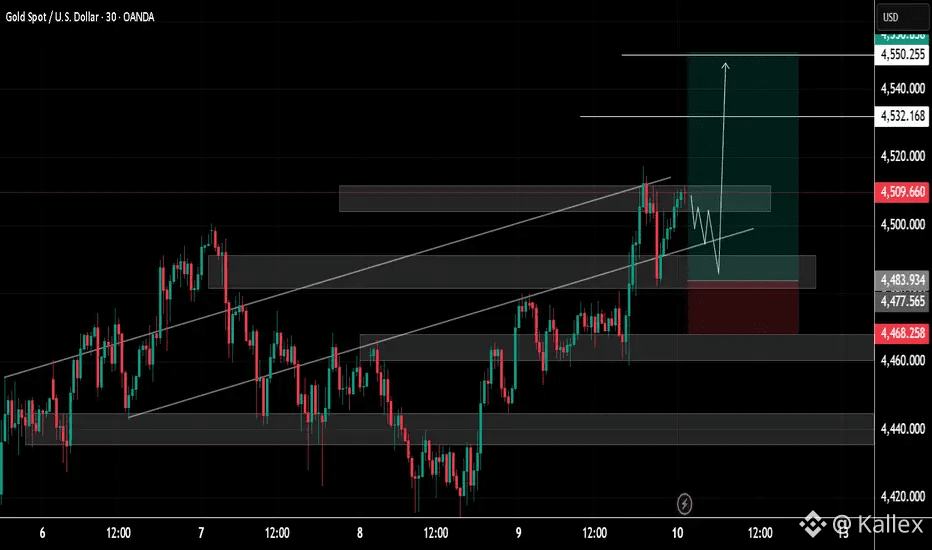

Gold is showing a bullish continuation structure after a strong impulsive move to the upside.

Price has broken above the previous consolidation and is now holding above a key demand zone around 4,483 – 4,490, which is acting as strong support. This area is important because it was previous resistance and now has flipped into support, showing buyers are still in control.

The market is respecting an ascending trendline, which confirms the bullish trend. The small pullbacks shown on the chart are healthy retracements, not signs of reversal. These dips suggest smart money accumulation before the next upward push.

The grey zone above current price around 4,509 – 4,515 is a minor resistance area. Once price breaks and closes above this zone, it can accelerate higher.

The projected bullish target is:

First target: 4,532

Second target: 4,550

As long as price remains above 4,483, the bullish bias stays valid. A drop below this level would weaken the setup and open the door for a deeper correction toward 4,468 – 4,460.

If you find it please like and comments for this post and share thanks.