📊 1) Current Price & Market Behavior

Price Trend & Short-Term Dynamics

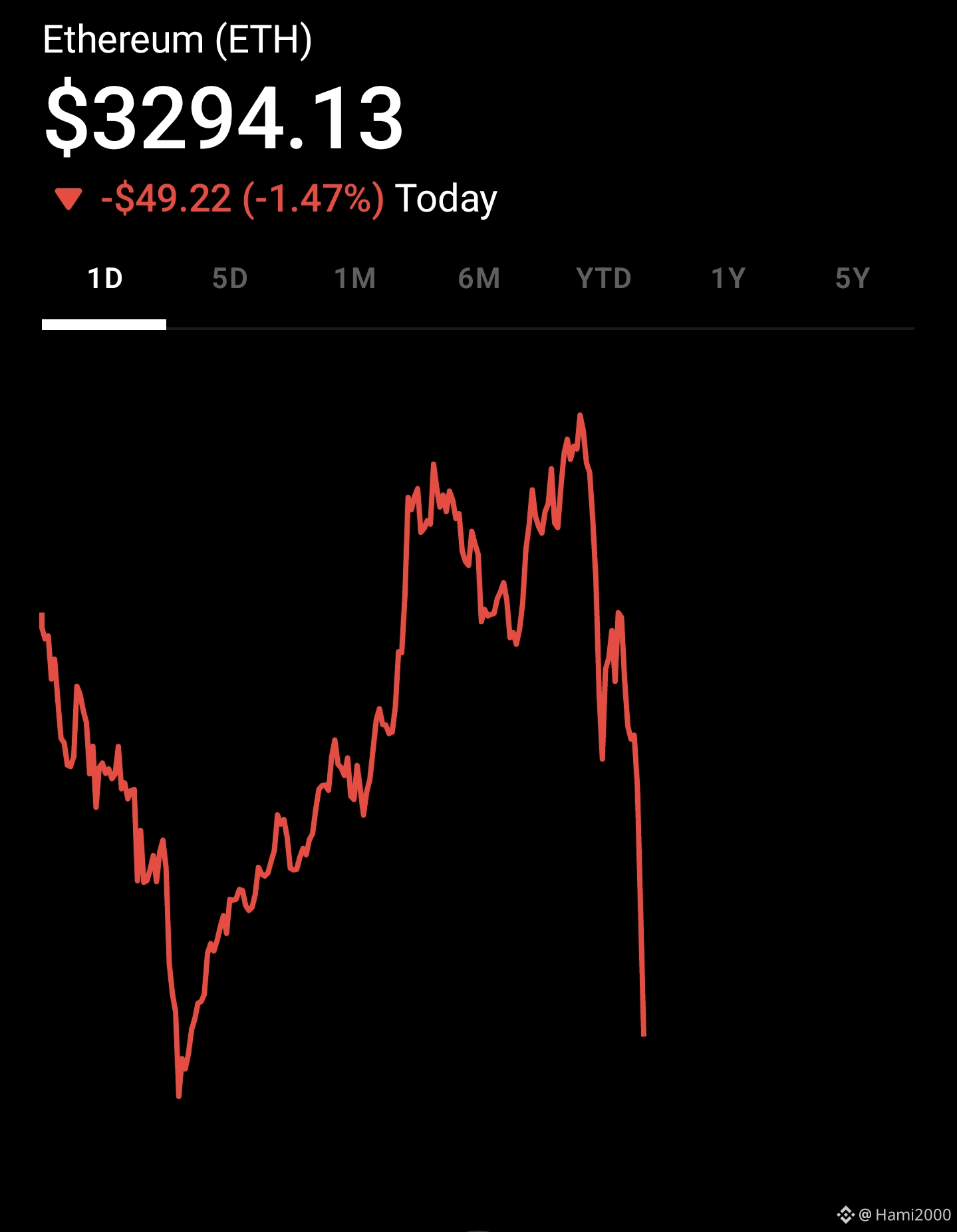

$ETH has been trading around $3,100–$3,400 recently, showing consolidation and some volatility. Analysts see possible near-term targets around $3,300–$3,550 if bullish momentum continues.

Market structure still fragile — bearish patterns could continue if critical supports fail.

Market Sentiment

Short-term sentiment is cautiously optimistic, with consolidation around current levels and potential upside if momentum strengthens. �

📈 2) Analyst Forecasts & Outlook

Bullish Views

Major financial institutions like Standard Chartered forecast strong long-term growth for ETH — potentially outperforming Bitcoin and reaching higher levels by the end of 2026 (e.g., ~$7,500+). �

Some models even project continued growth toward $15,000–$22,000 beyond 2026 based on institutional adoption, DeFi activity, and real-world asset tokenization. �

Neutral / Mixed Forecasts

Recent price predictions see ETH potentially breaking higher toward mid-$3,000s by late January 2026 if current patterns hold. �

Bearish / Risk Scenarios

Alternative forecasting models highlight risk of deeper pullbacks (e.g., prices down toward $2,500–$2,000) if broader markets weaken or key technical levels break. �

🛠 3) Network & Development – The Tech Story

Upgrades & Roadmap Ethereum’s ecosystem is actively evolving with multiple upgrades aimed at scalability, throughput, and decentralization:

2025 upgrades (Pectra & Fusaka) have already improved efficiency, staking, and Layer-2 performance, forming a stronger foundation for 2026.

The 2026 roadmap points to further major forks (e.g., Glamsterdam, Heze-Bogota) focused on parallel transaction execution, higher throughput, and increased privacy/censorship resistance. These aim to boost capacity from ~21 TPS toward much higher effective throughput.

These upgrades are designed to help Ethereum handle more users, lower fees, and support more complex financial and Web3 applications.

📰 4) Market News Impacting Ethereum

Positive Market Drivers

A broader crypto rally driven by regulatory developments in the U.S. has pushed ETH higher alongside Bitcoin gains.

Regulatory & Macro Influence

Delays and debates over U.S. crypto legislation (e.g., Digital Asset Market Clarity Act) are creating mixed market reactions — sometimes flat price effects for ETH while bulls await clearer rules.

Ecosystem Growth Signals

ETH remains key for decentralized finance (DeFi), stablecoins, and NFTs, and attracts institutional engagements — such as tokenized funds and blockchain adoption by financial firms.

🔎 5) Key Takeaways — What This Means

Bullish factors ✅ Ongoing major upgrades ➜ better scaling & utility

✅ Strong institutional interest & real-world assets growth

✅ Analyst forecasts see potential long-term upside

Neutral / Balanced factors ⚖️ Price consolidating, waiting for breakout signals

⚖️ Mixed macro and regulatory environment can slow momentum

Risk factors ❌ Broader market macro shocks or regulatory setbacks

❌ Technical resistance around mid-$3,000 levels

❌ Competing blockchains gaining traction

🧠 Summary

Ethereum today is a maturing asset:

• Price is stable but not yet in a definitive breakout.

• Future growth depends on broader crypto market strength, macro conditions, and successful upgrade rollouts.

• Long-term institutional adoption and real-world asset use cases remain key bullish drivers.

#btc #MarketRebound #Ethereum #USDemocraticPartyBlueVault #USJobsData