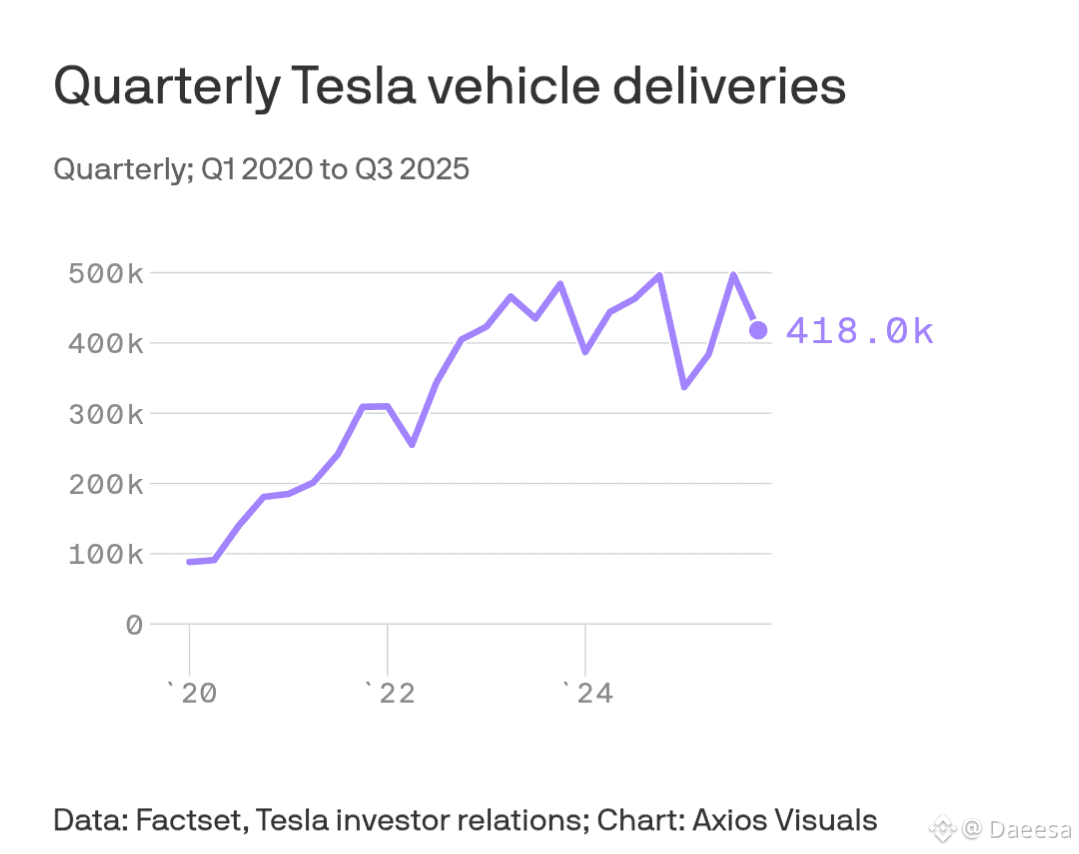

According to Axios, Tesla has reported its second consecutive annual decline in vehicle sales, marking its weakest performance since 2022 — a major red flag for the world’s most closely watched EV maker.

In 2025, Tesla delivered 1.64 million vehicles, an 8.6% year-over-year drop, while Chinese rival BYD surged ahead with 2.26 million EV sales, overtaking Tesla for the first full year ever.

🔍 Why This Matters

Tesla’s vehicle sales are the financial backbone of CEO Elon Musk’s grand vision — funding AI development, humanoid robots, and full self-driving technology. A prolonged slowdown puts pressure on those ambitions.

📉 The Numbers Tell a Tough Story

Q4 2025 deliveries: 418,227 vehicles

Down 15.6% compared to Q4 2024

Worst Q4 since 2022

Deliveries now 9.5% below Tesla’s 2023 all-time high

Missed Wall Street expectations despite a late-year buying rush before U.S. EV tax credits expired

⚠️ What Went Wrong?

Political backlash: Tesla faced consumer resistance after Musk’s high-profile political involvement in early 2025. Musk himself admitted the blowback hurt sales.

EV tax credit expiration: Demand cooled sharply once federal incentives ended.

Aging lineup: Tesla hasn’t launched a brand-new vehicle or fully redesigned its core models in years, while rivals innovate rapidly.

Rising competition: BYD and other global EV makers are delivering cheaper, newer, and more diverse models at scale.

📊 Market Reaction

Despite the grim headlines, Tesla shares rose 0.7% in early trading, as results came in slightly better than pessimistic “whisper numbers,” according to analysts.

🔮 What to Watch in 2026

Tesla is betting big on autonomy. Its self-driving car service in Austin, Texas, could be a make-or-break catalyst if expanded successfully. The question is whether autonomous tech can offset slowing car sales before investor patience runs out.

Bottom line: Tesla is no longer the uncontested EV king. With sales slipping, competition surging, and public sentiment divided, 2026 could define whether Tesla rebounds — or permanently loses its edge.