🔵 Scenario A – Bullish Continuation (Primary Bias)

Conditions

Price holds above 1.62 – 1.65 (POC/HVN)

No 1H close below 1.47

Execution Idea

Prefer:

Pullback to 1.62 – 1.65

Or deeper pullback into 1.53 – 1.55

Entry:

Wait for lower timeframe bullish confirmation (15m CHoCH / absorption)

Targets:

1.72

1.78

Invalidation

1H close below 1.47

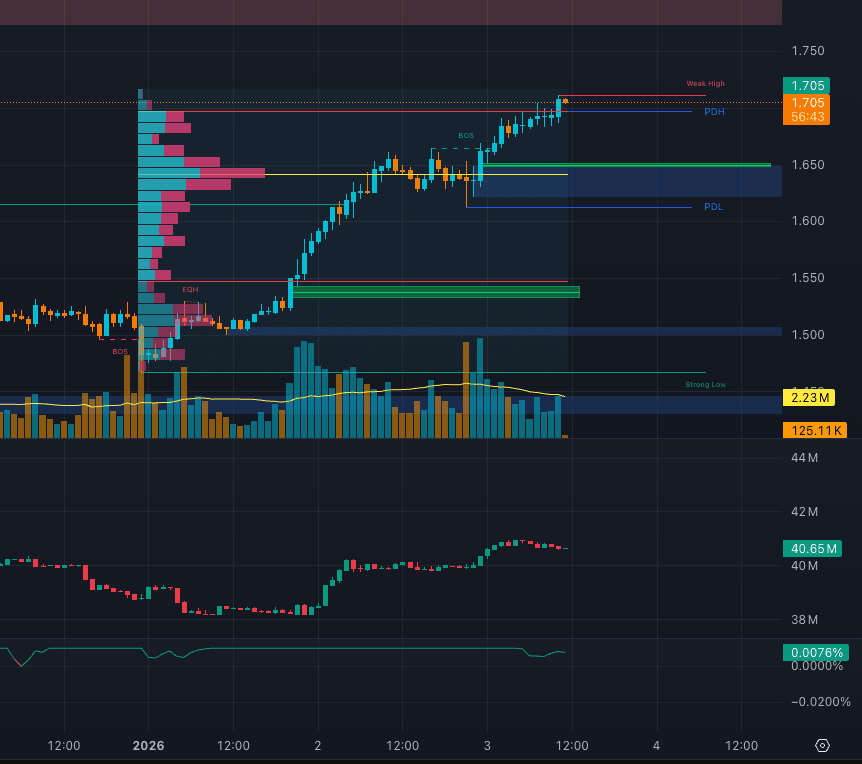

1. Market Structure (SMC)

NEAR is still trading in a clear bullish market structure on 1H.

Key observations:

Strong BOS above the previous range (~1.60)

Price continues to form higher highs and higher lows

The most recent pullback did not break the protected higher low (~1.47)

➡️ No bearish CHoCH on 1H so far.

➡️ Structure remains bullish continuation, not reversal.

2. Key Levels

🔴 Upside Liquidity

1.69 – 1.72

Current weak high

Buy-side liquidity resting above

High probability zone for:

Liquidity sweep

Short-term reaction or consolidation

🟢 Downside Support / Demand

1.62 – 1.65

High Volume Node (HVN)

Previous consolidation area

1.53 – 1.55

Demand + prior EQH

~1.47

Protected Higher Low

Structural invalidation level

📌 Only a 1H close below ~1.47 would invalidate the bullish structure.

3. Volume & Volume Profile

Volume

The impulsive move from ~1.55 → 1.69:

Accompanied by expanding volume

Confirms genuine demand, not a weak breakout

Recent candles near the high:

Volume is moderating, not climaxing

Suggests pause or pullback, not distribution yet

Volume Profile

POC currently sits around ~1.64

Price is trading above POC, in the upper value area

➡️ Acceptance above POC = bullish continuation

➡️ Loss of POC = short-term weakness, not structure break

4. Open Interest & Funding Rate

Open Interest

OI has been rising gradually during the uptrend

No aggressive spike at the highs

➡️ Indicates healthy trend participation, not late-stage FOMO

Funding Rate

Current funding: +0.008%

Interpretation:

Longs are paying

But not at extreme levels

No clear signal of imminent long squeeze

📌 Market is long-biased but not overcrowded.

5. Trade Scenarios

🔵 Scenario A – Bullish Continuation (Primary Bias)

Conditions

Price holds above 1.62 – 1.65 (POC/HVN)

No 1H close below 1.47

Execution Idea

Prefer:

Pullback to 1.62 – 1.65

Or deeper pullback into 1.53 – 1.55

Entry:

Wait for lower timeframe bullish confirmation (15m CHoCH / absorption)

Targets:

1.72

1.78

Invalidation

1H close below 1.47

🟠 Scenario B – Liquidity Sweep Then Pullback

Conditions

Price sweeps 1.69 – 1.72

Volume weakens near highs

OI rises faster than price

➡️ Expectation:

Short-term pullback into:

1.64

Or 1.55

📌 This is a pullback within an uptrend, not a trend reversal.

🔴 Scenario C – Bearish Reversal (Low Probability)

Only valid if

1H closes below 1.47

Followed by:

OI distribution

Funding flips negative

➡️ Until that happens, shorts are counter-trend trades.

Final Notes

Structure: Bullish

Trend quality: Healthy

Current price zone: Not ideal for chasing longs

Best approach:

Wait for pullback + confirmation

Avoid emotional entries near weak highs

#trading #TradingSignal #futures

✍️ Written by @CryptoTradeSmart

Crypto Insights | Trading Perspectives

⚠️ DISCLAIMER:

NOT financial advice. Perpetuals trading is high risk - you can lose your entire capital. This is my personal setup for educational purposes only. Always DYOR, use strict risk management, and never risk more than you can afford to lose. You are solely responsible for your decisions.

Trade safe! 🎯