📈 Context Recap (Why Price Moved Fast)

Bitcoin’s recent acceleration was driven by institutional ETF-related flows, liquidity breaks, and tightening supply. Activity associated with routed through reinforced structural demand, while price cleared stacked liquidity above prior highs.

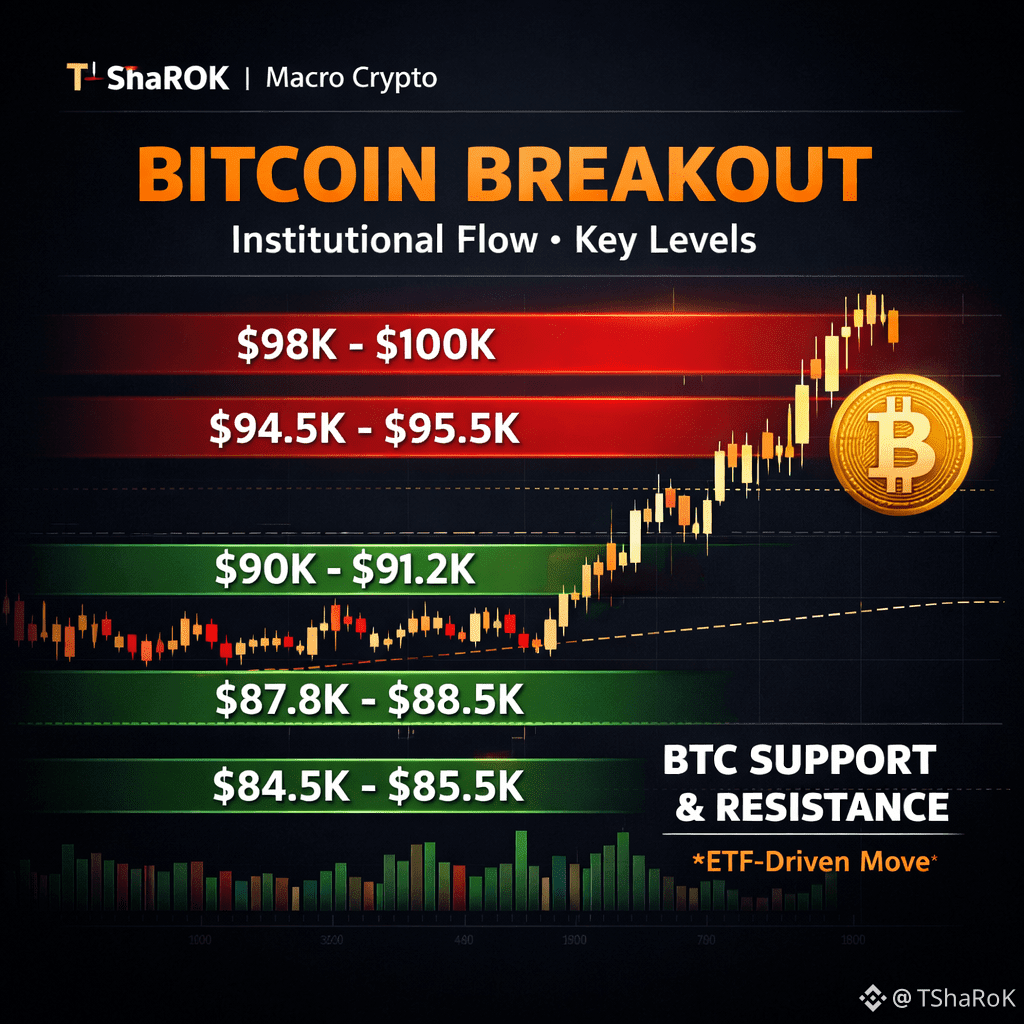

🎯 Key Trading Levels (Spot & Perpetuals)

Reference price zone: Above the $90,000 psychological threshold following a strong impulsive leg.

🟢 Primary Support Zones

$90,000 – $91,200 (Major Structural Support)

Prior resistance turned support

Psychological round number

First area institutions typically defend on pullbacks

$87,800 – $88,500 (Trend Continuation Support)

Previous consolidation base

Likely dip-buying zone during healthy retracements

Loss of this zone increases consolidation risk

$84,500 – $85,500 (Last Bullish Defense)

Breakdown level of the prior range

Holding above preserves higher-high / higher-low structure

Below this, market likely enters a deeper corrective phase

🔴 Key Resistance Zones

$94,500 – $95,500 (Immediate Supply Zone)

Short-term profit-taking area

Where momentum often pauses after fast expansion

$98,000 – $100,000 (Psychological & Liquidity Wall)

Heavy options interest and headline-driven selling

Requires sustained inflows and volume expansion to clear

Above $100,000 (Price Discovery Zone)

Limited historical resistance

Volatility expected to expand significantly

Trend strength becomes more important than exact levels

📊 How Traders Should Read This Structure

Bullish Continuation Bias:

As long as Bitcoin holds above $90K, pullbacks are statistically buy-the-dip, not trend reversals.Healthy Market Behavior:

Short-term consolidation between $90K–$95K would signal absorption, not weakness.

Risk Management Cue:

A sustained break below $87.8K increases the probability of range trading or deeper retracement.

🧠 Educational Insight for Binance Traders

Fast rallies often feel “overextended,” but in institutionally driven markets, continuation is decided by support defense, not how far price has already moved.

Bitcoin is currently trading in a regime where:

Structure leads sentiment

Liquidity drives acceleration

Support zones matter more than intraday noise

🔖

#Bitcoin #BTC #BTC100kNext? #BitcoinETF #MarketStructure #InstitutionalFlow #BinanceSquare #TSHAROK