While Decentralized Finance (DeFi) has made earning passive income on stablecoins accessible to everyone, a significant hurdle remains: the constant trade-off between liquidity and utility. Traditionally, if you wanted to earn yield, your funds may be locked away; the moment you needed to spend, your earnings stopped. Most traditional crypto payment card options function as "pass-through" tools that hold your funds in non-interest-bearing accounts, essentially letting your money sit idle and lose value overtime while you wait to swipe.

Imagine a world where your money never stops working for you—where you earn high-interest returns until the very second you pay. This is the era of the On-Chain Yield Card, a new category of crypto payment tool that allows you to "Earn While You Spend." By bridging the gap between on-chain yield investment and daily liquidity, this on-chain solution is fundamentally redefining how Web3 users manage their wealth in the real world.

What is an On-Chain Yield Card?

An On-chain Yield Card is a next-generation crypto payment tool. Beyond the standard spending features of traditional crypto cards, it allows the card balance to participate in on-chain yield strategies. Unlike traditional cards, which act solely as payment gateways where funds remain idle, an on-chain yield card—once the 'earn' feature is activated—allocates funds to DeFi protocols to generate potential returns.

In short: While funds in a traditional crypto card simply sit waiting to be spent, the balance in an On-chain Yield Card captures potential yield while maintaining full liquidity.

How Does an On-Chain Yield Card Work? Where Does the Revenue Come From?

The core of an On-Chain Yield Card lies in its ability to allow card account balances to participate in on-chain yield strategies rather than simply sitting idle awaiting consumption. Unlike a Traditional Crypto Payment Card, once a user actively enables the "Earn" feature, the account balance participates in on-chain DeFi protocols according to preset strategies to seek potential returns. This process is transparent, verifiable, and executed by smart contracts, ensuring users maintain full control over their funds. Please note that yields fluctuate with market volatility, and fixed returns are not guaranteed.

The income generated by these cards typically originates from the following sustainable on-chain sources:

Over-collateralized Lending: The most common source of yield. Assets are provided to decentralized lending protocols such as Aave or Compound. Since borrowers must provide collateral higher than the loan amount, the risk of principal loss is minimized while interest flows back to the depositor.

Staking and Network Rewards: For compatible Proof-of-Stake (PoS) assets, yields are earned by participating in the security validation of the blockchain network itself.

Liquidity Provisioning: Funds are used to provide liquidity for decentralized exchange (DEX) pools. In return, holders receive a proportional share of transaction fees generated by global trading activity.

Tokenized Real-World Assets (RWA): Advanced on-chain solutions are bringing institutional-grade yields—such as tokenized U.S. Treasuries—directly into account balances. This allows users to capture government-backed "risk-free" rates while maintaining 24/7 liquidity.

The entire lifecycle is automated. When a transaction occurs at a Point of Sale (POS), the system triggers "instant" liquidation, redeeming only the precise amount required to settle the payment. The remaining balance continues to generate yield uninterrupted, ensuring your funds are continuously compounding until the very moment of consumption.

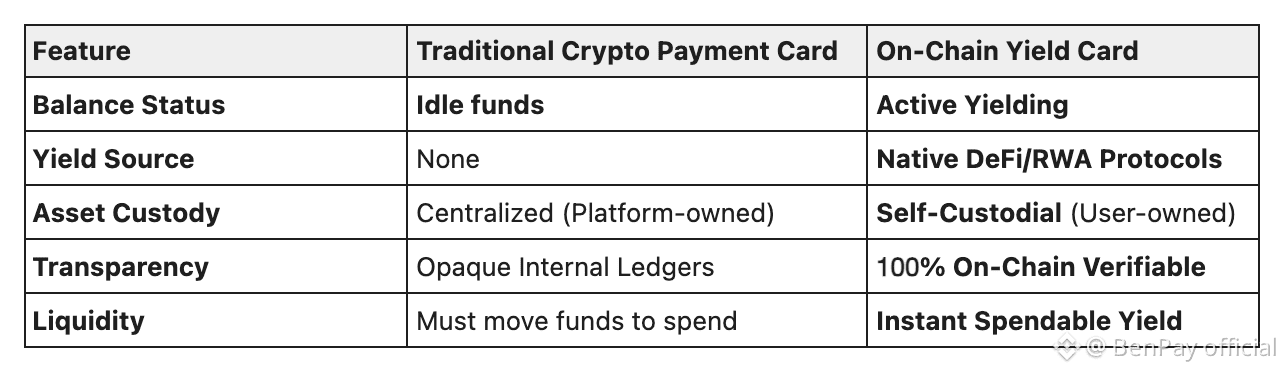

On-Chain Yield Card vs. Crypto Payment Card: What’s the Difference?

To understand the difference between a yield card and a Traditional Crypto Payment Card, one must first examine how standard crypto cards work. While they successfully bridge crypto assets with real-world payments, their design prioritizes spending convenience over asset efficiency, leaving idle balances unable to generate yield.

How a Traditional Crypto Payment Card Works?

A Traditional Crypto Payment Card is essentially a "bridge" or "gateway" tool. The process is typically linear: you manually "top up" a custodial wallet where funds sit as "dead assets" until they are converted into fiat at the time of payment. This model forces users to sacrifice yield potential for the sake of spending convenience.

Flaws of Traditional Crypto Payment Cards:

The "Idle Asset" Trap: Most traditional cards require you to deposit funds into a zero-interest wallet. If you keep $5,000 in your card for monthly expenses, those assets are effectively "dead."

Yield Interruption: To spend, funds must be moved out of yield-bearing accounts, causing interest generation to stop immediately.

Centralization Risk: Most standard cards are custodial. You do not own private keys, and the security of your funds depends entirely on the platform.

Invisible Fees: Many traditional cards hide poor exchange rates or high "spreads" when converting cryptocurrency to fiat.

Why the On-Chain Yield Card is Outperforming Traditional Crypto Payment Cards

As the global economy transitions toward a 24/7 digital model, the on-chain yield card represents the future of Web3 payments. It eliminates the outdated practice of ‘parking’ funds in non-interest-bearing accounts. In this new era, holding funds is just as profitable as asset appreciation—giving your daily balance a higher velocity of capital and more generous returns than traditional savings accounts.

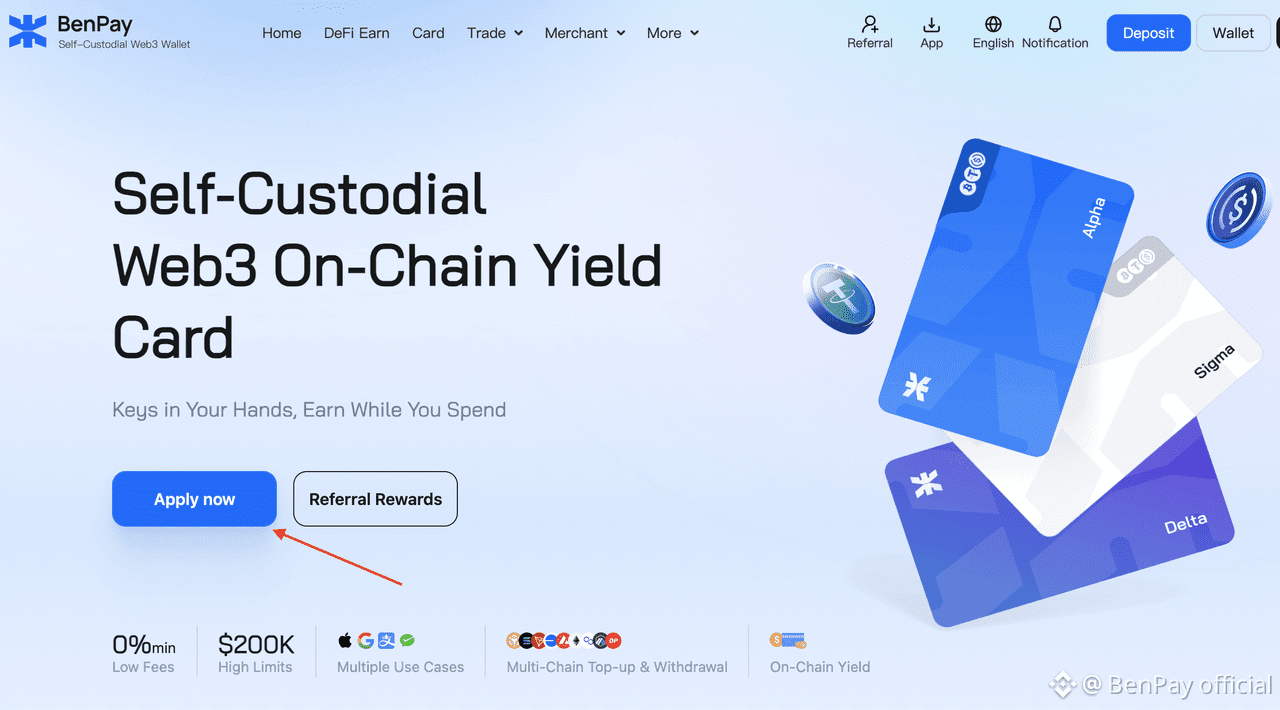

BenPay Card: A Web3 On-Chain Yield Card Built for Real-World Use

In the realm of on-chain yield cards, the BenPay Card stands out as a Web3 on-chain yield card specifically designed for modern users seeking security and asset appreciation. BenPay is more than just a payment method; it is a comprehensive asset allocation tool.

BenPay's Innovative Design: On-Chain Yield for Card Account Balances

As a leading on-chain yield card, BenPay Card introduces several advantages:

Self-Custodial Web3 Card: Security is the cornerstone of BenPay. You hold the keys to your financial future, ensuring your assets remain under personal control and free from the risks associated with centralized exchange collapses.

Yields on Card Account Balances: This is BenPay’s most powerful feature. When your funds are placed in the ‘Card Account,’ simply toggling the ‘Earn’ button allows your card account balance to immediately start generating on-chain yields.

Seamless Spending Management: When you are ready to shop, just transfer the required amount from the ‘Card Account’ to the ‘Card Balance.’ The system deducts the spending amount, while the remaining unused funds in the ‘Card Account’ continue to accrue interest, ensuring uninterrupted yields throughout the process.

Daily Settlement: Yields are calculated and settled daily, becoming available for withdrawal or reinvestment to earn compound interest the very next day. You maintain control over your earnings, ensuring your assets always operate at peak efficiency.

How to Apply for Your BenPay Card

Stepping into the future of Web3 payments is effortless. BenPay offers a streamlined onboarding experience, allowing you to activate your on-chain yield card in minutes. Simply visit our official website and click ‘Apply Now’ to request your card and start making your cryptocurrency work for you.

Ready to experience the next generation of financial sovereignty? Follow our Step-by-Step Application Guide to activate your card and start earning while you spend today.

Who Is the On-Chain Yield Card For?

For those who understand the time value of money, an on-chain yield card is the logical choice:

Passive Earners: Ideal for users who want to maximize asset efficiency without having to personally research and manage complex DeFi strategies. BenPay automates heavy lifting for you.

Stablecoin Enthusiasts: If a significant portion of your net worth is held in USDT or USDC, an on-chain yield card helps protect that value against fiat inflation.

Digital Nomads: For those who earn in crypto and spend in various fiat currencies across borders, the yields can help offset transaction fees.

DeFi Power Users: Why keep "spending money" in a 0% yield wallet when you can deposit it into BenPay to earn 3-5% (derived from on-chain yields and subject to fluctuation)?

Conclusion

With the evolution from traditional crypto payment cards to on-chain yield cards, your funds are no longer just waiting to be spent; they are actively participating in yield strategies while they wait. You no longer have to choose between earning returns and daily spending. With innovative tools like BenPay, you can finally achieve the ultimate convenience of earning while you spend.

Ready to stop letting your crypto sit idle? Get your BenPay on-chain yield card today and start earning while you spend it.

Frequently Asked Questions (FAQ)

Q1: Are on-chain yield cards safe compared to traditional bank cards?

While traditional bank cards are protected by government schemes, on-chain yield cards rely on the security of blockchain technology and audited smart contracts. By using an on-chain yield card, you enjoy asset transparency—you can clearly see where your funds are—and if it is a self-custodial card, you are the only one with the authority to move your assets. However, please note that risks still exist; please assess your personal risk tolerance before use.

Q2: How is an on-chain yield card different from a High-Yield Savings Account (HYSA)?

While both offer interest in balances, an on-chain yield card typically provides relatively secure and stable returns by directly accessing curated decentralized protocols. Additionally, yields fluctuate with market conditions, and a fixed return is not guaranteed.

Q3: How is the APY of an on-chain yield card calculated?

The APY of an on-chain yield card is determined by the market supply and demand of the underlying DeFi protocols and will fluctuate with market changes. Actual returns may increase or decrease, and a fixed return is not guaranteed.