Traders, post-data analysis. The December 2025 U.S. Non-Farm Payrolls report has landed with a mixed, fundamentally confusing signal: +50K jobs added (below expectations of +60K), but a drop in the Unemployment Rate to 4.4% alongside higher-than-expected wage growth.

The market's initial reaction—a muted, slightly negative move in Gold—tells the deeper story. This isn't a clean "risk-on" or "risk-off" trigger. Instead, it's a classic volatility catalyst that tests underlying market structure. For disciplined traders, the reaction at key technical levels now matters far more than the headline figure.

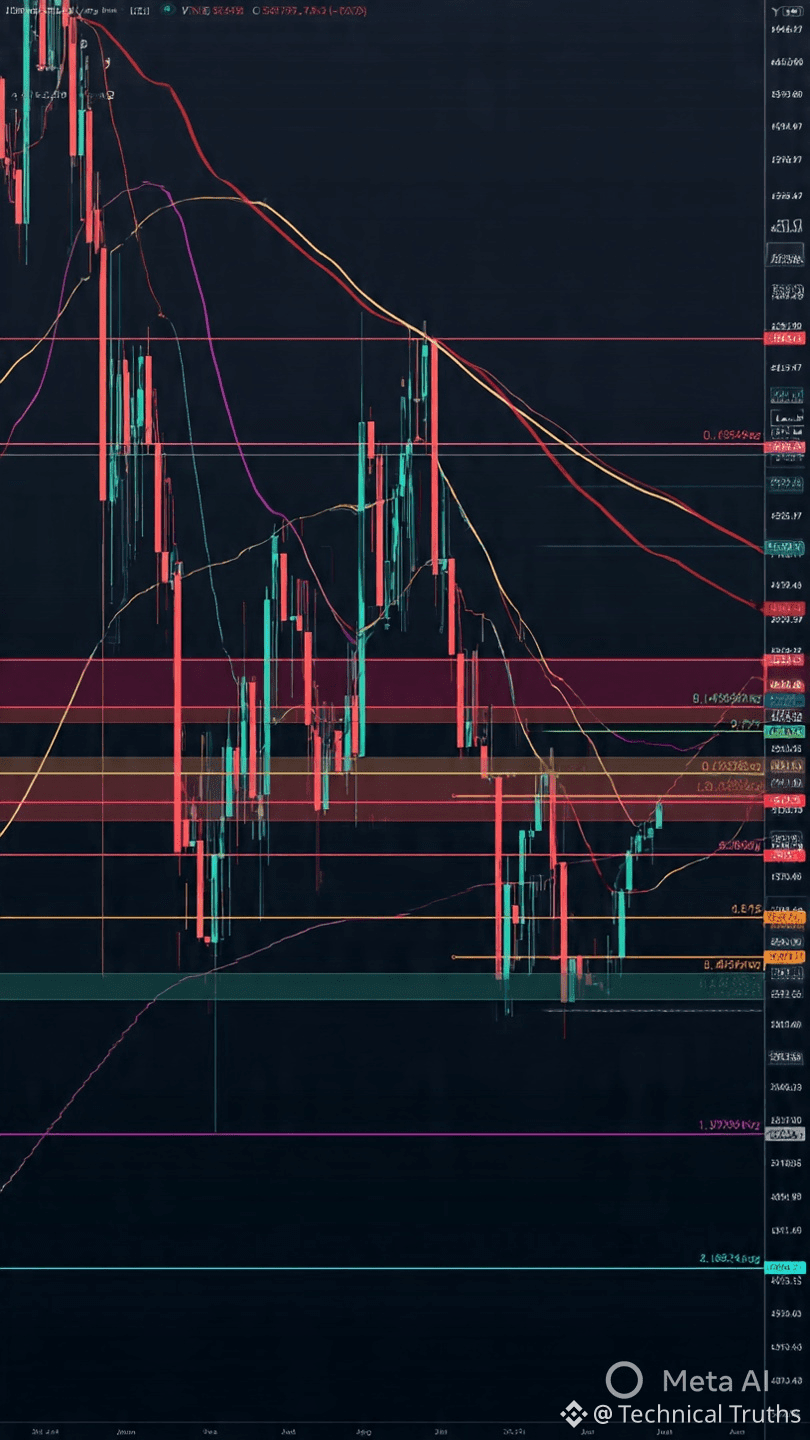

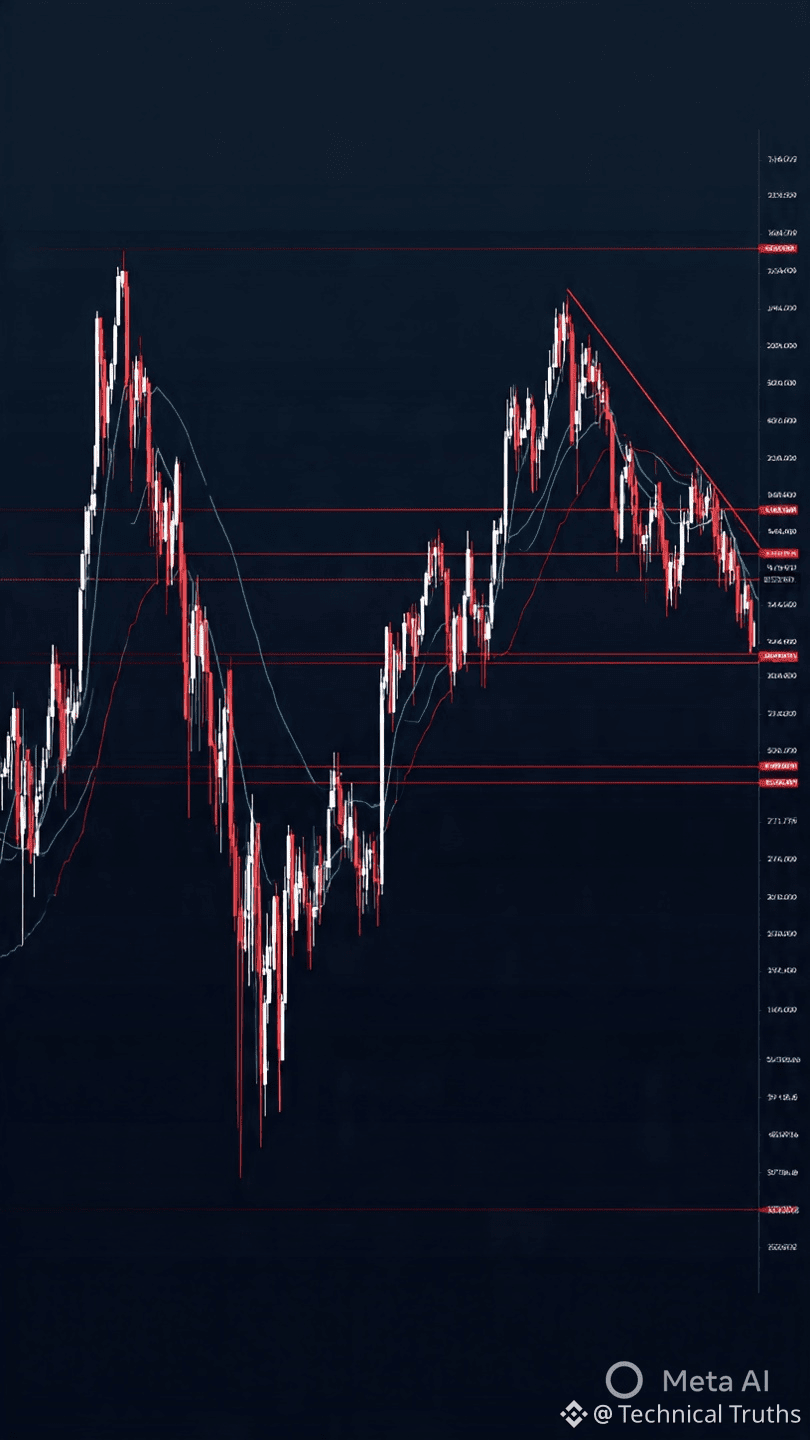

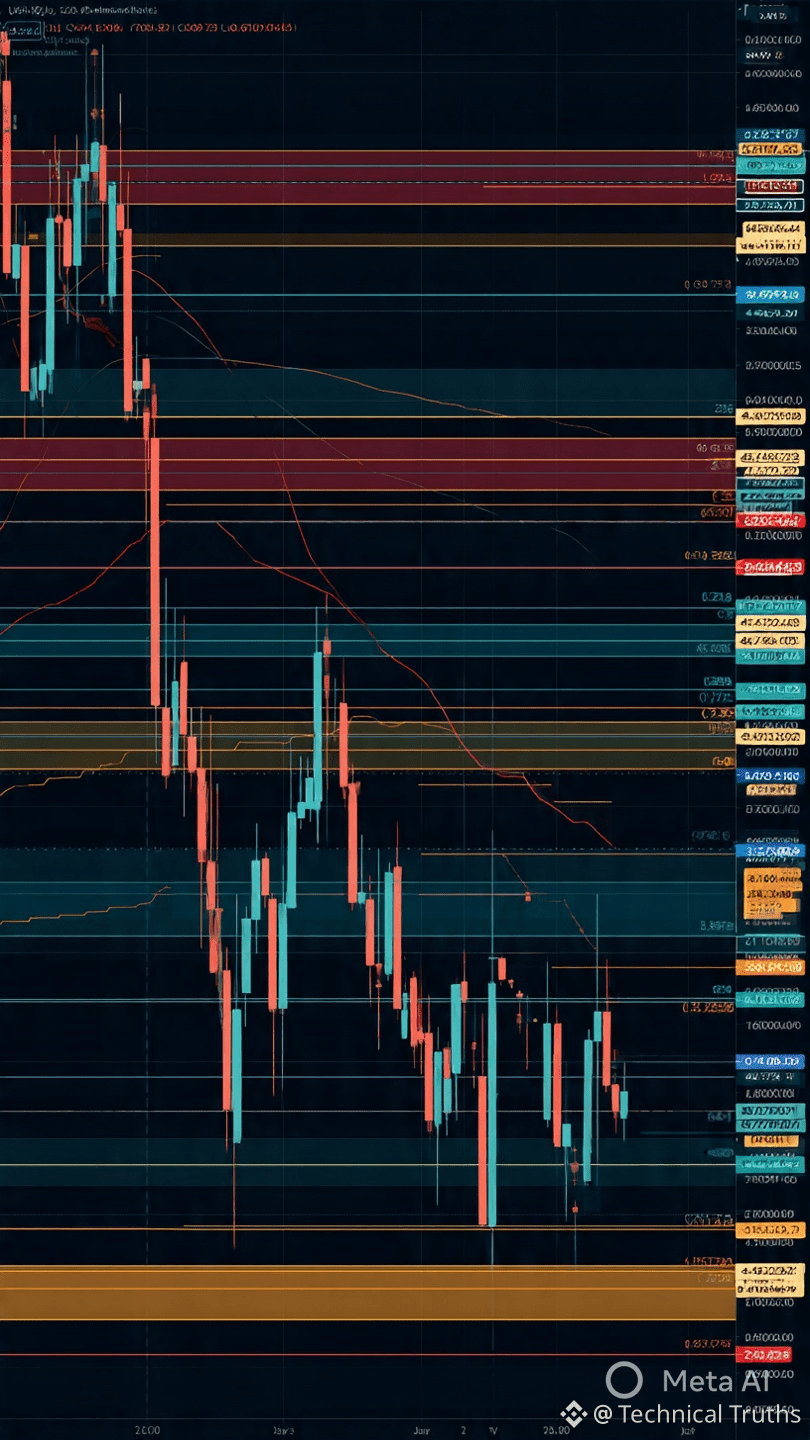

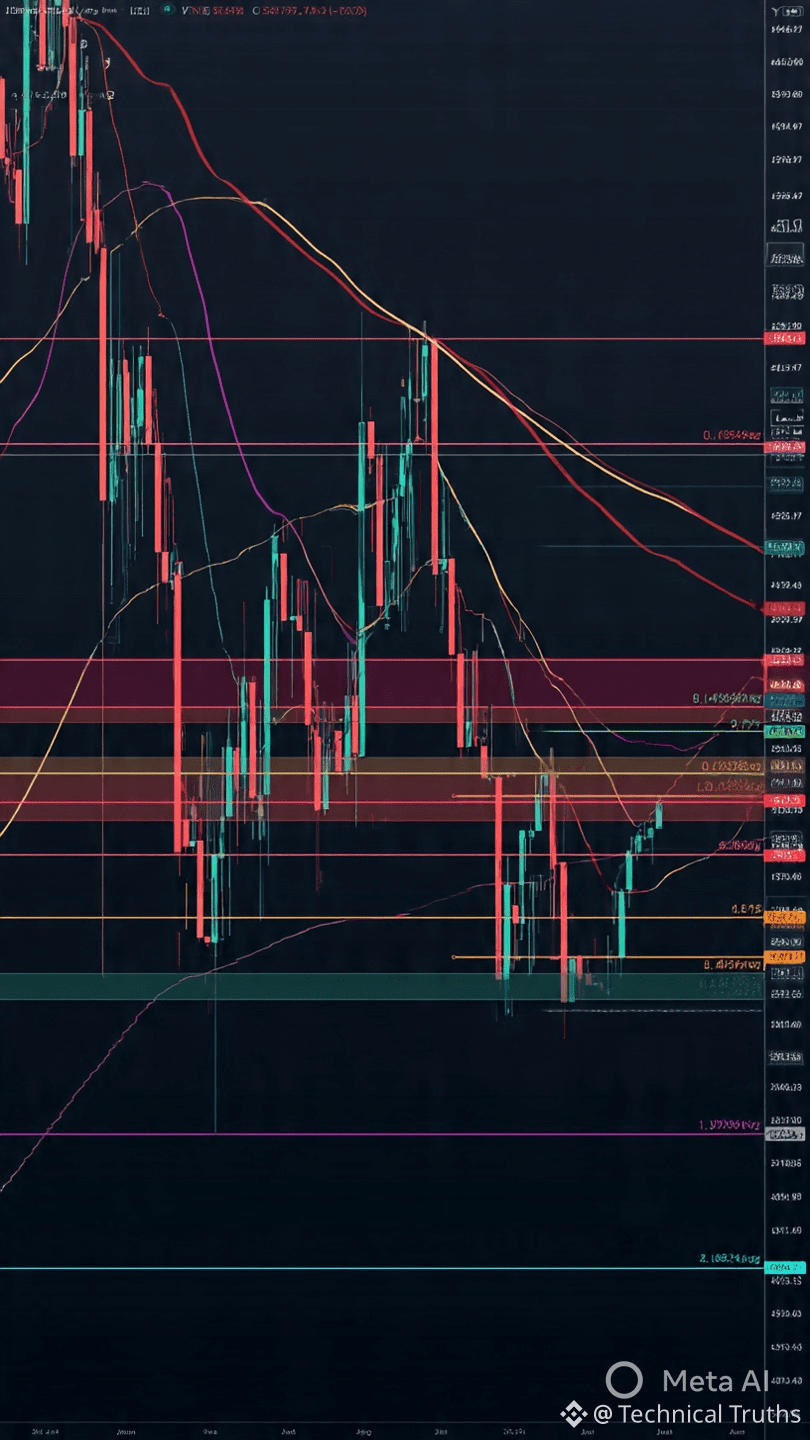

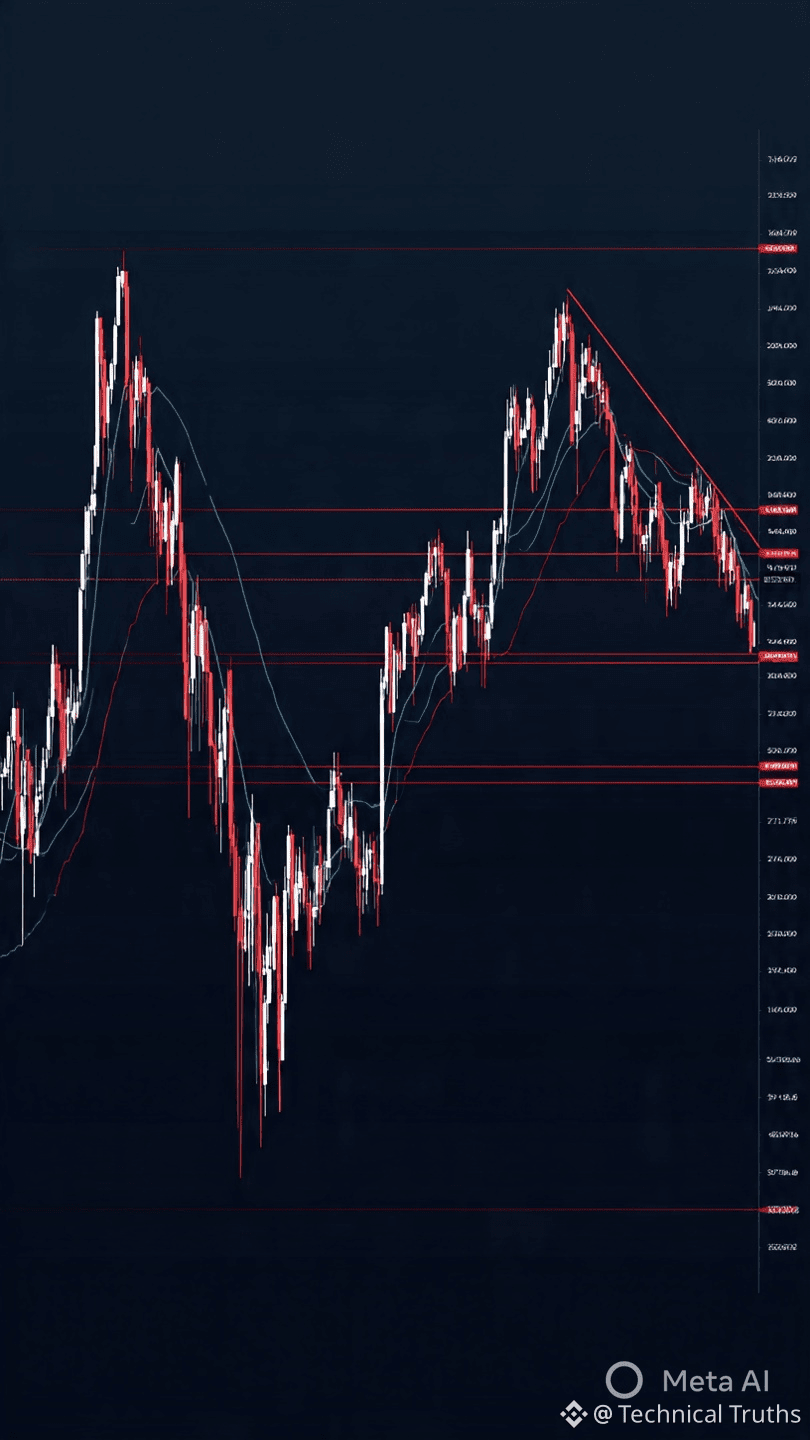

🔴Key Technical Framework Post-NFP:

· Immediate Support Zone: $4,420 - $4,408. This remains the critical battleground. A firm hold here suggests the bullish macro structure is absorbing the news.

· Immediate Resistance & Bullish Signal: $4,475 - $4,490. A reclaim of this zone would indicate the data has been digested as net-positive for gold (focus on weaker job growth over wage fears).

· Breakdown Scenario: A sustained break below $4,408** could trigger a deeper pullback toward **$4,387 and the major $4,322 support.

The Strategic "Long Thinking": Psychology Over Noise

🔴Today's lesson is in market mechanics. High-impact events like NFP are not for prediction; they are for preparation and measured reaction.

1. Liquidity Check: The initial spike and fade are often driven by algorithmic liquidity hunting, not informed trend conviction. Your edge is patience.

2. Confirmation Over Action: The "prodigy mindset" waits for price to settle and show its hand at a known technical level. The best trade is often the one you don't take in the first 15 minutes.

3. Macro Narrative Intact: Does today's data truly alter the 2026 trajectory of geopolitical risk, central bank demand, and the eventual Fed pivot? Likely not. It merely adjusts the timing and provides a potential entry point.

🔴Actionable Outlook:

The bias remains neutral-to-bullish within the larger uptrend, but the burden of proof is on the bulls to defend support. Reduce leverage, observe the $4,420-$4,408 zone, and wait for a clear, settled price rejection or acceptance before committing new capital.

Your Move: Did you take a position based on the NFP headline, or are you waiting for the technical confirmation? Share your read on whether this dip is a buying opportunity or a warning sign in the comments.

#NFP #tradingpsychology #RiskManagement #BinanceSquare #TechnicalTruths