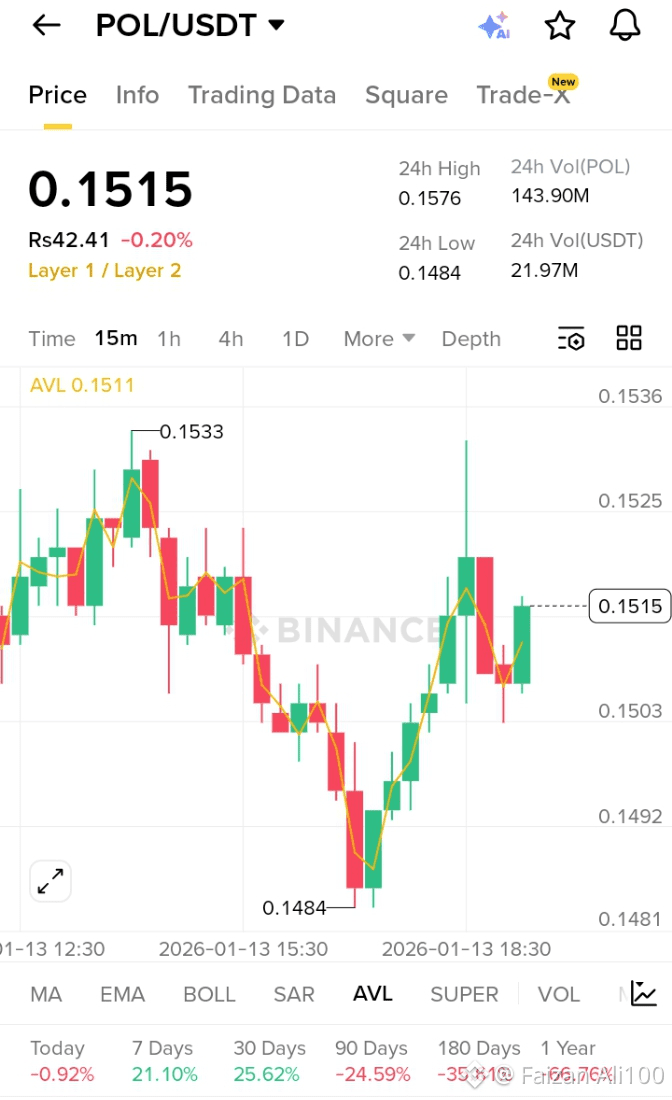

Traders, let’s talk $POL — the token that’s been under pressure lately. After a period of sideways action and recent sell-offs, POL has corrected sharply, shaking out weak hands and flipping market sentiment to the cautious side.

Here’s what’s happening in the market:

📉 Recent Downfall Explained

Profit-taking after earlier rallies has driven price lower.

Market volatility and BTC’s choppy movement impacted altcoins

Short-term fear and consolidation set in as buyers stepped aside.

This isn’t unusual — even strong projects go through corrective phases. What matters most is how the coin behaves at key technical levels.

🔍 Why a Rebound Could Be Near

Here are the bullish signals we’re watching:

✔ Support Zone Holding Strong

POL has tested major support multiple times and buyers have stepped in — showing real demand at lower price levels.

✔ RSI Near Oversold Levels

Technical momentum indicators suggest sellers are exhausted — opening the door for an upside bounce.

✔ Volume Profile Shift

We’re seeing volume dry up on the sell side and strong wicks upward — a classic sign of accumulation.

✔ Market Rotation Into Alts

If Bitcoin stabilizes or starts trending up, capital rotation into quality altcoins like POL could ignite a strong rally.

📅 Short-Term Price Scenarios

🔹 Bullish Flip: Break above immediate resistance triggers fast moves to higher levels.

🔸 Sideways Consolidation: Continued quiet price action before a breakout — healthy for long-term sustainability.

💡 Quick Take

Yes, $POL has been in a downtrend — but it’s testing critical structural support, and early indicators point toward a shift in momentum. History shows that coins that correctly shake out weak holders often prepare for explosive rebounds.

📈 Watch closely:

👉 Support level

👉 Breakout above resistance

👉 Volume uptick

👉 BTC strength

Stay smart. Stay patient. The next POL surge could be closer than you think.#artical #writetoearn #square #pol