When Profit Is Earned, Not Hoped

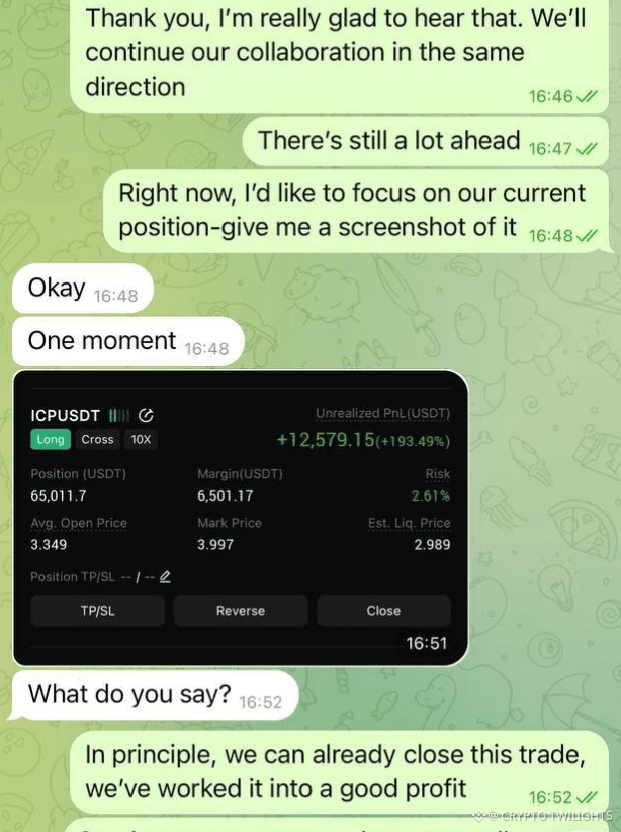

This screenshot tells a very important story — not just of numbers, but of mindset, timing, and responsibility. Many people will look at the unrealized PnL and only see the green color. A professional looks deeper. A professional asks one simple question at the right time:

“What do you say?”

That question separates emotional trading from structured decision-making.

The conversation here is calm, respectful, and focused. No rush. No excitement. No pressure. Just clarity. That alone already shows that the trade was not accidental. It was planned, managed, and controlled from the beginning.

Let’s talk about what really matters.

This position is already deep in profit. Not a small fluctuation. Not a lucky spike. This is a trade that has been worked into profit. That phrase is important. Profit wasn’t gifted by the market — it was extracted through patience and correct execution.

Most traders don’t lose money because the market is against them.

They lose money because they don’t know when to stop.

They see green and think, “Maybe more.”

They see momentum and forget risk.

They ignore the fact that unrealized profit is not real profit.

Here, the mindset is different.

“In principle, we can already close this trade.”

That sentence reflects maturity. It shows understanding that the job of a trader is not to predict the future perfectly, but to manage the present intelligently.

Markets are uncertain by nature. Anyone promising certainty is lying — either to others or to themselves. What we can control is risk, exposure, and decision timing. And this trade shows exactly that.

Notice how leverage is being handled. Yes, leverage is involved. But leverage without control is gambling. Leverage with discipline is just a tool. The liquidation price is respected. The margin health is monitored. The risk percentage is low. This is how professionals survive volatile markets.

Another key lesson here:

There is no ego in closing a winning trade.

Ego says, “Let it run forever.”

Experience says, “Protect what the market has already given.”

Many traders feel emotional pain when they close a trade and price keeps moving further. That pain comes from attachment, not logic. A disciplined trader understands that leaving money on the table is normal. Losing capital is not.

This trade doesn’t need excitement. It doesn’t need validation. It doesn’t need noise. It only needs a correct decision at the correct moment.

Also notice the communication. There is trust. There is confirmation. There is no blind action. Decisions are discussed, not forced. This is how long-term consistency is built — not through impulse, but through alignment.

People often ask why consistency feels so difficult. The answer is simple but uncomfortable: consistency requires boredom. It requires repeating the same behavior even when emotions want something different. It requires saying “enough” when greed wants “more”.

This is why most people blow accounts after a few good trades. They confuse confidence with invincibility. Professionals never do that. Every trade is independent. Every position is treated with respect.

Another powerful lesson here is timing. The trade is not being closed because of fear. It’s being closed because the objective has already been achieved. That distinction matters. Fear exits are chaotic. Planned exits are calm.

Trading is not about squeezing every last dollar from a move. It’s about stacking controlled wins over time. One good decision repeated many times beats one perfect prediction.

If you are still learning, understand this clearly:

Big profits come from small rules followed consistently.

Protect capital.

Lock profits.

Respect risk.

Detach emotions.

The market doesn’t care about hopes, screenshots, or opinions. It only reacts to liquidity and behavior. Your job is to survive, adapt, and grow.

This screenshot is not motivation.

It’s a reminder.

A reminder that patience pays.

A reminder that discipline works.

A reminder that the market rewards those who respect it.

Trade smart.

Think long term.

And always remember — unrealized profit is just potential. Real profit is a decision. 📊📈