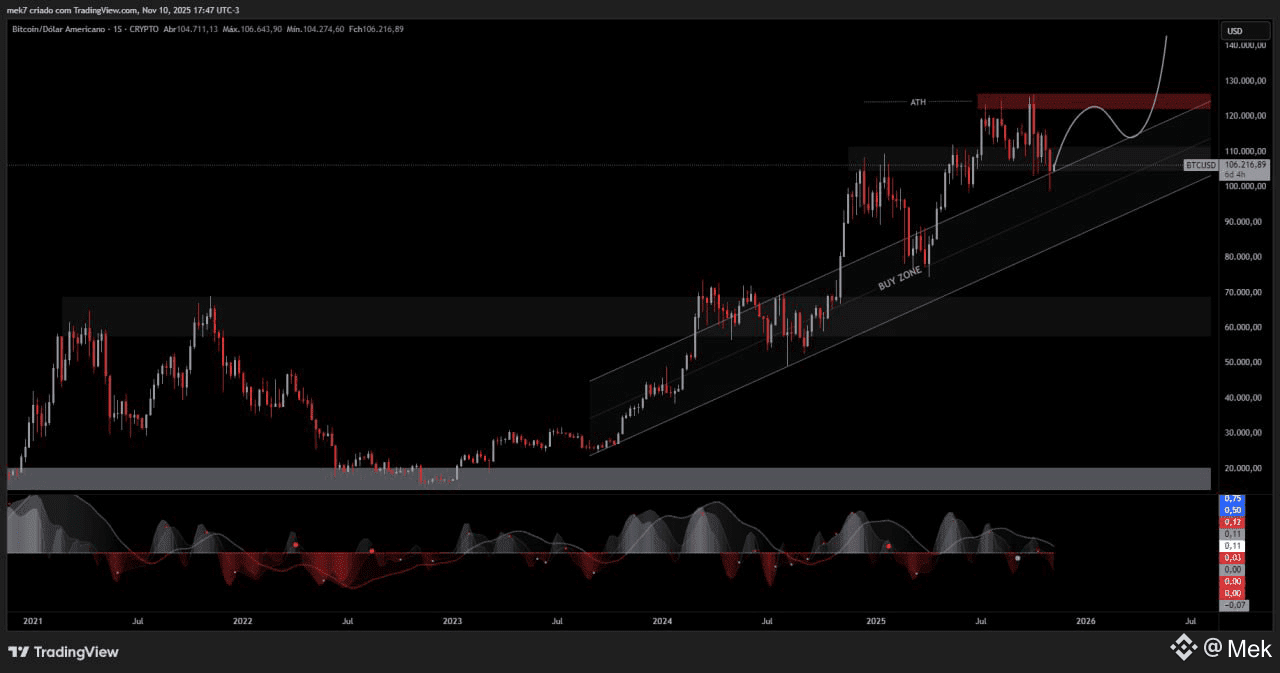

Volatility fell 40% YoY, but the positive asymmetry shines, with Bull Runs in average cycles of 180% above the lows. As we reach November 2025, with the CPI cooling to 2.1% and the technical analysis shows to be an accumulation zone, eyes on US$ 120 thousand by the end of this fourth quarter and US$ 140,000 at the beginning of next year.

Traders, what's your Top $BTC vision this cycle, macro or on-chain? 👇