Ripple's monthly 1 billion XRP escrow unlocks have a historically minimal and often short-lived direct price impact because the market anticipates these scheduled events and Ripple typically re-locks the majority of the tokens. The price of XRP tends to be more heavily influenced by broader market conditions, regulatory news, and overall market sentiment than the unlocks themselves.

Key Insights

Managed Supply: Ripple established the escrow system in 2017 to ensure a predictable supply of XRP and prevent sudden market shocks.

Minimal Net Increase: Of the 1 billion XRP unlocked each month, approximately 60% to 80% is typically returned to new escrow contracts. Only about 200–400 million XRP net enters the circulating supply for operational needs, institutional sales, and ecosystem support.

Market Anticipation: The scheduled and transparent nature of the unlocks means they are largely priced into the market in advance, reducing the potential for significant, unexpected volatility.

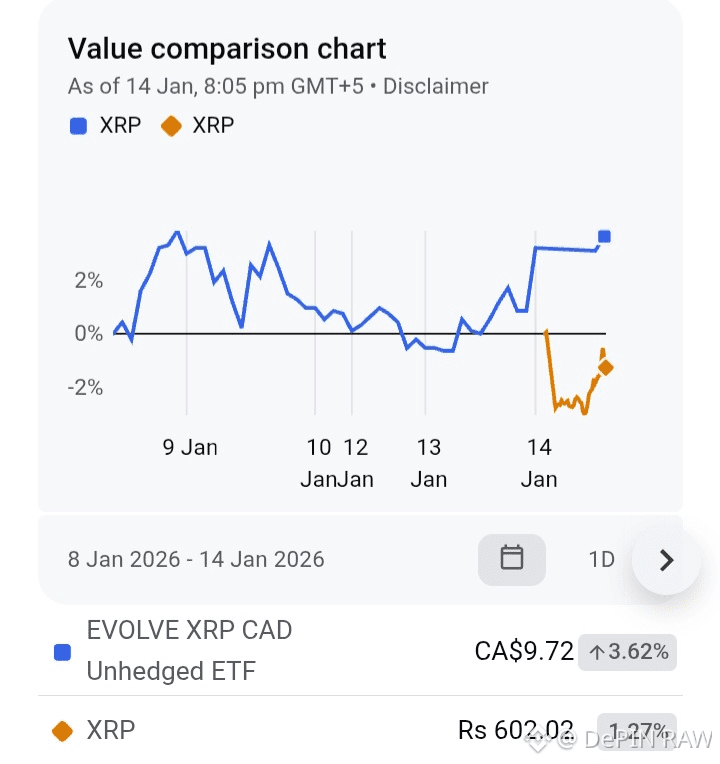

Broader Influences: Factors such as flows into US spot XRP ETFs, the ongoing SEC lawsuit's resolution in August 2025, and general crypto market cycles have a much larger impact on the price than the routine escrow releases.

Volatility Driver: While direct price impact is limited, the headline news of a large unlock can still increase short-term volatility as day traders react to the potential for increased supply.