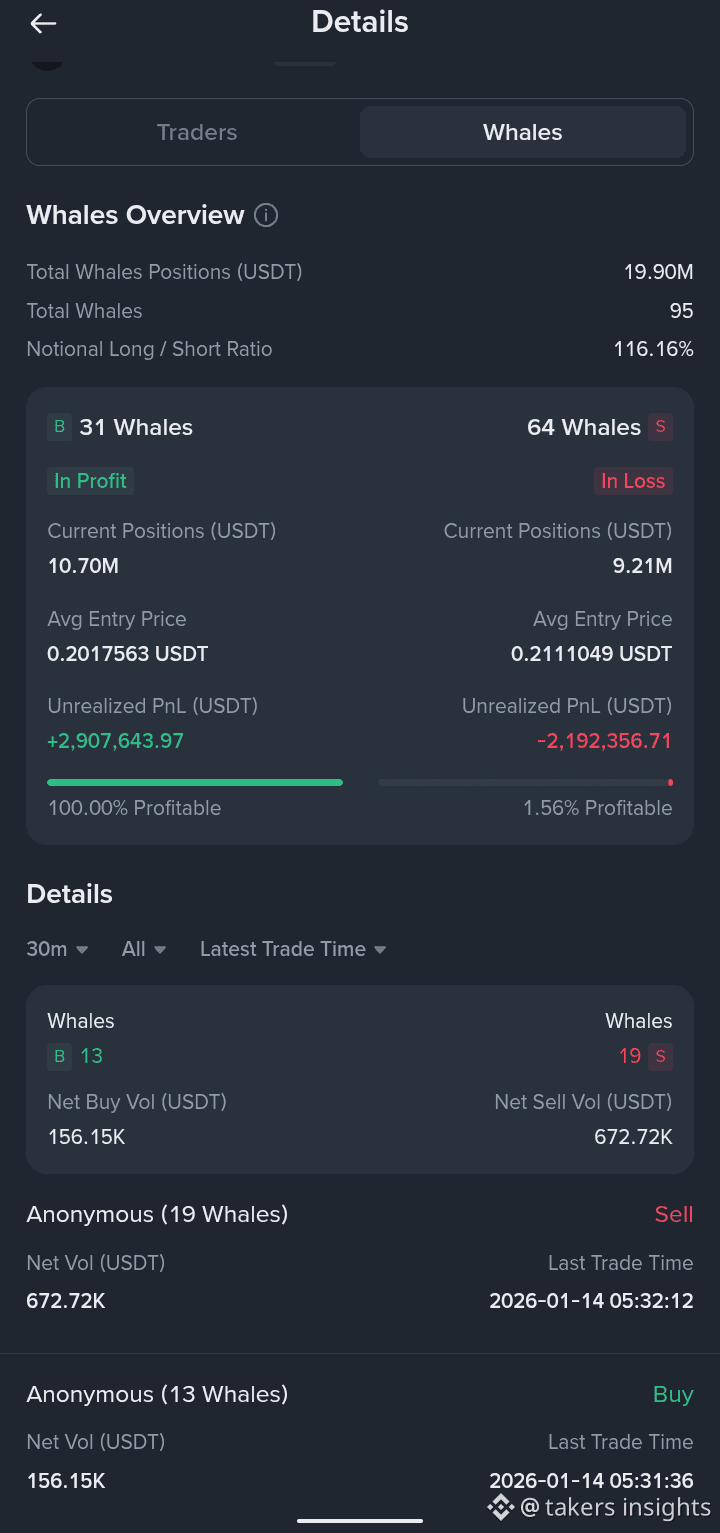

Whales Overview:

Total Whale Positions: $19.90M USDT

Total Whales: 95

Notional Long / Short Ratio: 116.16%

Bullish control: Long whales are heavily in profit (+$2.9M) while most short whales are losing (−$2.19M). This shows price is moving in favor of longs, not shorts.

Smart money positioning: Despite fewer long whales (31 vs 64 shorts), long positions hold more value and are perfectly profitable. This often indicates strong, well-timed accumulation.

Short pressure building: With shorts deeply underwater and only 1.56% profitable, the market is vulnerable to short covering or a short squeeze if price continues upward.

Mixed short-term flow: Recent whale activity shows more sell volume than buy volume, suggesting profit-taking or hedging, not necessarily trend reversal.

Overall takeaway:

The trend remains bullish, controlled by profitable long whales, while short whales are under stress. Short-term volatility or pullbacks are possible, but market structure favors upside continuation unless long whales start distributing heavily.