As crypto payments move closer to everyday use, crypto cards have become a practical tool for cross-border spending, ad payments, and premium subscriptions. Yet one long-standing problem remains unresolved: Money sitting in a card account does nothing until it is spent. This inefficiency is exactly what an on-chain yield card is designed to solve.

In this guide, we’ll explain what an on-chain yield card is, how Earn While You Spend works in practice, the security and self-custody model behind it, real-world implementation examples (BenPay), and who this product is best suited for.

What Is an On-Chain Yield Card?

An on-chain yield card is a crypto payment card that enables the card account balance to participate in on-chain earnings after the "Earn" button is activated by the user. In simple terms: An on-chain yield card = a crypto payment card combined with an on-chain yield mechanism based on the balance of the card account

Unlike traditional crypto cards, where balances sit idle until spent, an on-chain yield card ensures that unused funds continue to work and generate on-chain yield in the background.

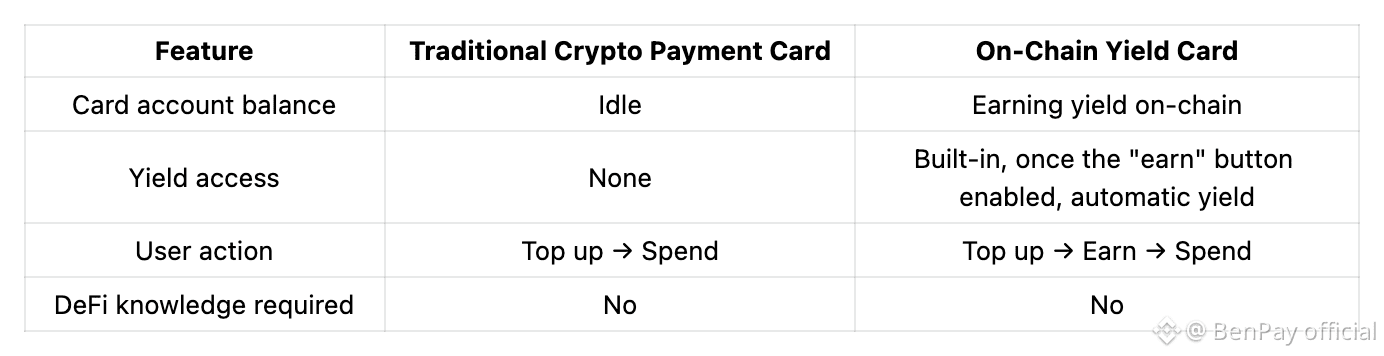

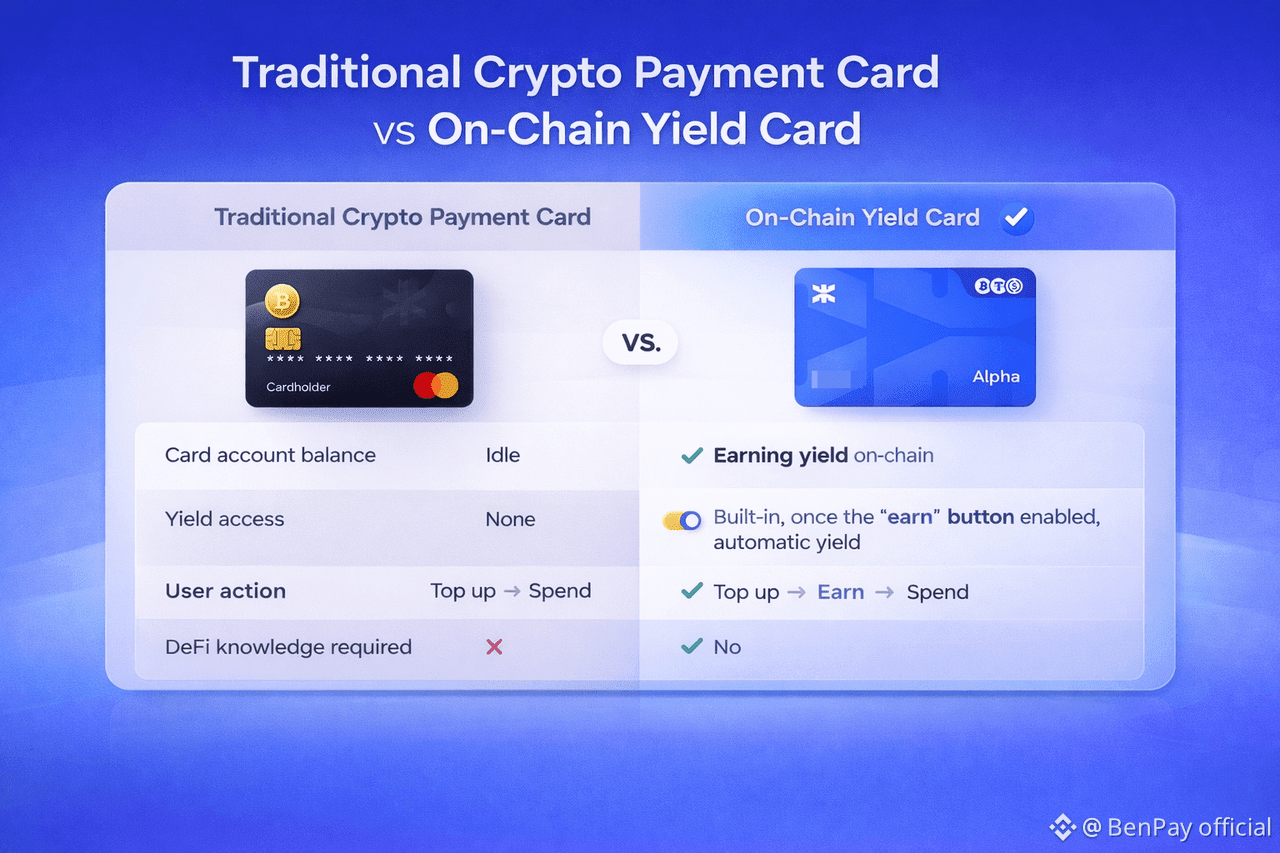

Key Differences from Traditional Crypto Cards

Users do not need to manually participate in DeFi or understand complex DeFi protocols. After activating the "Earn" button, as long as the funds remain in the card account, they can continuously generate on-chain returns.

How “Earn While You Spend” Works

Card Account Balance-Based On-Chain Yield Model

In an on-chain yield card, Earn While You Spend refers to a card account balance-based on-chain yield mechanism, not transaction-based rewards. Instead of earning from each payment, users earn an on-chain yield from the unspent portion of their card account balance.

Here’s how it works in practice:

Card Account Balances Remain On-Chain

When users top up stablecoins into an on-chain yield card, those funds are held in an on-chain wallet linked to the card. Before being consumed, the balance of the card account remains on the chain, enabling it to be compatible with smart contracts and on-chain yield protocols. The card itself is merely a payment interface, not an asset custodian.

Idle Funds Are Automatically Allocated to Yield

Any portion of the card account balance that is not immediately spent is considered idle funds. After users activate the "Earn" function, these idle funds are allocated into high-liquid, relatively low-risk on-chain yield strategies.

After starting to "earn", the entire process is automated for users:

No manual deposits

No complex DeFi knowledge required

From the user's perspective, the card account balance will continue to accrue on-chain yield during the period the "earn" is active.

Spending Does Not Interrupt Earning

A key feature of the Earn While You Spend model is that earning and spending happen simultaneously. When a user makes a payment:

The amount spent will be deducted from the card balance

The remaining balance in the card account will continue to generate income

The funds in the card account can always be used immediately

For example, if a user tops up 1,000 USDT to the card account and spends 300 USDT on the card, the remaining 700 USDT in the card account will continuously generate on-chain income until it is spent.

Not Cashback, Not Rewards

It’s important to clarify that this model is fundamentally different from cashback or reward cards.

Yield is not generated by spending

There are no per-transaction incentives

Earnings come from time and the balance size of the card account, not from usage frequency

Yield accrues as long as funds remain in the card account. The longer funds remain in the card account, the more yield they generate—without affecting the user’s ability to spend.

Therefore, the true meaning of "earn while you spend" is that users do not have to choose between "using funds" and "letting the funds make money." They can consume freely while allowing the remaining balance in their card accounts to continuously participate in on-chain yield in the background.

Security and Self-Custody

Security is the foundation of any on-chain financial product.

Self-Custodial Architecture

Most mature on-chain yield cards adopt a self-custodial architecture, meaning:

Users retain full control of their assets

The platform does not freely move user funds

Asset states can be verified on-chain

In practice: The card is a spending interface, not a custodian of assets.

Yield Strategies Designed for Liquidity

Unlike aggressive DeFi investments, yield strategies behind on-chain yield cards prioritize:

High liquidity

Ability to withdraw funds at any time

Capital preservation over maximum APY

The objective is not yield maximization, but: Stable, uninterrupted earnings while maintaining spendability

Clear Risk Boundaries

An on-chain yield card is:

Not risk-free

But it has a significantly lower risk than active DeFi investing

Comparable to an “on-chain money market” experience

This balance makes it suitable for users who want yield without complexity.

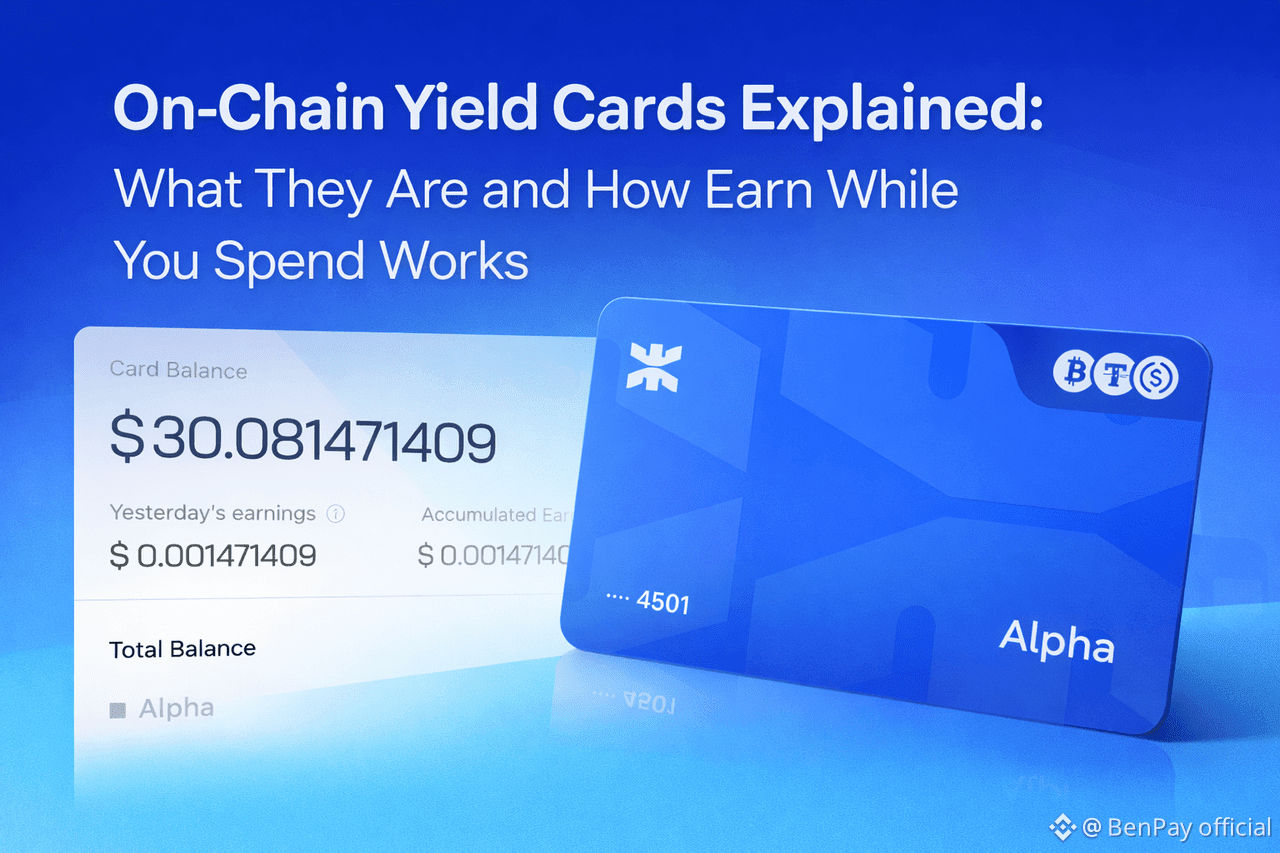

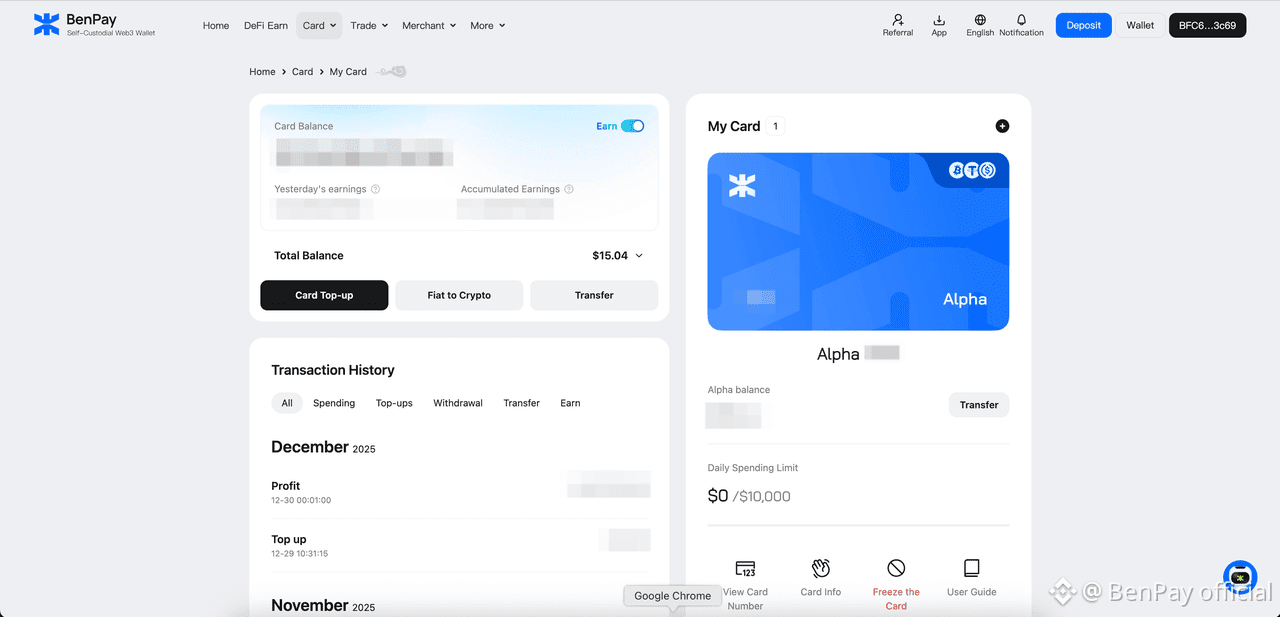

Real-World Implementation Example: BenPay On-Chain Yield Card

To illustrate how an on-chain yield card works in practice, consider the BenPay On-Chain Yield Card (mentioned purely as an example).

Users top up stablecoins (USDT/USDC) to card accounts for daily spending

Unused card account balances will automatically participate in on-chain yield after the user actively activates the earn function

Daily earnings are visible, such as: “Yesterday’s yield: +2 USDT”

No additional action is required, and spending remains seamless

The key innovation is not high yield, but changing the default state of card account balances from "idle funds" to "on-chain assets that can generate value". This transformation has also fundamentally changed users' perception of card account balances: the money in the card account is no longer just temporary consumption funds, but a continuously operating asset.

Who is an on-chain yield card Best Suited For?

Cross-Border Spenders and Ad Buyers

Typical traits

Frequently top up 100–2,000 stablecoins

Do not spend the full balance immediately

Highly sensitive to fees and card costs

Why it fits

Idle balances no longer feel “wasted.”

Even non-yield-focused users perceive higher value

The card feels economically smarter

Web3 and Crypto-Native Users

Typical traits

Hold stablecoins long-term

Understand DeFi but prefer automation

Care about capital efficiency

Why it fits

Passive yield without manual strategy management

Improved utilization of funds already sitting in the card account

No operational overhead

Non-Crypto Users

Typical traits

No DeFi knowledge

Understand “on-chain yield of card account balance” concepts

Want safety, simplicity, and automation

Why it fits

Extremely low learning curve

Visualized daily earnings build trust

Acts as a gateway into on-chain finance

Typical User Scenarios

Scenario A: Idle Balance Awareness

A user tops up 1,000 USDT for spending. Only 300 USDT is used . The remaining 700 USDT earns yield automatically.

The user realizes the card account balance is no longer “dead money.”

Scenario B: Card Comparison Decision

When comparing multiple crypto cards:

One card offers cashback

Another offers a yield on the card account balance

The realization that “My money won’t sit idle here” is often used to justify higher upfront costs.

Scenario C: DeFi Without the Hassle

A Web3 user wants yield, but:

Doesn’t want to manage complex DeFi protocols

Fears of operational mistakes

The on-chain yield card offers: Curated DeFi strategies + instant liquidity

Why On-Chain Yield Cards Matter

Strategically, the on-chain yield card serves as the lowest-friction entry point into DeFi

By introducing users to:

Passive yield

Visible daily returns

On-chain trust

It naturally prepares them for:

Higher-yield strategies

More advanced DeFi products

Larger capital commitments

FAQ: On-Chain Yield Cards

Where does the yield come from?

From on-chain yield protocols, not platform subsidies.

Does earning yield affect spending speed?

No. Spending and earning on-chain yield can happen simultaneously.

Do I need Complex DeFi knowledge?

No. Users only need to enable the earn function independently. The subsequent on-chain interest generation process will be automatically executed by the system, and users do not need to perform any DeFi operations.

Is it risk-free?

No on-chain product is risk-free, but risk is significantly lower than active DeFi.

Is it meant for long-term investing?

It’s best for idle balances used for spending and storage—not high-risk investing.

Final Thoughts

The On-Chain Yield Card is not merely for obtaining earnings. Its true value lies in solving the problems of idle funds and inefficient use, allowing your assets to continuously increase in value through consumption and payment. By turning idle balances into productive assets, it transforms a crypto payment card into a value-generating financial interface, bridging everyday spending and on-chain finance in a way that feels natural, simple, and sustainable.

Risk Notice

On-chain yield cards are not risk-free. Funds are exposed to on-chain protocols, smart contract risks, and market fluctuations. Users should understand that earnings are not guaranteed. Always review platform terms and consider potential losses before using them.