Privacy-focused cryptocurrency Dash (DASH) has attracted renewed trader interest as price action stabilizes after recent volatility. After a period of sideways movement and consolidation, technical indicators and market structure suggest potential for further upside continuation provided key support levels hold.

Current Market Action

DASH’s price has been trading within a relatively tight range in the short term, reflecting consolidation after recent gains. This phase has allowed some rebuilding of bullish momentum as buyers and sellers find a new equilibrium.

Recent technical summaries show bullish signals on short-term indicators, with momentum oscillators and moving averages pointing toward continued positive bias. However, overbought conditions in some metrics highlight the potential for short-term cooldowns before further advances.

Key Technical Levels

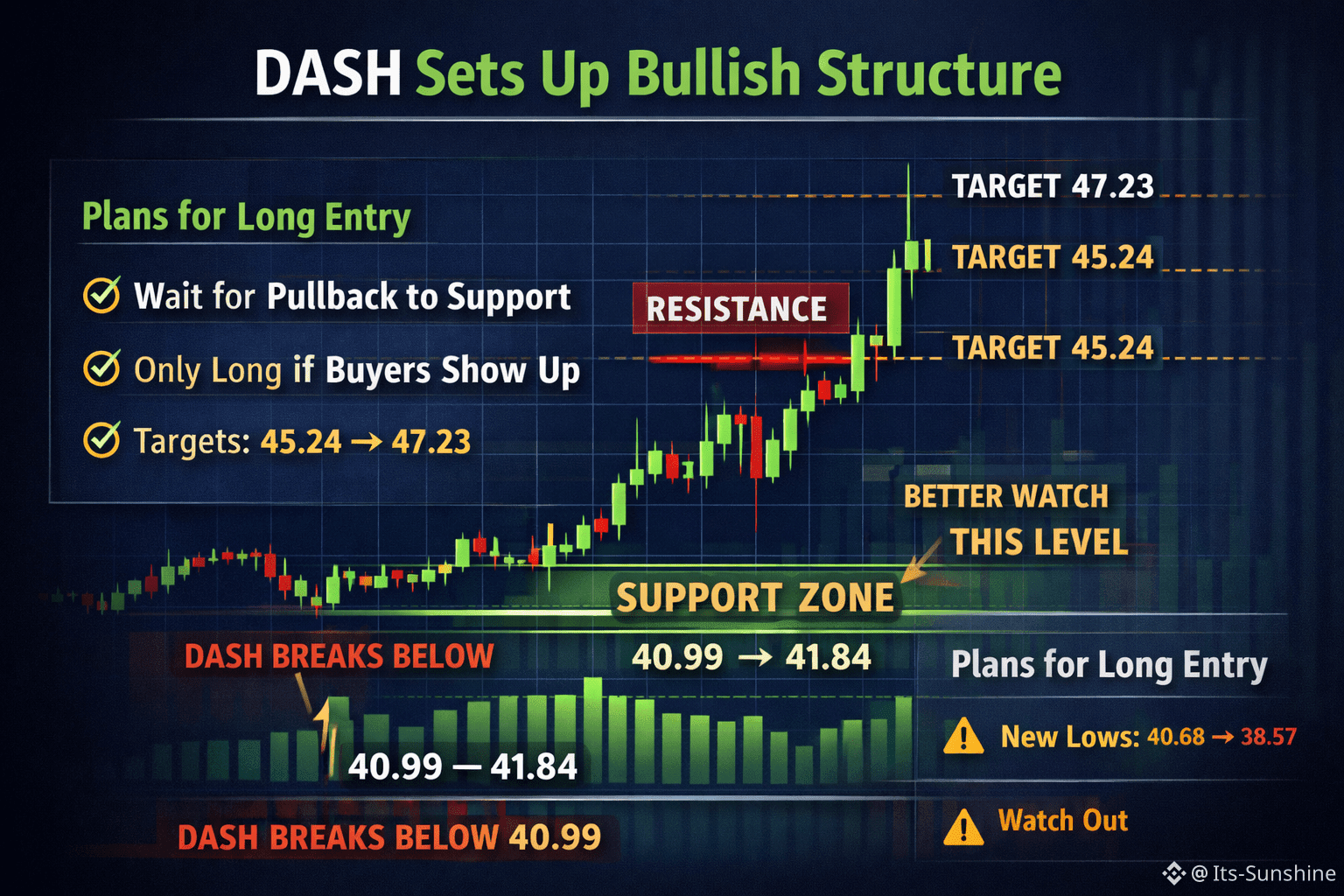

Traders are focusing on key short-term zones that could define the next directional move:

Support area:

Around mid-$40s — holding above ~41.8 supports bullish structure.

Resistance levels: Near $45–$46, with higher barriers forming around $48–$50.

As long as price remains above the support range, the bullish structure remains intact. A deeper pullback into the support area could offer more attractive entry opportunities for continuation setups, particularly if buyers show strength and clean technical confirmations (such as bullish candlestick patterns). A breach of lower support, however, may shift short-term tone toward neutral or corrective action.

Potential Scenarios for Traders

Bullish continuation:

If DASH maintains support above roughly 41.8 and overcomes resistance near the mid-$40s, traders could see follow-through toward higher levels — including ~$45 and beyond into the upper $40s. Continued strength could build a case for upside toward $50+ in alignment with broader price compression breakouts seen in similar altcoin moves.

Correction risk:

A break below critical near-term support would open the door to deeper retracements. Traders would then watch for momentum to shift lower, potentially testing sub-$40 levels before recovering. Sustained violation of support could signal weakening short-term structure.

Broader Market and Sentiment

DASH’s recent performance fits into a larger trend of renewed interest in privacy-focused assets, which have seen significant volume increases and price rebounds earlier in 2025. While broader crypto market conditions remain mixed, Dash’s technical resilience and higher volumes around key moves suggest heightened engagement from traders.

Summary:

Dash looks technically poised for potential continuation, but its near-term trajectory will depend heavily on support holding and clean confirmation of demand at key levels. Price structure remains constructive for upside scenarios, with clear risk defined below critical support zones.

#WriteToEarnUpgrade #DASH #BTC90kChristmas #BinanceAlphaAlert