✳️Let’s be honest.

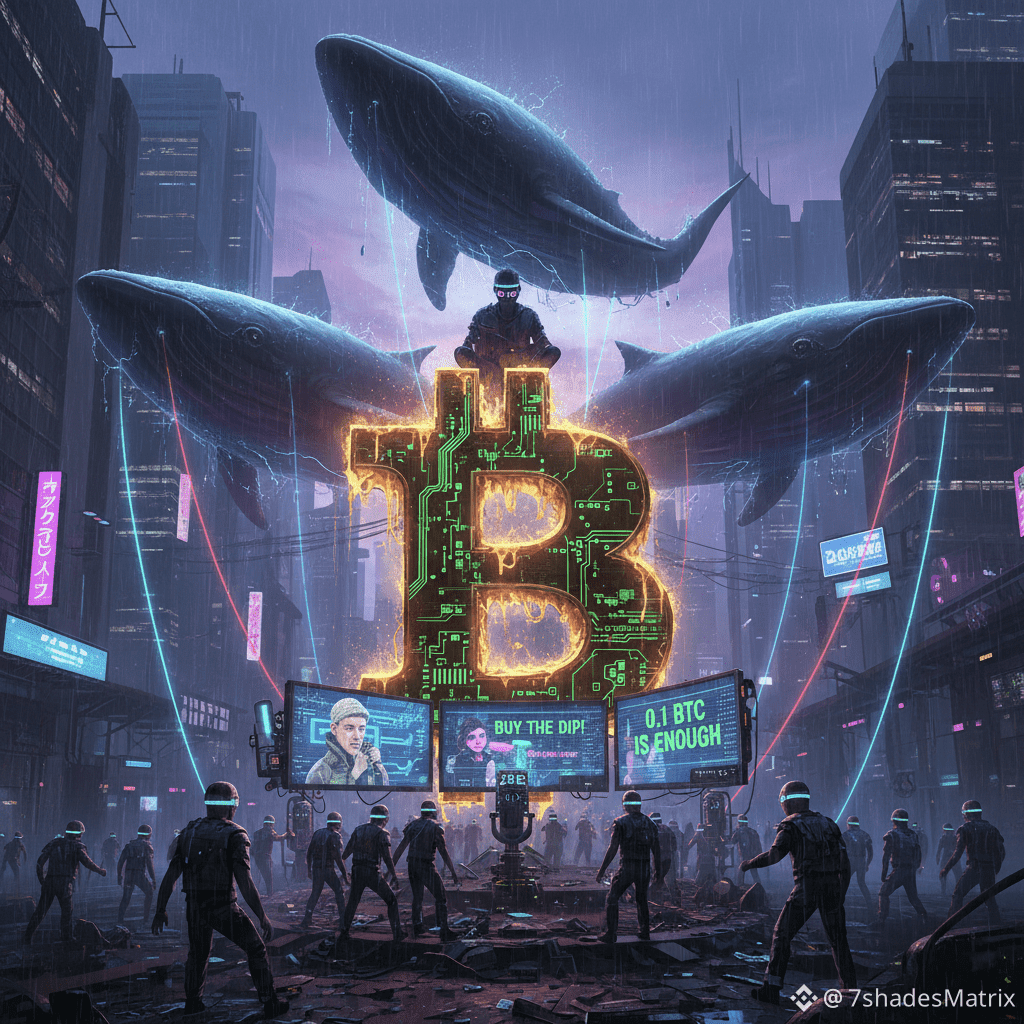

Bitcoin is no longer a revolution — it has become a kingdom controlled by whales, institutions, and narrative engineers.

If you entered Bitcoin before 2024, you already won. You took the real risk when uncertainty was high, liquidity was low, and belief was scarce.

But if you’re still buying Bitcoin now, driven by influencer hype, you are not early — you are exit liquidity.

The “0.1 BTC Will Make You Rich” Lie

Every cycle, the same recycled propaganda returns:

“You don’t need 1 BTC. Even 0.1 or 0.01 BTC is enough for financial freedom.”

This is not education.

This is marketing.

Early holders, funds, and institutions need continuous demand so they can distribute their positions slowly without collapsing price. Retail money is attracted through emotional storytelling, not logic or math.

Let’s Talk Reality

Bitcoin did not grow naturally over a long, healthy cycle.

In reality, Bitcoin has compressed more than 10 years of price growth into just 2–3 years.

This growth was unnatural, accelerated, and liquidity-driven, not the result of organic adoption.

Such vertical expansion is dangerous for new entrants:

🛞Price runs far ahead of real value discovery

🛞Risk-to-reward becomes extremely asymmetric

🛞Any distribution phase punishes late buyers the most

What looks like strength on the chart is actually exhaustion.

When an asset pulls future growth into a short time window, it leaves no space for new capital to win. Early holders secure freedom; late buyers inherit the risk.

This is not a healthy growth curve — this is over-advanced pricing.

Bitcoin Price Is Held, Not Discovered

Do you really believe Bitcoin is freely traded anymore?

👉ETFs absorb and control supply

👉Whales dominate liquidity

👉Institutions defend psychological price levels

👉Influencers keep retail buying dips

This is price management, not free-market discovery.

The game has changed — but the narrative hasn’t.

Financial Freedom Doesn’t Come From Crowded Trades

Real financial freedom never comes from:

👉Assets everyone already agrees on

👉Trades where upside is capped

👉Narratives repeated endlessly on social media

Bitcoin today is capital preservation for the rich, not opportunity creation for the masses.

The biggest mistake retail keeps making is confusing safety with opportunity.

Where the Real Opportunity Is: Altcoins

If you want asymmetric returns, you don’t chase exhausted narratives.

You position where fear, doubt, and underpricing exist.

Fundamentally strong altcoins still offer:

💥Lower market caps

💥Ongoing development

💥Expanding real-world use cases

💥Exponential upside potential

Projects like:

⚡Ethereum ($ETH ) — the backbone of DeFi and Web3

⚡Solana ($SOL ) — high-performance infrastructure with real users

⚡$XRP — global payment rails being battle-tested

⚡SUI — next-generation scalability architecture

This is where wealth is built, not where it is defended.

Final Truth (Uncomfortable but Necessary)

Bitcoin will not make you financially free anymore unless:

You entered very early

Or you already control significant capital

For everyone else, Bitcoin has become:

A slow mover

A narrative-driven asset

A liquidity sink for retail money

Stop repeating the same mistake every cycle.

Don’t buy what influencers already own.

Buy what they will promote after you’re positioned.

Financial freedom belongs to early thinkers — not late believers.