Introduction:

Long-term trading (also known as position trading or investing) in cryptocurrency focuses on capturing major market cycles rather than short-term price noise. Bitcoin (BTC) leads the entire crypto market, and most altcoins follow BTC’s long-term trend. Understanding market structure, key patterns, and fundamentals is essential for long-term success.

This article explains how to trade BTC long term, how to diversify with other coins, and the most reliable chart patterns every long-term trader should know.

1. Why Bitcoin Is Best for Long-Term Trading

Bitcoin is considered digital gold and remains the safest long-term asset in crypto.

Key Reasons:

Limited supply (21 million BTC)

Institutional adoption (ETFs, funds, banks)

Strong historical cycles (bull & bear markets)

Market leader (alts follow BTC)

📌 If BTC is bullish long term, the overall crypto market usually follows.

2. Long-Term Trading vs Short-Term Trading

Long-Term Trading

Short-Term Trading

Weeks to years

Minutes to days

Low stress

High stress

Based on trends

Based on volatility

Strong risk control

Emotional trading risk

✔ Best for busy traders & investors

3. Best Cryptos for Long-Term Holding (Along with BTC)

Core Portfolio (Low Risk)

BTC (Bitcoin) – 40–60%

ETH (Ethereum) – 20–30%

Growth Portfolio (Medium Risk)

BNB

SOL

LINK

High-Risk / High-Reward (Small Allocation)

New Layer-1s

AI or Web3 projects

📌 Never go all-in on one altcoin.

4. Key Long-Term Chart Patterns (Very Important)

🔹 1. Ascending Triangle (Bullish Continuation)

Higher lows

Flat resistance

Breakout = trend continuatio

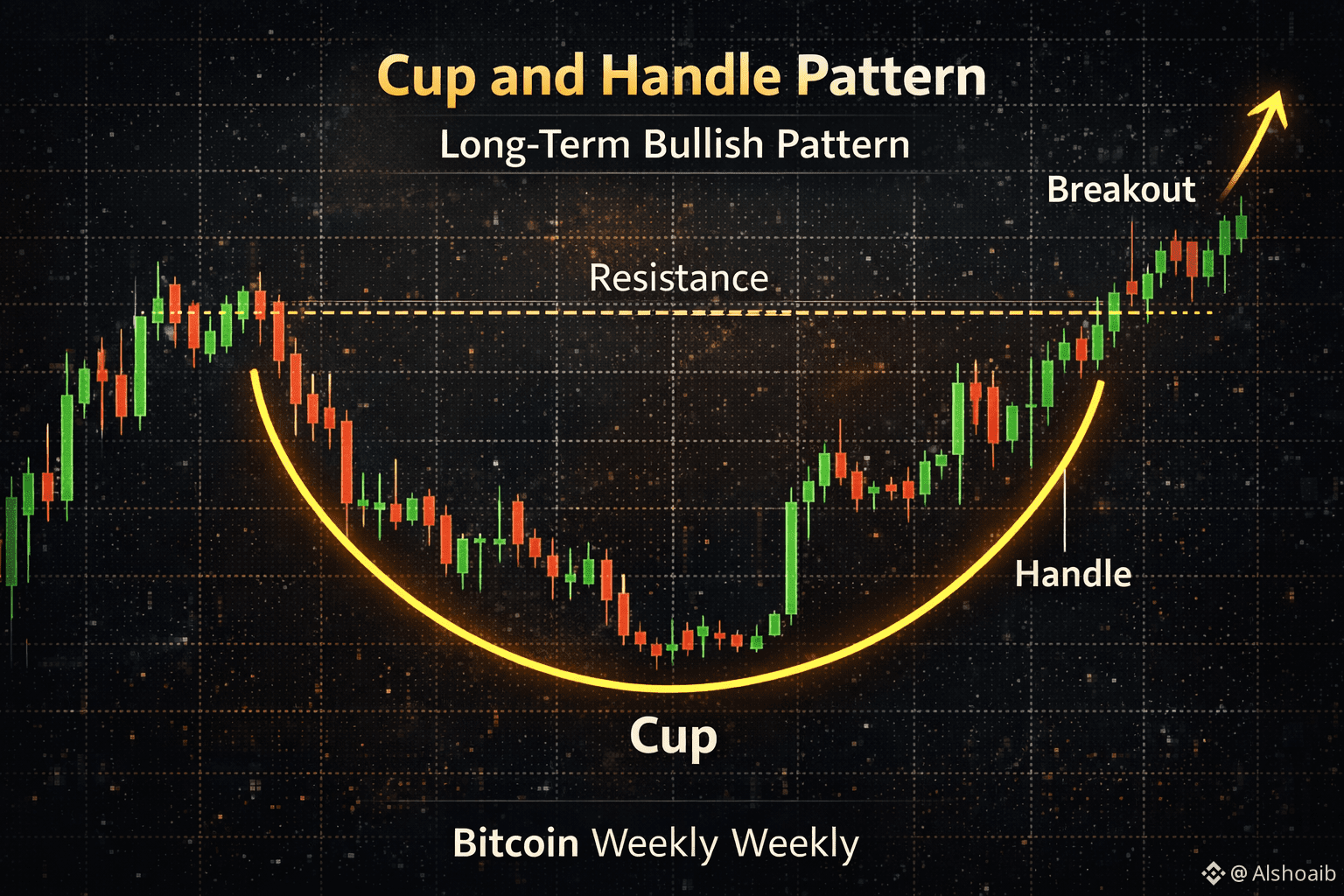

🔹 2. Cup and Handle (Strong Bullish Pattern)

Rounded bottom

Small pullback (handle)

Indicates accumulation

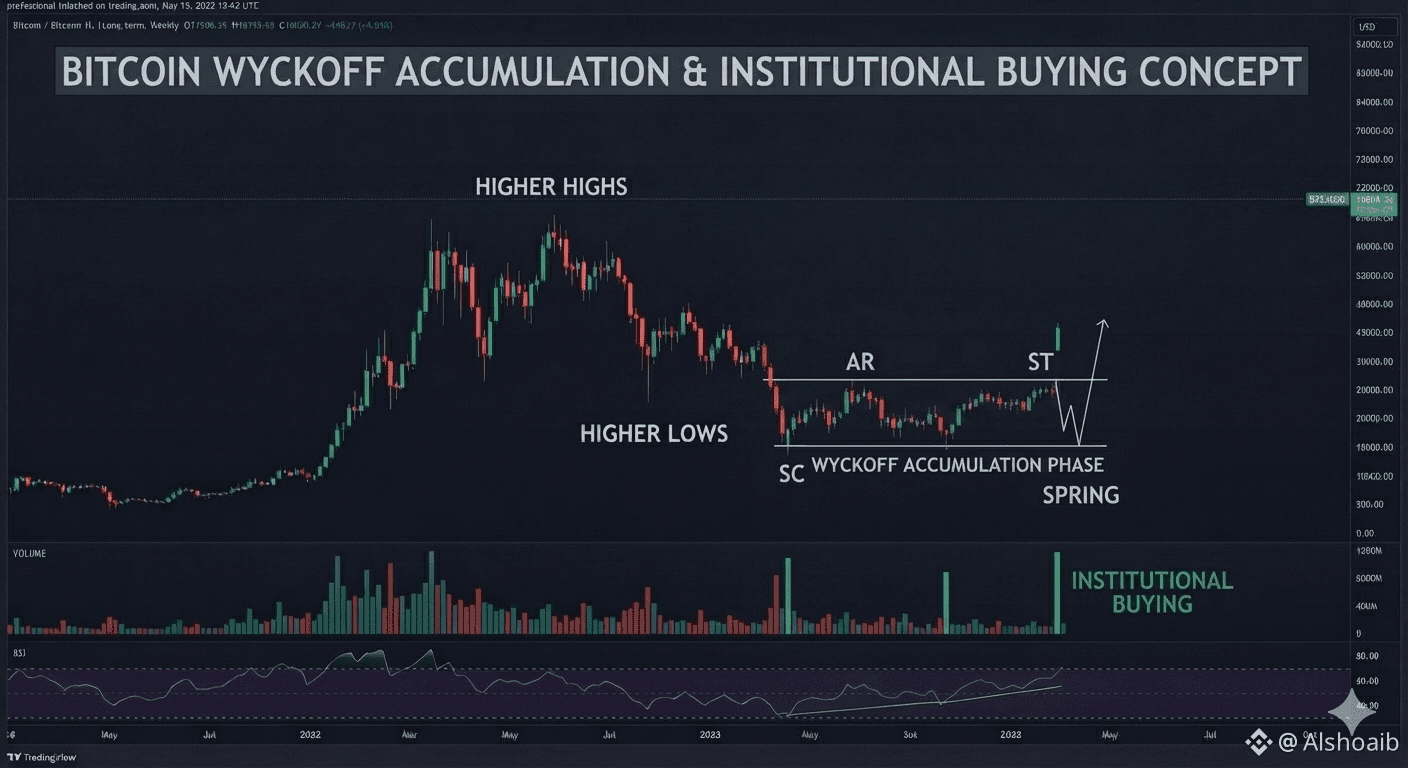

🔹 3. Higher Highs & Higher Lows (Uptrend Structure)

Market control by buyers

Safest long-term trend

🔹 4. Accumulation Zone (Smart Money Buying)

Sideways market after downtrend

Low volume

Big move comes after accumulation

5. Best Indicators for Long-Term BTC Trading

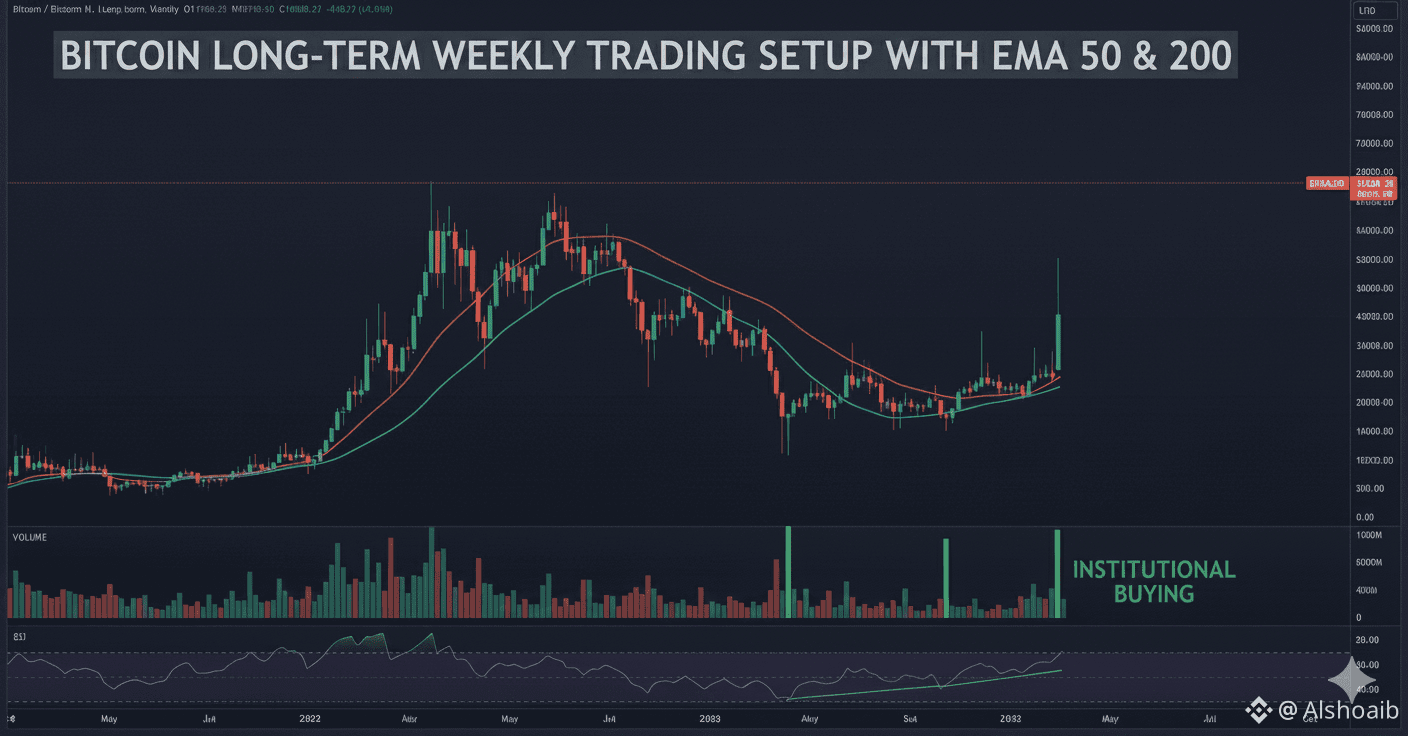

📈 Moving Averages

EMA 50 & EMA 200 (Weekly/Daily)

Price above EMA 200 → Bull market

EMA 50 above EMA 200 → Strong long-term buy zone

📊 RSI (Weekly)

RSI above 50 → Bullish bias

RSI below 40 → Bear market

6. Long-Term Trading Strategy (Simple & Effective)

✅ Entry Strategy

Buy near major support

Buy during accumulation

Use dollar-cost averaging (DCA)

🎯 Exit Strategy

Partial profit near resistance

Exit when weekly trend breaks

Never sell all at once

🛑 Risk Management

Never risk more than you can hold emotionally

Use cold wallets for long-term holding

Avoid leverage for long-term trades

7. Psychological Rules for Long-Term Traders

Ignore daily noise

Avoid FOMO

Trust the trend, not emotions

Patience beats prediction

📌 Long-term trading rewards patience, not speed.

Conclusion

Long-term trading with Bitcoin as the foundation and strong altcoins as support is one of the most reliable strategies in crypto. By understanding market cycles, bullish patterns, and proper risk management, traders can benefit from major moves without constant screen-watching.

📈 In crypto, wealth is often transferred from the impatient to the patient.