WHAT’S A FUNDING FEE IN CRYPTO

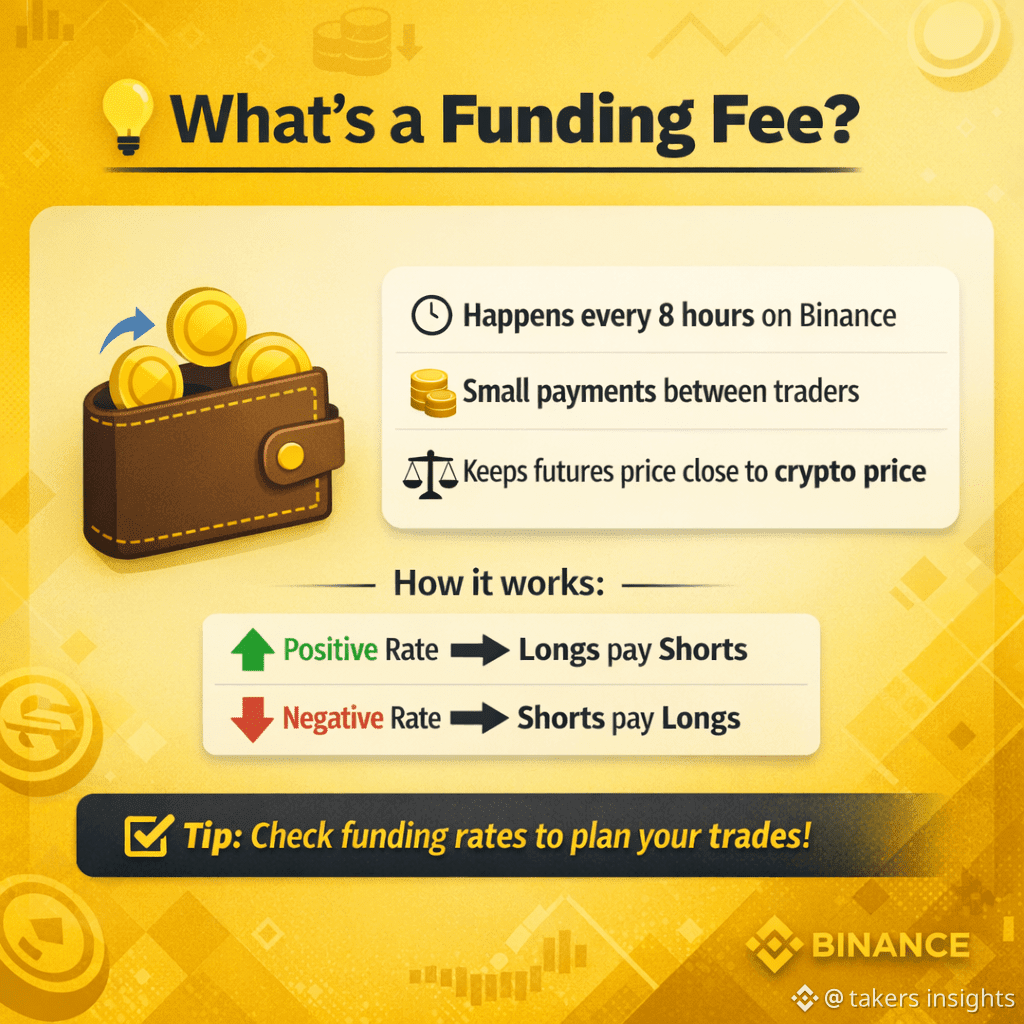

This is When trading crypto futures, you don’t just pay for the coin — you may also pay a funding fee.In simple term Funding fees are small payments between traders.

They happen regularly (every 8 hours on Binance).

Purpose: Keep the price of perpetual futures close to the real crypto price.

🔹 How it works:

Positive Funding Rate

Definition: The rate is above 0.

Who pays whom: Longs (people betting prices go up) pay Shorts (people betting prices go down).

Why it happens: There are more long positions than short positions, so the market incentivizes traders to balance.

Effect: Being long costs a bit more; being short earns a small payment.

Negative Funding Rate

Definition: The rate is below 0.

Who pays whom: Shorts pay Longs.

Why it happens: There are more short positions than long positions, so the market encourages more long positions.

Effect: Being short costs a bit more; being long earns a small payment.

📌 Why it matters:

Market Stability

Keeps perpetual futures prices close to real crypto prices.

Balanced Liquidity

Encourages both long and short traders to participate.

Risk Management

Reduces arbitrage gaps and prevents extreme price swings.

Profit Opportunities

Traders can earn or pay funding fees depending on market sentiment.

Adaptable to Market Trends

Adjusts automatically based on bullish or bearish conditions.

Healthy Market Cycles

Helps prevent one-sided dominance and extreme volatility.

QUICK TAKEAWAY FOR BEGINNERS

The funding rate rotates between positive and negative depending on market sentiment.

It’s not a fee from Binance, it’s trader-to-trader payments.

Check the funding rate before entering a trade to know if you might pay or earn it.

#Write2Earn #CPI_BTC_Watch #FundingRates $BTC