In the world of trading, the difference between success and failure often isn't about finding a "magic" indicator—it's about avoiding the psychological and mechanical traps that wipe out 90% of retail participants.

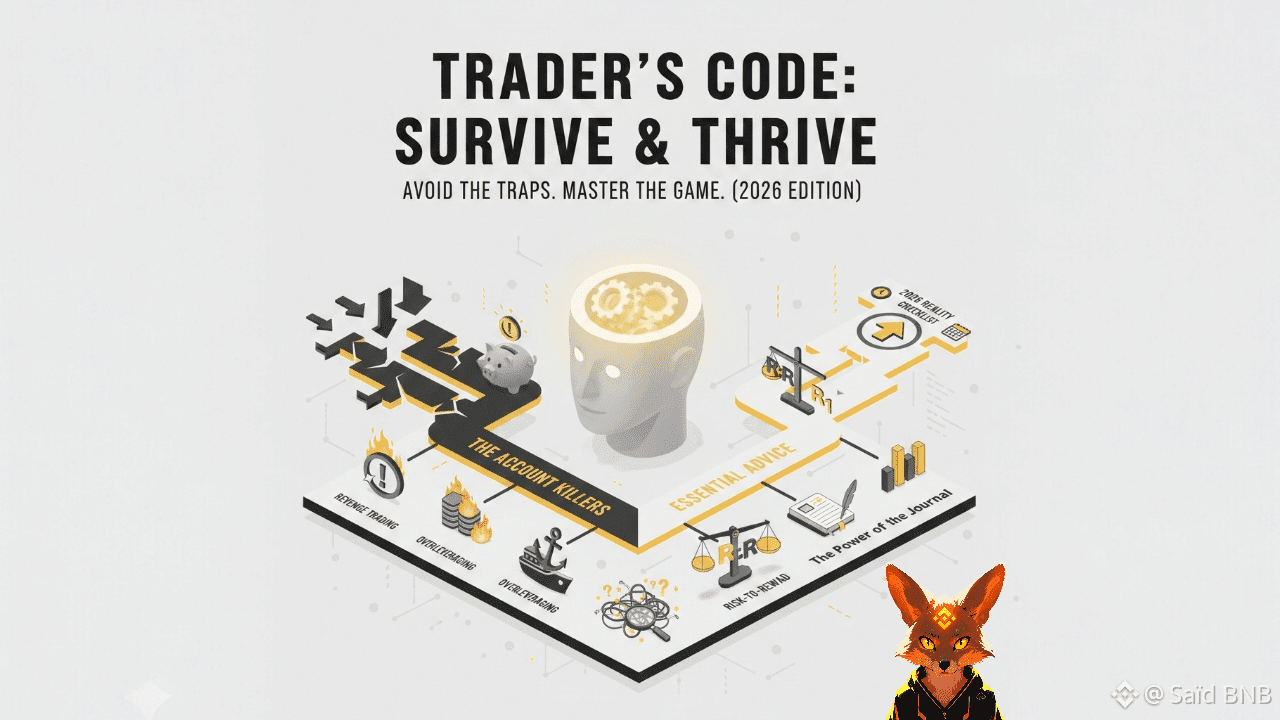

1. The "Account Killers": What to Avoid

Most traders don't lose money because they were wrong about a price move, they lose money because they were wrong about their behavior.

🚩 Revenge Trading

This is the most dangerous emotional trap. After a loss, the ego feels "wronged" by the market and tries to "get it back" immediately. This leads to forced entries, ignoring your rules, and doubling down on bad positions.

The Fix: Implement a "Maximum Daily Loss" rule. If you lose a certain amount, shut down the platform for the day.

🚩 Overleveraging (The "Lotto" Mentality)

Many beginners use excessive leverage to turn a small account into a fortune overnight. This leaves zero room for error.

A tiny fluctuation against you can trigger a margin call, wiping out your capital.

The Fix: Treat leverage as a tool for capital efficiency, not a way to gamble. Keep your position sizes consistent with your risk plan.

🚩 "Marrying" a Position

This happens when you refuse to admit a trade is wrong, Instead of hitting your stop-loss, you move it further away or "average down" (buying more as the price drops), hoping for a bounce.

The Fix: Your stop-loss is an invalidation point. If the price reaches it, your reason for being in the trade is gone. Exit immediately.

🚩 Information Overload (Analysis Paralysis)

In 2026, with AI-driven news and thousands of indicators, many traders suffer from "Analysis Paralysis." They wait for ten different signals to align, missing the move entirely, or they get conflicting signals and freeze.

The Fix: Pick 2–3 core tools (e.g., Support/Resistance and Volume) and master them, Simplicity beats complexity.

2. Essential Advice for Long-Term Success

Professional trading is a business of probability management, not certainty.

🛡️ Master the "1% Rule"

Never risk more than 1% to 2% of your total account balance on a single trade. This ensures that even a string of ten losses (which happens to the best) only results in a 10–20% drawdown, rather than total bankruptcy.

📈 Focus on Risk-to-Reward (R:R)

A "win rate" is a vanity metric.

What matters is your Expectancy, If you win only 40% of your trades but your average win is $300 and your average loss is $100 (a 3:1 R:R), you will be highly profitable.

Advice: Only take trades where the potential reward is at least twice the potential risk.

📓 The Power of the Journal

You cannot improve what you do not measure, A trading journal should record:

The Setup: Why did you enter?

The Emotion: Were you feeling anxious, bored, or confident?

The Result: Did you follow your rules or deviate?

Reviewing your journal weekly reveals patterns of behavior that are costing you money.

3. The "2026 Reality" Checklist

The modern market is faster and more influenced by macro-events and algorithmic flows.

To stay ahead:

Respect the News: Never trade right before a high-impact event (like CPI or Fed announcements) unless your strategy specifically accounts for volatility.

Wait for Confirmation: Don't try to catch a "falling knife." Wait for the market to show a change in structure (Higher Highs/Higher Lows) before entering.

Think in Samples: Don't judge your strategy by one trade. Look at the results after 20 trades. This removes the emotional sting of a single loss.

#TrendingTopic #tradingGuide #SaidBNB

Pro Tip: If you find yourself staring at the screen, praying for a price to turn around, you are no longer trading—you are gambling.

Real traders are indifferent to the outcome of a single trade because they trust their system over the long run.