Closing the Trade: Where Discipline Matters More Than Profits

In trading, most people focus on entries. They obsess over the perfect setup, the exact indicator alignment, the best confirmation candle. Very few talk seriously about exits. Yet, if you look closely, the real difference between consistent traders and emotional traders is not how they enter the market—it’s how and when they close their trades.

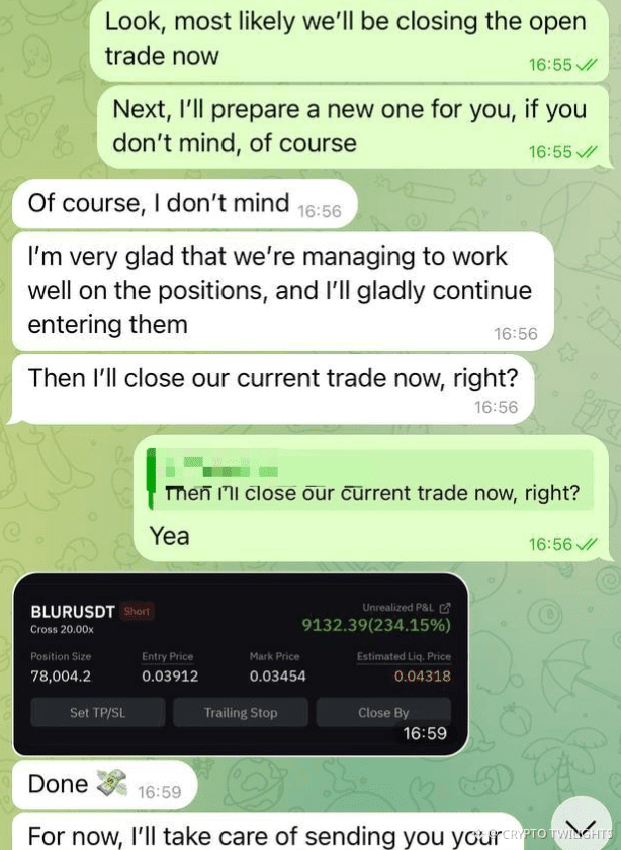

The screenshot above captures a simple moment, but it reflects something much deeper. A decision to close an open position. No panic. No greed. No unnecessary delay. Just a clear acknowledgment that the trade has done its job.

This is where maturity in trading begins.

The Psychology Behind Closing a Trade

Closing a trade is emotionally harder than opening one. When you enter, hope is high. Possibilities feel endless. But when it’s time to close, your mind starts negotiating:

“What if it goes a little more?”

“Maybe I should wait for one more push.”

“I don’t want to leave money on the table.”

These thoughts are natural, but they are also dangerous.

A professional trader understands that the market does not reward hope. It rewards execution. Once the plan has played out, staying longer is no longer trading—it’s gambling.

In the conversation shown, there is no emotional back-and-forth. One side suggests closing the trade. The other confirms. The trade is closed. Done.

That’s how it should be.

Profit Is Not the Goal — Process Is

Many traders say, “I want to make money.” That’s understandable, but it’s also incomplete. Money is a byproduct, not the goal.

The real goal is:

Following your plan

Managing risk

Executing exits without hesitation

You can make money on a bad process once or twice. But you can only survive long-term with a good one.

Closing a trade at the right time—even if price later moves further—does not mean the decision was wrong. If the exit was according to plan, it was correct. The market moving afterward is irrelevant.

This mindset removes regret, and regret is one of the most toxic emotions in trading.

Unrealized Profit Is Not Real Profit

One of the biggest traps traders fall into is falling in love with unrealized P&L. Seeing big green numbers on the screen creates attachment. You start protecting the number instead of protecting the account.

But until a trade is closed, nothing is yours.

Markets can reverse faster than emotions can react. A position that looks perfect can turn average. An average one can turn into a loss. That’s why closing at predefined levels matters more than chasing extremes.

The moment shown in the image—pressing “close”—is the moment profit becomes real. Everything before that is just potential.

Discipline Looks Boring — and That’s a Good Thing

There’s nothing dramatic here. No celebration. No hype. No emotional messages. Just execution.

Most people expect trading to feel exciting. They want adrenaline. They want constant action. But excitement is usually a sign of overexposure or poor risk management.

Consistency feels boring.

Discipline feels repetitive.

Professionalism feels quiet.

And that’s exactly what you want.

When closing trades becomes routine instead of emotional, you know you’re on the right path.

Trust and Clarity in Execution

Another important element visible here is clarity. There’s no confusion about what’s happening next. One trade closes, and only then does the focus shift to the next opportunity.

This prevents a common mistake: stacking decisions on top of open risk.

Many traders open new positions while emotionally tied to old ones. Their judgment becomes clouded. They start reacting instead of planning.

Clean execution means:

One trade

One decision

One outcome

Then you move on.

Why Holding Longer Is Not Always Smarter

A common misconception is that the best traders always catch the full move. That’s not true.

The best traders catch their part of the move.

Trying to squeeze every last percentage out of the market usually leads to:

Late exits

Giving back profits

Emotional frustration

Markets reward those who respect probability, not those who try to be perfect.

Closing when conditions are met—even if price continues—is a sign of strength, not weakness.

The Hidden Risk of “Just One More Candle”

“Let me wait for one more candle” has destroyed more accounts than bad entries.

That one candle often turns into five.

Five turn into hope.

Hope turns into denial.

Denial turns into loss.

Having the ability to say “Yes, close it now” without hesitation is a skill built over time. It comes from experience, losses, and learning the hard way that markets don’t care about your expectations.

Consistency Is Built in These Small Moments

Big wins don’t define a trader.

Big losses don’t either.

What defines a trader are the small, repeated decisions made every day:

Closing when planned

Not overextending

Not second-guessing

The moment of closing a trade may seem small, but over hundreds of trades, it becomes everything.

This is how accounts grow—not explosively, but steadily.

Final Thought

Trading is not about predicting the future. It’s about managing the present.

The ability to close a trade calmly, confidently, and without emotional attachment is one of the clearest signs of growth in this journey.

No noise.

No ego.

No hesitation.

Just execution.

And in the long run, that’s what keeps you in the game.