With more and more merchants and payment networks accepting cryptocurrency assets, crypto payment cards are gradually evolving from "whether they can be used" to "how to use them more efficiently". In this process, crypto cashback cards and crypto yield cards (also known as on-chain yield cards) have become the two most commonly compared products by users.

They all seem to be able to "generate profits while being used", but the essential differences are very obvious in the sources of income, risk structure, asset control, and target audience. This article will focus on comparing these key points and using the BenPay Card as a specific case for analysis.

Crypto Cashback Card vs. Yield Card: What Is the Essential Difference?

The crypto cashback card is based on the premise of "completing the consumption", and returns cash, tokens, or points in proportion after the transaction occurs; without consumption, there is usually no income. The crypto yield card is based on "asset balance". After the user actively activates the earning function, the funds participate in the on-chain DeFi protocol through smart contracts. Even if there is no consumption, the idle balance may continue to generate income. Essentially, the cashback card is a consumption incentive tool, while the yield card is an asset efficiency tool.

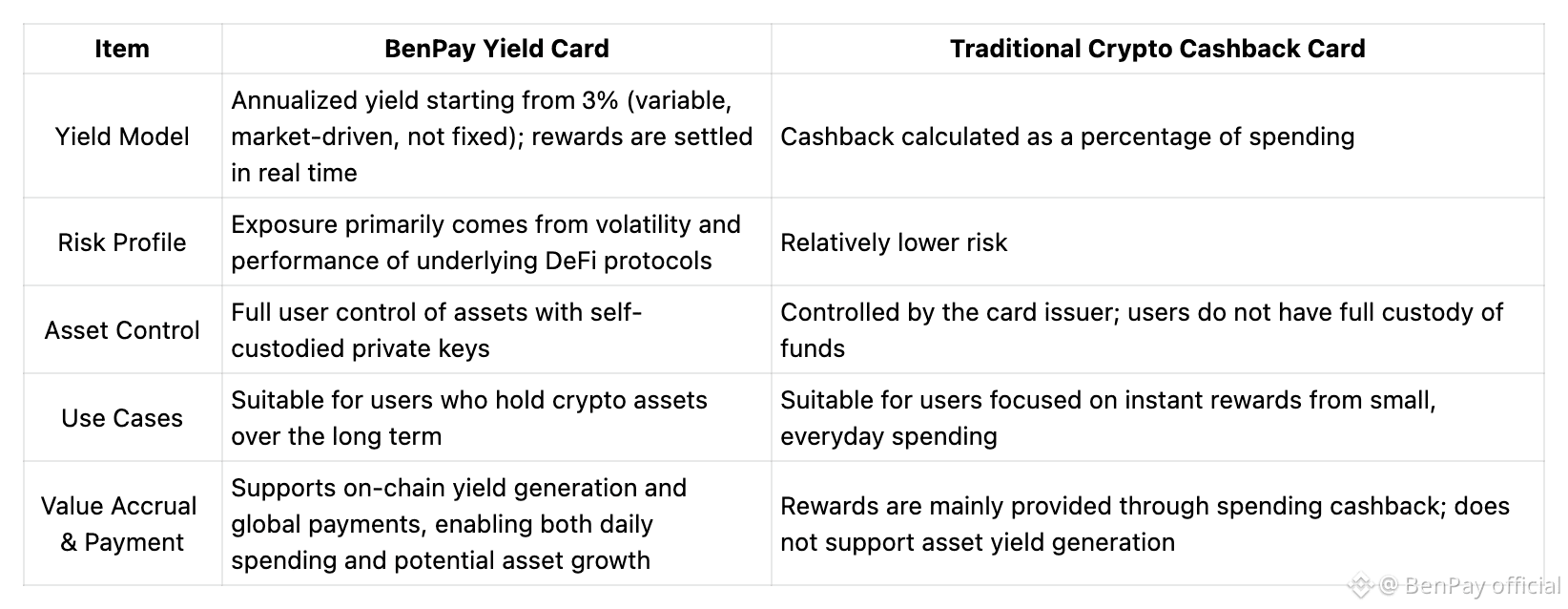

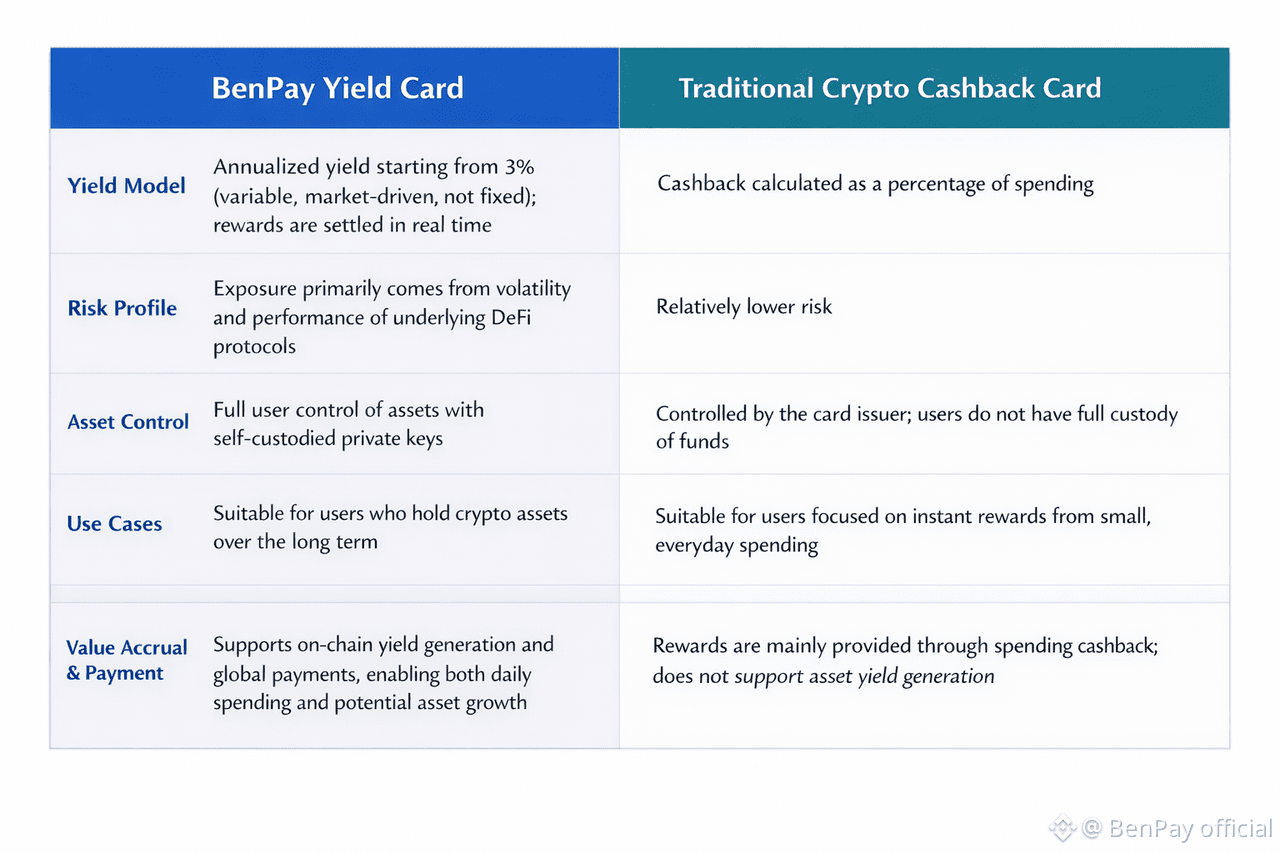

Core Comparison Between the Crypto Cashback Card and the BenPay Yield Card

Taking BenPay yield card and common cashback crypto card as examples, the differences between the two types of products are mainly reflected in the following aspects:Yield Model

BenPay Yield Card:

Utilizes a self-custodied Web3 on-chain yield mechanism. Card account balances can participate in on-chain yield strategies, with annualized returns starting from 3% (actual yield levels depend on the selected on-chain protocols and prevailing market conditions). Yields are settled in real time, and funds can be withdrawn or spent at any time.

This model is built on blockchain technology and DeFi protocols in a fully decentralized manner, ensuring transparency and security while avoiding reliance on centralized intermediaries.Traditional Crypto Cashback Card:

Relies on cashback programs, returning a certain percentage of spending in cash or reward points. Cashback typically comes with caps, and the reward rates are generally modest.

This model does not involve blockchain-based or decentralized yield strategies and, therefore, cannot generate additional returns through on-chain protocols.

Risk Management

BenPay Yield Card:

Risks primarily arise from fluctuations in DeFi protocols and changing market conditions. To mitigate these risks, the platform selects established blue-chip DeFi protocols and applies multiple security measures, such as smart contract audits and on-chain self-custody.

User assets remain under self-custody at all times, with private keys fully controlled by the user, ensuring complete ownership and control.Traditional Crypto Cashback Card:

Generally considered lower risk, with risks mainly related to card security and the financial stability of the card issuer or partner banks. Since cashback rewards depend on merchant partnerships and card limits are subject to bank approval, users have limited control over fund security and risk management.

Asset Control

BenPay Yield Card:

Users retain full control over their assets through a self-custody model. Private keys are held by the user, and all actions—such as deposits, withdrawals, or yield claims—require user authorization. Card balances remain fully under user control, minimizing reliance on third parties.Traditional Crypto Cashback Card:

Card issuers maintain significant control. Spending limits, cashback structures, and reward rules are determined by the issuing institution.

Users do not have full custody of their funds, and card usage terms may be affected by policy or regulatory changes from banks or payment providers.

Value Accrual & Payment Functions

BenPay Yield Card:

Supports both on-chain yield generation and global payments. Funds can be used for everyday spending while simultaneously participating in on-chain value accrual.

Card balances can earn yield through DeFi protocols and be flexibly transferred for payments.Traditional Crypto Cashback Card:

Rewards are primarily provided through spending-based cashback. This model does not support asset yield generation and is limited to consumption-driven incentives.

If a user’s primary needs are global payments and asset value growth, the BenPay Yield Card offers greater flexibility and long-term value accrual potential. If the user prefers immediate spending rewards, a crypto cashback card may be a better fit. Each option serves different priorities, and the choice ultimately depends on the user’s preferences regarding payment methods, asset value growth, and spending rewards.

Yield Model

BenPay Yield Card:

Utilizes a self-custodied Web3 on-chain yield mechanism. Card account balances can participate in on-chain yield strategies, with annualized returns starting from 3% (actual yield levels depend on the selected on-chain protocols and prevailing market conditions). Yields are settled in real time, and funds can be withdrawn or spent at any time.

This model is built on blockchain technology and DeFi protocols in a fully decentralized manner, ensuring transparency and security while avoiding reliance on centralized intermediaries.Traditional Crypto Cashback Card:

Relies on cashback programs, returning a certain percentage of spending in cash or reward points. Cashback typically comes with caps, and the reward rates are generally modest.

This model does not involve blockchain-based or decentralized yield strategies and, therefore, cannot generate additional returns through on-chain protocols.

Risk Management

BenPay Yield Card:

Risks primarily arise from fluctuations in DeFi protocols and changing market conditions. To mitigate these risks, the platform selects established blue-chip DeFi protocols and applies multiple security measures, such as smart contract audits and on-chain self-custody.

User assets remain under self-custody at all times, with private keys fully controlled by the user, ensuring complete ownership and control.Traditional Crypto Cashback Card:

Generally considered lower risk, with risks mainly related to card security and the financial stability of the card issuer or partner banks. Since cashback rewards depend on merchant partnerships and card limits are subject to bank approval, users have limited control over fund security and risk management.

Asset Control

BenPay Yield Card:

Users retain full control over their assets through a self-custody model. Private keys are held by the user, and all actions—such as deposits, withdrawals, or yield claims—require user authorization. Card balances remain fully under user control, minimizing reliance on third parties.Traditional Crypto Cashback Card:

Card issuers maintain significant control. Spending limits, cashback structures, and reward rules are determined by the issuing institution.

Users do not have full custody of their funds, and card usage terms may be affected by policy or regulatory changes from banks or payment providers.

Value Accrual & Payment Functions

BenPay Yield Card:

Supports both on-chain yield generation and global payments. Funds can be used for everyday spending while simultaneously participating in on-chain value accrual.

Card balances can earn yield through DeFi protocols and be flexibly transferred for payments.Traditional Crypto Cashback Card:

Rewards are primarily provided through spending-based cashback. This model does not support asset yield generation and is limited to consumption-driven incentives.

If a user’s primary needs are global payments and asset value growth, the BenPay Yield Card offers greater flexibility and long-term value accrual potential. If the user prefers immediate spending rewards, a crypto cashback card may be a better fit. Each option serves different priorities, and the choice ultimately depends on the user’s preferences regarding payment methods, asset value growth, and spending rewards.

How to Choose: BenPay Yield Card or a Crypto Cashback Card?

When choosing between the BenPay Yield Card and a crypto cashback card, users can make a decision based on their own needs. Each option has its own strengths and is designed for different use cases.

If you prioritize instant cashback, low learning cost, and pure spending rewards, a crypto cashback card may be more suitable.

If you value asset ownership, on-chain transparency, and long-term asset efficiency, the BenPay Yield Card is likely the better choice.

Payment Compatibility

BenPay Yield Card: Supports global payments for both online and offline use, making it suitable for a wide range of payment scenarios worldwide.

Crypto Cashback Card: Also supports global payments, but may face certain limitations depending on partner merchants or payment channels, subject to the issuing institution.

Spending Limits

BenPay Yield Card: Some card tiers offer relatively higher spending limits, making them suitable for frequent spending or large payments, especially in scenarios such as business travel.

Crypto Cashback Card: Typically comes with spending limits, particularly for new users or users with lower credit profiles, who may find it harder to obtain higher limits.

Reward Model

BenPay Yield Card: By allocating the card account balance into on-chain yield mechanisms, users can earn returns while spending. This model is suitable for users who wish to improve asset efficiency through on-chain yield participation.

Crypto Cashback Card: Primarily relies on spending-based cashback. Cashback rates are usually modest and often capped, focusing on immediate rewards rather than long-term asset growth.

Cross-Chain Operations and Fees

BenPay Yield Card: Supports multiple blockchains, allowing users to choose the most suitable network based on their needs, potentially lowering transaction fees and increasing operational flexibility.

Crypto Cashback Card: Most rely on traditional payment settlement systems and do not directly interact with on-chain protocols. As a result, they generally do not support cross-chain asset management, offering limited flexibility in on-chain fund usage.

If your primary goal is global payments combined with asset efficiency and long-term value creation, the BenPay Yield Card offers greater flexibility and long-term potential. If you prefer instant consumption rewards, a crypto cashback card may better align with your needs. Ultimately, the choice depends on your preferences regarding payment methods, asset efficiency, and spending rewards.

Who Is the BenPay Yield Card Designed For?

The BenPay Yield Card is not designed solely for crypto enthusiasts—it addresses the needs of multiple user groups. Compared with traditional crypto cashback cards, the Yield Card offers a more efficient and flexible way to grow assets while balancing everyday payments and asset allocation. Specifically, it is well suited for the following users:

• Crypto Beginners

For users who are new to cryptocurrency, the BenPay Yield Card offers a low-barrier entry to on-chain yield generation. Users do not need to understand complex crypto mechanics to benefit from automated value accrual. Once on-chain yield is enabled, the entire process is automated, allowing assets to grow without additional manual operations.

• DeFi Users

For users familiar with DeFi and on-chain strategies, the Yield Card provides a convenient gateway to participate in selected on-chain yield strategies. Unlike traditional DeFi participation, users are not required to actively manage positions. Assets remain liquid while earning yield, making them readily available for everyday spending.

• Cross-Border Business Professionals

The Yield Card supports global payments with high spending limits, making it suitable for frequent travelers and cross-border business users. Whether domestically or overseas, the card integrates seamlessly with mainstream POS terminals and digital payment platforms such as Apple Pay, Google Pay, and WeChat Pay, delivering a smooth and convenient payment experience.

• Long-Term Crypto Holders

For users who believe in the long-term value of crypto assets but still require liquidity, the Yield Card offers an ideal balance. Users can allocate part of their holdings to the card, enabling daily spending while participating in on-chain value accrual—maintaining flexibility without leaving assets idle.

• Traditional Finance Users

Traditional finance users seeking exposure to crypto-based value growth can also benefit from the Yield Card. It provides the same convenience as traditional payment tools, while adding on-chain yield generation and value accrual. This allows users to access crypto-based returns without changing their existing spending habits.

Summary

Crypto cashback cards focus on making spending more rewarding, while yield cards focus on ensuring assets do not remain idle. If your goal is instant rewards and simplicity, a cashback card may be sufficient.

If you place greater emphasis on asset control, on-chain transparency, and long-term value growth, crypto yield cards—represented by the BenPay Yield Card—offer a more suitable choice.