As cryptocurrency evolves from an investment target to a payment tool, a more fundamental question arises: Is the “crypto card” in our hand merely a spending channel, or is it a self-growing asset engine?

Imagine this scenario: You have 5,000 USDT sitting in your card, waiting for your next business trip, hotel booking, or daily expenses. During those 60 days you haven't spent it, it has done nothing. The issue isn't whether you spend it or not, but rather: those 5,000 USDT could have continued earning while “waiting to be spent.”

The answer quietly marks the division between two eras. On the one hand are traditional crypto cards, which act as one-way pipelines, converting your digital assets into fiat currency for spending. On the other hand, there are emerging on-chain yield cards that function like smart asset terminals with built-in generators, aimed not just at facilitating payments but at making every bit of your money work for you even while it awaits spending.

Beyond the obvious difference of “yield generation,” this upgrade from “channel” to “engine” reflects fundamental changes in capital efficiency, security models, and user experience.

This article will systematically compare: the core differences between on-chain yield cards and traditional crypto payment cards; how they differ in terms of yield, security models, and payment experience; whether on-chain yield cards are the same as DeFi and whether they are truly more secure; and, with reference to the real-world product practice of BenPay, help you decide which is more suitable for long-term use.

Core Differences Between On-Chain Yield Cards and Traditional Crypto Payment Cards

What is a Traditional Crypto Payment Card?

A traditional crypto payment card is essentially a "channel." Its design philosophy focuses on being an efficient conversion tool, with its core value lying in "connectivity." Under this model, the funds are merely held idle in the card and do not generate any yield. This is akin to keeping cash in a non-interest-bearing drawer—it simply sits there, waiting to be spent, without growing on its own.

More importantly, this card quietly incurs several types of efficiency losses in daily use:

Time is wasted: Funds sit completely idle while waiting to be used.

Revenue opportunities are missed: The same USDT or USDC could be earning yield elsewhere, but it remains at zero in a traditional crypto card.

Usage habits become entrenched: Long-term use makes users accept that "money in the card is just for spending," overlooking the potential for asset growth.

These hidden losses may not seem significant individually, but as the scale of funds and the duration of use increase, the resulting efficiency gap continues to accumulate.

Traditional Crypto Card Workflow

The workflow of a traditional crypto payment card can be summarized as "spend-and-convert, channel-first." When you use a traditional crypto card for a purchase, the entire process functions like a trigger for instant conversion:

Initiate Payment: You swipe the card or make an online payment at a merchant.

Instant Settlement: Upon receiving the request, the payment network immediately sells the corresponding amount of cryptocurrency in your card (e.g., Bitcoin, Ethereum) at the current exchange rate, converting it into fiat currency (e.g., USD, RMB).

Complete Transaction: The converted fiat currency is paid to the merchant, finalizing the transaction.

Throughout this process, your cryptocurrency assets are used only passively at the time of payment, with the sole purpose of being converted into fiat to complete the settlement. Before and after the payment, the assets remain statically stored in the card’s associated wallet or account, generating no yield. Their value fluctuates entirely with the volatility of the cryptocurrency market.

Three Core Limitations of Traditional Crypto Cards

This model addresses the basic need of "spending cryptocurrency," but it suffers from several inherent flaws:

1. Zero Funds Efficiency

From the moment funds are deposited until they are spent—whether it takes days, weeks, or months—the assets remain idle in the platform’s account as static reserves, generating no returns. In an inflationary environment, this leads to an implicit erosion of purchasing power.

2. Fragmented User Experience

Payment (spending) and asset growth (saving/investing) are completely separate actions. If users wish to grow their assets, they must manually transfer funds to exchanges, wallets, or various DeFi protocols—a cumbersome process that disrupts the convenience of payment.

3. Opaque Economic Costs

Beyond potential monthly fees or cross-border transaction charges, the highest cost lies hidden in the "exchange rate." The platform’s bid-ask spread and handling fees may be substantially higher than open-market rates, with these costs borne passively by the user.

What is an On-Chain Yield Card?

Emerging on-chain yield cards represent a philosophy of "efficiency." They are no longer content with being passive pass-through channels but strive to become "intelligent efficiency engines" for your personal assets. Their core innovation lies in leveraging the programmability of blockchain and the flexible composability of decentralized finance (DeFi) to redefine what a payment account can be. Now, your payment account simultaneously functions as an automated, yield-generating "asset growth tool," ensuring your money continues to work and generate returns even while awaiting payment use.

How Does an On-Chain Yield Card Generate Returns?

The core principle of how an on-chain yield card generates returns can be summarized as follows: after the user actively enables the "earn" feature, the system allocates the card account balance to carefully selected and optimized on-chain DeFi protocols to generate returns, achieving the goal of "earning while holding and spending while earning." The yield generation of an on-chain yield card is fundamentally based on the user's active decision to enable the earn feature.

User Authorization to Enable Earnings

The user transfers funds into the card account balance and manually activates the earn feature.

Smart Contract Execution for Yield Generation

After user authorization, the system uses smart contracts to allocate the card account balance to on-chain yield protocols in accordance with predefined strategies. The entire execution process is automated and auditable.

Parallel Processing of Payments and Earnings

When a payment is made, only the required amount is redeemed for the transaction. The remaining balance in the card account continues to participate in yield generation uninterrupted.

Are On-Chain Yield Cards Equivalent to DeFi?

No, on-chain yield cards are not equivalent to DeFi, but they are fintech products built with DeFi as their core "engine." The relationship between the two can be likened to that of "a car and its engine":

DeFi functions like a high-performance engine and transmission system, providing a series of composable protocols (such as lending, staking) that enable digital assets to generate returns automatically.

An on-chain yield card, on the other hand, is like a fully integrated smart car. It not only incorporates the DeFi engine but also integrates payment channels, compliance systems, user interfaces, and more, aiming to deliver a secure, convenient everyday spending experience.

In short, DeFi is the underlying technological capability, while on-chain yield cards are consumer-grade products that package it for everyday use.

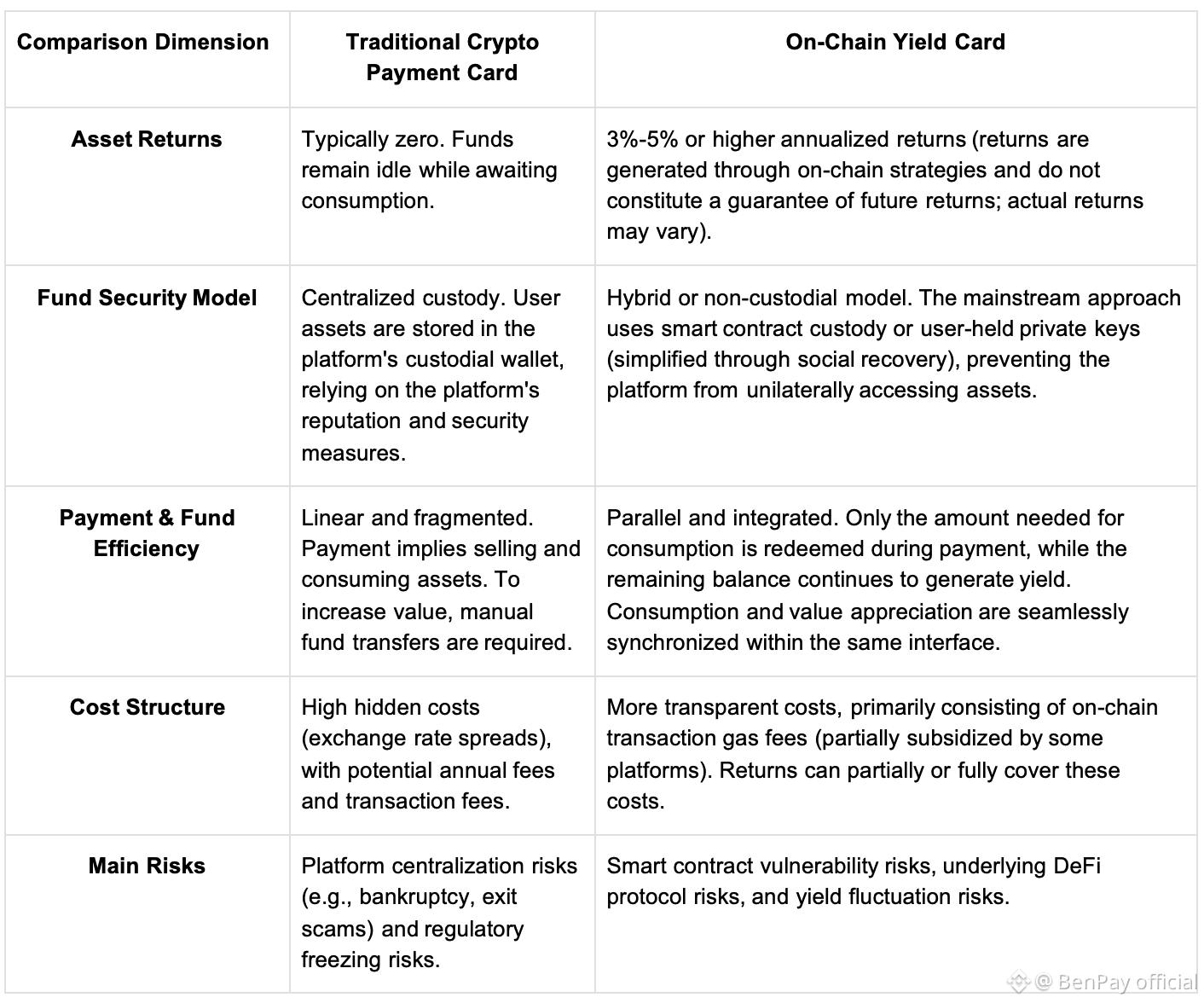

On-Chain Yield Cards vs Traditional Crypto Cards: Key Dimensions Comparison

To more clearly illustrate the differences between the two, we can directly compare them across three core dimensions:

Traditional crypto cards solve the question of “how to spend your crypto,” while on-chain interest-bearing cards solve the question of “whether your money is sitting idle before you even spend it.”

Is It Really More Complicated to Use On-Chain Yield Cards?

When first encountering on-chain interest-bearing cards, most users are most concerned not about returns, but three very practical questions.

First, do I have to manage it daily?

No. Users only need to manually activate the “Earn” feature once after funds enter the card's account balance. After that, both earning and spending are handled automatically in the background. Day-to-day usage is no different from a regular crypto card.

Second, if I decide I don't want to earn anymore, can I stop at any time?

Yes. The Earn feature is not a lock-up. Users can turn it off anytime, and funds will exit the earning state according to the rules, returning as available balance. The entire process is under the user's active control.

Third, will it not feel like a “normal card” to use?

No. In real spending scenarios—swiping, online payments, cross-border use—the experience is largely the same as with a traditional crypto card. When a payment is made, the system only redeems the required amount; the remaining balance continues as before. You’ll hardly notice any complex mechanisms running behind the scenes.

For users, the change isn't in “how to use it”—it's that the same balance, before being spent, finally starts generating value.

Taking BenPay as an Example: The Real Product Practice of On-Chain Yield Cards

BenPay's core product — the On-Chain Yield Card serves as a key application of this system. Its design reflects a thoughtful, practical integration across three key dimensions: yield, security, and user experience, with a particular emphasis on maximizing user autonomy and asset transparency.

Product Highlights:

In terms of yield, BenPay does not simply connect users to a single high-risk protocol.

Instead, it employs a diversified, robust asset allocation strategy to provide a sustainable source of returns. More importantly, yield generation begins only with explicit user authorization: funds must be transferred to a dedicated "Card Account Balance" pool, and users must manually activate the "Earn" feature.

This design is far from redundant; it fundamentally ensures users' absolute control over their funds. It clearly distinguishes between liquid balances for payments and principal allocated for yield generation, preventing any misunderstanding that "funds are being automatically used."

Regarding security, BenPay strikes a balance between convenience and safety through "Social Login + Zero-Knowledge Proof" technology.

Furthermore, asset settlement and record-keeping are based on a high-performance blockchain optimized for finance, ensuring transaction finality and auditability. This architecture technically safeguards the security and transparency of assets within the "Card Account Balance," making every bit of generated yield fully traceable.

For user experience, BenPay's design aims to eliminate complexity and deliver seamless, frictionless interaction.

This is first achieved through a clear fund structure: the app interface distinctly separates the "Card Account Balance" (earning yield) from the "Total Card Balance" (available for spending), giving users an instant overview of their asset status.

Secondly, by integrating with global payment networks, interest-bearing assets can be used for worldwide consumption at any time. When a payment is initiated, the system automatically redeems the required amount from yield-earning assets in accordance with predefined rules, completing the process within seconds. The payment experience is thus identical to that of a traditional card. This design means users need only make one proactive choice—activating the "Earn" feature—to subsequently enjoy the automated convenience of "spending while earning," without any complicated steps for each transaction.

In summary, the practical approach of the BenPay Interest-Bearing Card is to deliver native on-chain financial yield through meticulous product design while strictly adhering to the principle of user sovereignty. It returns control and transparency to users, thereby building a powerful and trustworthy financial tool.

Who Should Choose an On-Chain Yield Card?

Choosing which crypto card to use may seem like a product preference on the surface, but it's really about how you view "that money in the card."

An on-chain yield card is better suited for you if:

Long-term stablecoin holders: If you hold USDT or USDC as cash reserves or emergency funds, an on-chain interest-bearing card allows your idle capital to grow consistently, rather than remaining at zero long-term.

Frequent cross-border spenders: Every payment may involve exchange rate spreads and fees. An on-chain interest-bearing card not only reduces hidden costs but also ensures your funds generate returns before they’re spent.

Those receiving stablecoin salaries or income: If your salary or income arrives in stablecoins, an on-chain interest-bearing card helps create a seamless cycle from receipt to spending, putting every dollar to work for you.

Long-term thinkers / efficiency-driven users: You aren't satisfied with "money just sitting there." You want your assets to deliver value every moment in the digital age, merging payment and growth into one.

Traditional crypto cards are still suitable for users who:

Use crypto assets for payments only occasionally, with funds remaining in the card for short periods

Prefer to avoid potential volatility risks associated with on-chain protocols

Value simple tap-and-pay convenience over asset growth

Ultimately, the choice of which card to use comes down to whether you want idle funds to continue creating value for you—not just waiting to be spent.

Conclusion: This Isn't Just a Feature Upgrade, It's a Choice About Fund

The difference between an on-chain interest-bearing card and a traditional crypto payment card isn’t just about “whether it earns interest.” They represent two fundamentally different ways of using capital: one accepts that funds lie idle while waiting to be spent; the other tries to keep money in motion no matter what state it’s in.

With a clear understanding of the risks, the real question is no longer: “Should I use an on-chain yield card?” It’s rather: Are you willing to let a portion of your fund that could be working for you continue to do nothing?

Risk Disclosure

The returns generated by on-chain interest-bearing cards originate from on-chain DeFi protocols and do not guarantee future yields; actual returns may fluctuate. Funds engage in smart contract operations, which entail potential technical risks. In a non-custodial model, asset security depends on the user's own safeguards. In extreme market conditions, fund redemptions may be restricted or delayed. Please fully understand the product mechanism and evaluate your personal risk tolerance before use.