$ORDI ORDI ($ORDI) Analysis: The "Bitcoin Gold" of Inscriptions

If you’re watching the Bitcoin ecosystem, ORDI is the pioneer. As the first-ever BRC-20 token, it serves as a high-beta proxy for Bitcoin’s momentum and the growing "Inscription" economy.

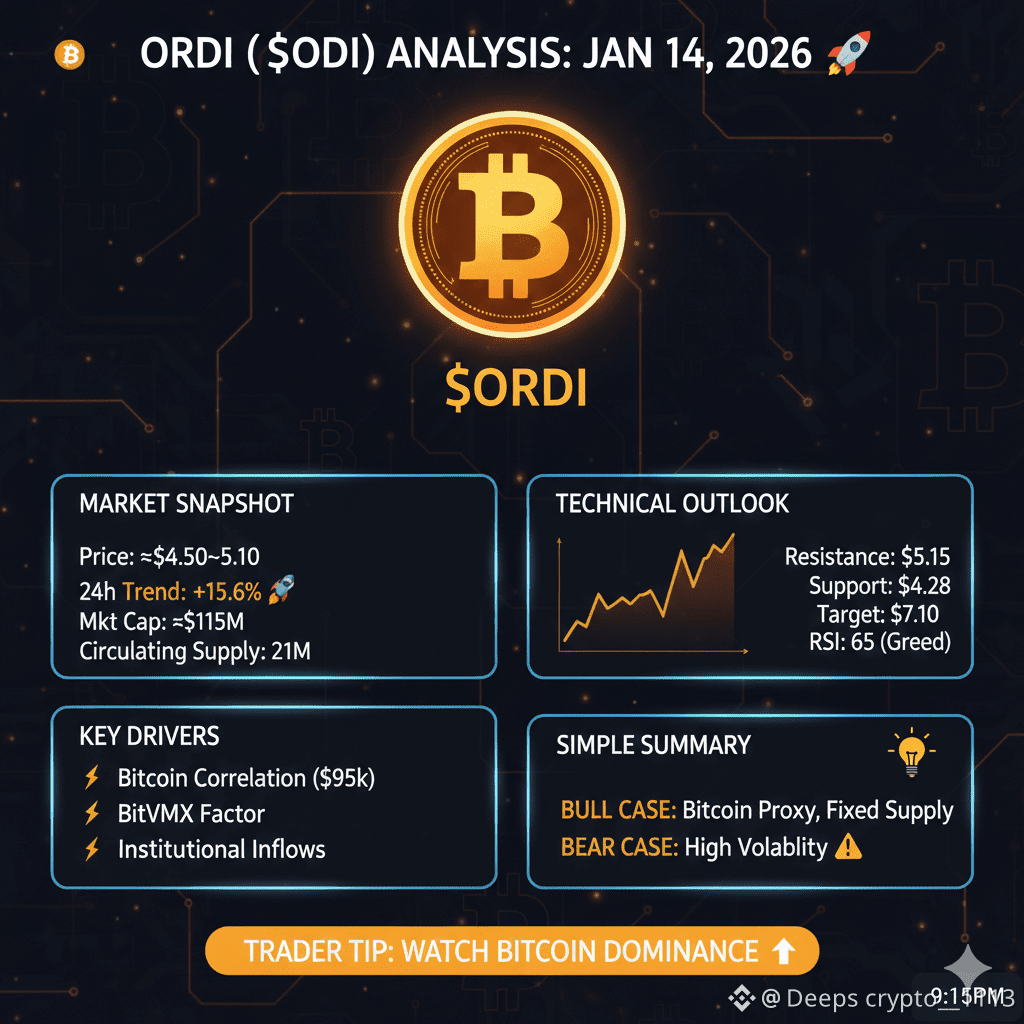

Here is your simple breakdown for January 14, 2026.

1. Market Snapshot

* Current Price: ~$4.50 – $5.10 (Highly volatile session)

* 24h Trend: +15.6% (Strong rebound led by Bitcoin’s rally)

* Market Cap: ~$115M

* Circulating Supply: 21M (Fully circulated—matches Bitcoin’s max supply).

2. Why is $ORDI Surging Today?

* Bitcoin Correlation: Bitcoin just broke past $95,000, eyeing the historic $100k mark. As a "leveraged proxy," ORDI often moves 2-3x faster than BTC, capturing the capital flowing into the Bitcoin ecosystem.

* The "BitVMX" Factor: Recent integrations allowing ORDI to be bridged to other chains like Cardano and Solana have unlocked new DeFi utility. It's no longer just a "meme" inscription; it’s becoming a cross-chain asset.

* Institutional Inflows: Massive inflows into Bitcoin ETFs (+$754M yesterday) are trickling down into "blue-chip" BRC-20 tokens like ORDI as investors look for higher-beta returns within the BTC umbrella.

3. Technical Outlook: Bullish or Bearish?

* The Resistance Wall: ORDI is currently fighting to break through the $5.15 level. If it holds above this, the next major psychological target is $7.10.

* Support Floor: If the market cools, look for buyers at $4.28, which aligns with the 50-day SMA and has acted as a strong rebound zone this month.

* Sentiment: The Fear & Greed Index for ORDI has jumped into "Greed" territory today. While bullish, watch for short-term "bull traps" if Bitcoin faces a rejection near $98k.

4. The "Simple" Summary

The Good: ORDI is the "first mover" of Bitcoin inscriptions. It has a fixed supply of 21 million (just like BTC), making it a rare digital collectible with massive brand recognition.

The Risk: It is extremely sensitive to Bitcoin’s price. If Bitcoin drops 5%, ORDI might drop 15%. High reward comes with high volatility.