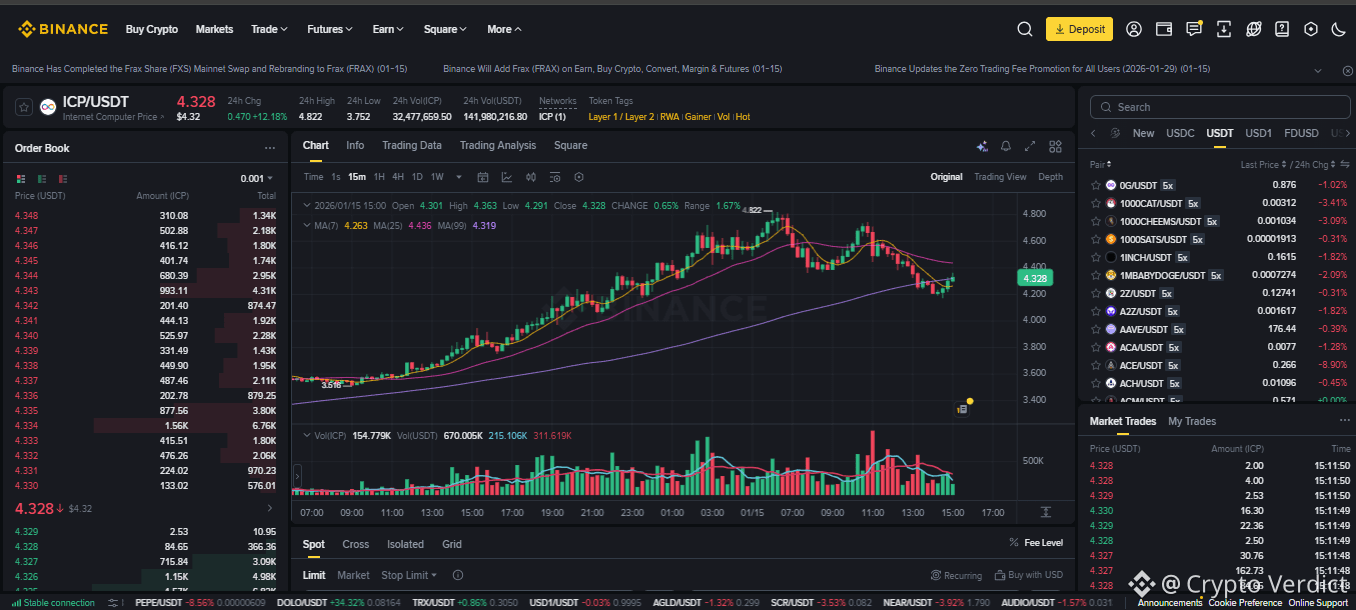

Lately, ICP's$ICP everywhere people talk. Screens flash numbers jumping back and forth. Online chatter grows louder by the hour. Folks watch every move, waiting. Yet past the rush of posts and price swings, one clear pattern stands out on the graph. That shape might just hint at what happens next.

Here is what it means without fancy words.

ICP Gains Attention

What makes ICP stand out? Not just another coin chasing trends. Building toward an internet that opens wider than now - that matters. Lately, attention has returned. Chatter pops up on Twitter. Conversations spread through Discord. Everywhere you look, talk grows.

Fresh changes arrived just lately, stirring interest among market players. Yet here's what really matters:

Fake progress or actual change?

At this moment, keep your eyes on just two numbers. One shifts fast, the other changes slow. Each affects what comes next. Pay attention to how they move apart - or sometimes line up

Should ICP move past $4.82, a rise might follow.

Falling under $4.36 could trigger a quick decline.

Market Activity Overview

A wobble in stocks today. Not much, but the S&P 500 slipped - so did the NASDAQ. Nerves show up when numbers dip like that.

Falling faster than most, ICP shows clear signs of strain lately. A powerful US dollar plays its part. Lower bond returns add to the weight. Pressure builds on digital assets such as ICP under these conditions.

Where ICP Stands

At this moment, ICP sits near $4.41. Hitting $4.82 was attempted - didn’t happen though. Still waiting.

Imagine the graph doing this - it bumps into a level it can’t break, yet each dip climbs just a bit more. This shape? Traders often name it an ascending triangle.

When it cracks the upper limit, a sharp rise might follow. A sudden move upward becomes likely if resistance fails. Breaking through high levels often triggers quick momentum shifts. Once that barrier is gone, speed can pick up rapidly.

When it cracks the surface, a quick drop might happen. A fall could start if the ground splits open.

Check the indicators quickly

Bumping up toward overbought, RSI sits at 72. Could mean things cool off soon. A dip might follow. Watch how it holds there.

A shift upward shows on the MACD, though power behind it feels thin. Still, signs point to buying pressure creeping in.

Remember these numbers:

Current: $4.41

Resistance: $4.82

Support: $4.36

Lower supports: $3.94 and $3.50

A climb past $4.82 might open the path toward $6.00. Reaching that level depends on what happens after this key point.

Three Possible Paths

Betting on higher prices? There is a 40 percent shot it jumps. Above $4.82, momentum could carry it near $6.00. Timeline: one to two weeks. Movement isn’t guaranteed, yet possible.

Betting against the trend? Thirty-five in a hundred odds point south. Slide past $4.36 opens door to $3.94. Or maybe even $3.50 if pressure builds.

A stretch of steady numbers might show up - hovering near 4.36 to 4.82. Odds sit at one in four. Movement pauses, just for now.

A Simple Trading Plan

Action: HOLD

Price range to consider: $4.36 up to $4.45

Stop loss: $4.15

Win a bit at $4.82 - that's the first target. Reaching it means progress, nothing more

Win number two lands at five fifty

A little caution helps. When things start rising, gains might grow fast.

What To Be Aware Of

Falling prices might hit the entire market. Still, some areas may resist the trend.

Failure can happen with the triangle setup. Sometimes it just does not hold up.

A stumble might shake ICP deeply.

Price might have moved too far, according to RSI.

Putting just a tiny bit - say 1 or 2 percent - keeps things steady. Safety shows up in small bets.

Bottom Line

Now ICP faces two different paths ahead.

A move past $4.82 might keep climbing. That level cleared, further gains seem possible.

Beneath $4.36 lies a path downward. Slipping past that point opens room for further decline.

For once, waiting pays off. Pay attention to where prices move next.

Quick Snapshot

Price: $4.41

RSI: Overbought

Pattern: Ascending triangle

Up top, $4.82 stands first. Above that, $5.50 waits its turn. Then comes $6.00 - higher still

Bottom at 4.36, then dips to 3.94 before landing near 3.50

Recommended: HOLD

Timeframe: 1–2 weeks

Final Verdict

Action: HOLD

Confidence: 60%

Target: $5.50

Risk/Reward: 1:4

A sudden jump past $4.82 on heavy volume - that’s what has to unfold. Only then does momentum truly shift upward. The climb gains credibility once price clears that level with conviction.

Look sharp. That tells you where ICP moves from here.