🔴 Scenario 1: SHORT (Primary Bias)

Rationale

HTF bearish structure

Weak pullbacks

Volume + OI + Funding all align with downside continuation

Invalidation

Strong acceptance and close above 1.56

Entry Zone: 1.529 – 1.561

Execution:

Limit sell at supply

Or market entry after bearish rejection / 15m displacement

Stop Loss: 1.567

Targets

TP1: 1.503

TP2: 1.473

TP3: 1.433 (HTF demand)

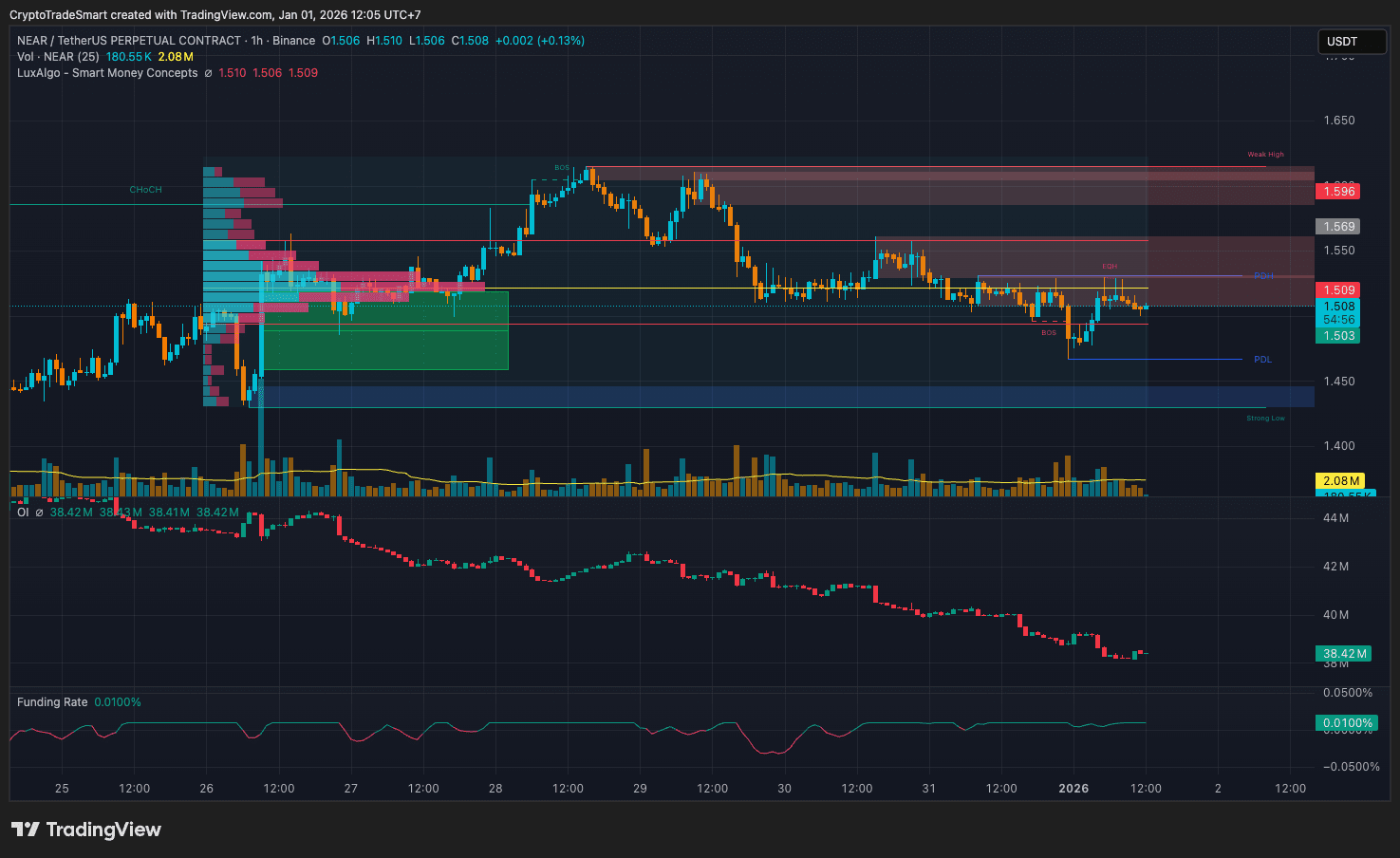

1. Market Structure (SMC)

The higher-timeframe structure on 1H remains bearish.

After a prior bullish CHoCH, price failed to hold bullish BOS and was strongly rejected from the upper supply.

Recent price action shows:

Lower High formation

A confirmed bearish BOS near the 1.50 area

The current consolidation is a bearish pullback, not a trend reversal.

SMC Bias:

➡️ Bearish continuation after distribution.

2. Key Price Zones

Supply / Resistance Zones

1.53 – 1.56

Clear 1H supply

Confluence with EQH

~1.58 – 1.61 (Weak High)

Only relevant if a short squeeze occurs (no signal yet)

Mid-Range / Value Area

~1.50 – 1.53

POC + high interaction zone

Acts as short-term balance, but below HTF value

Demand / Support Zones

1.50 – 1.47

PDL, weak low, vulnerable to liquidity sweep

1.45 – 1.43

Strong HTF demand

Higher probability reaction zone

3. Volume & Volume Profile

Volume Behavior

Sell-offs are accompanied by increasing volume.

Pullbacks and bounces show declining volume, indicating weak demand.

No bullish displacement candles with strong volume confirmation.

Volume Profile

POC located around 1.52 – 1.53

Price is currently accepted below POC, which is bearish.

Below POC:

Thin volume → higher probability of fast downside expansion

Above 1.55:

Low-volume area → suitable for sell premium, not accumulation

➡️ Volume confirms distribution, not accumulation.

4. Open Interest & Funding Rate

Open Interest (OI)

OI has been steadily decreasing.

During recent pullbacks: No meaningful OI expansion

➡️ Indicates:

No strong new longs entering

Mostly short covering + lack of real demand

Funding Rate

Funding remains slightly positive (~0.01%)

Longs are still paying shorts

Market is not short-crowded

➡️ No short squeeze conditions present.

5. Trade Scenarios

🔴 Scenario 1: SHORT (Primary Bias)

Rationale

HTF bearish structure

Weak pullbacks

Volume + OI + Funding all align with downside continuation

Invalidation

Strong acceptance and close above 1.56

Entry Zone: 1.529 – 1.561

Execution:

Limit sell at supply

Or market entry after bearish rejection / 15m displacement

Stop Loss: 1.567

Targets

TP1: 1.503

TP2: 1.473

TP3: 1.433 (HTF demand)

🟡 Scenario 2: No Trade / Wait

If price ranges tightly around 1.51 – 1.52

Low volume, declining OI

➡️ High probability of traps on both sides

❌ Scenario 3: LONG (Low Probability)

Only consider longs if:

Price breaks and holds above 1.61

Followed by:

Strong bullish displacement

Rising OI

Funding cooling toward neutral or negative

➡️ Currently no confirmation for this scenario.

Final Takeaway

NEARUSDT remains in a bearish continuation phase.

The current price action is corrective and distributive, not accumulation.

Bias stays short-on-rallies until market structure and derivatives data change.

#trading #TradingSignal #futures

✍️ Written by @CryptoTradeSmart

Crypto Insights | Trading Perspectives

⚠️ DISCLAIMER:

NOT financial advice. Perpetuals trading is high risk - you can lose your entire capital. This is my personal setup for educational purposes only. Always DYOR, use strict risk management, and never risk more than you can afford to lose. You are solely responsible for your decisions.

Trade safe! 🎯