Inflation Cooling – Bullish for Crypto 🚀

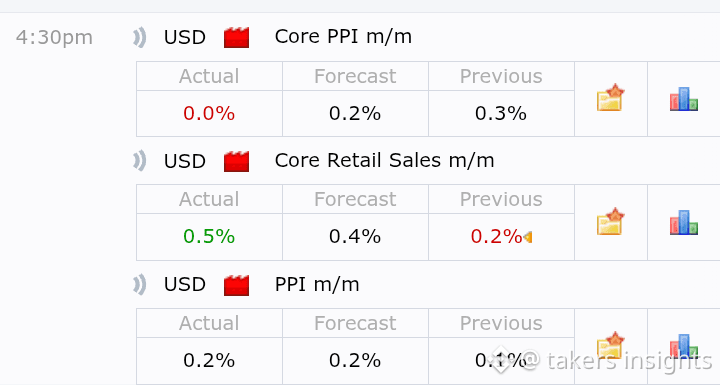

The latest Core PPI data for January has come in at 0.0% (vs. 0.2% forecast), showing no increase in producer prices. This is a significant slowdown from last month’s 0.3% increase and signals easing inflation pressures.

KEY TAKEAWAYS:

Core PPI is a key inflation indicator, and a 0.0% result suggests no upward price pressures at the producer level.

With inflation cooling, the Fed’s tightening cycle may slow, or even shift towards rate cuts in the future.

A more dovish Fed means lower interest rates, which is generally bullish for risk assets like Bitcoin and altcoins.

WHY THIS MATTERS FOR CRYPTO:

Lower inflation → Less restrictive monetary policy

Weaker USD → Greater demand for Bitcoin and altcoins

Risk-on sentiment builds, increasing liquidity and driving price growth for BTC and ETH 🚀

Short-term: Potential market volatility

Mid-term: Bullish for risk assets, including crypto

#Inflation #USNonFarmPayrollReport $BTC