Tomorrow, the U.S. Supreme Court rules on Trump-era tariffs — and markets are severely underestimating the downside risk.

Current probabilities suggest a ~76% chance the tariffs are ruled illegal.

Some are calling this bullish. That view is dangerously shallow.

Here’s what the market isn’t pricing in:

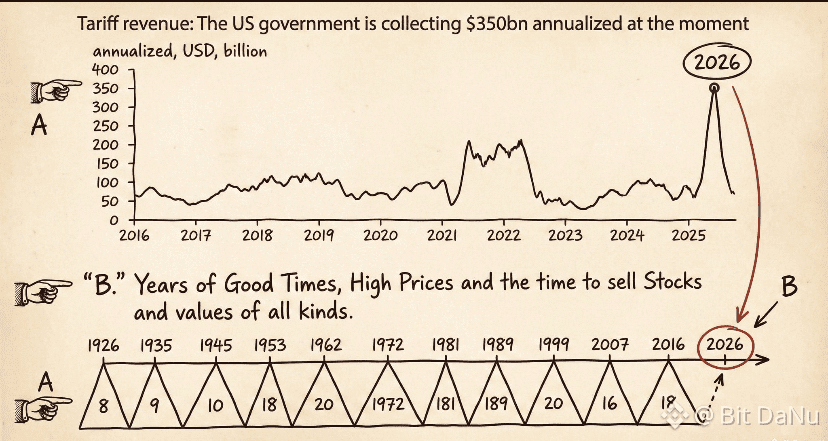

Trump has publicly stated that refund liabilities could reach hundreds of billions

When investment damage claims are included, exposure escalates into trillions

A negative ruling instantly blows a massive hole in U.S. Treasury revenue

This isn’t a policy tweak — it’s a fiscal shock event.

Immediate consequences could include:

• Forced tariff refunds and legal disputes

• Emergency debt issuance to cover revenue gaps

• Heightened geopolitical and retaliation risk

• Abrupt liquidity withdrawal across all risk assets

When that hits, everything becomes exit liquidity:

Bonds. Equities. Crypto. No sector is immune.

Markets are calm — but calm before a macro repricing is often the most dangerous phase.

Risk management matters more than conviction here.

Watch closely: