After a sharp move down from the recent high near 31, RIVERUSDT entered a cooling phase and found strong demand around the 17 zone. Since then, price behavior has changed noticeably. The panic is gone, and the market is moving in a more controlled way.

Current Market Structure $RIVER

Current Market Structure $RIVER

On the lower timeframe, price is forming higher lows, which usually signals that sellers are losing strength. Each dip is getting bought faster than before. This doesn’t mean a straight rally, but it does suggest that downside pressure is fading.

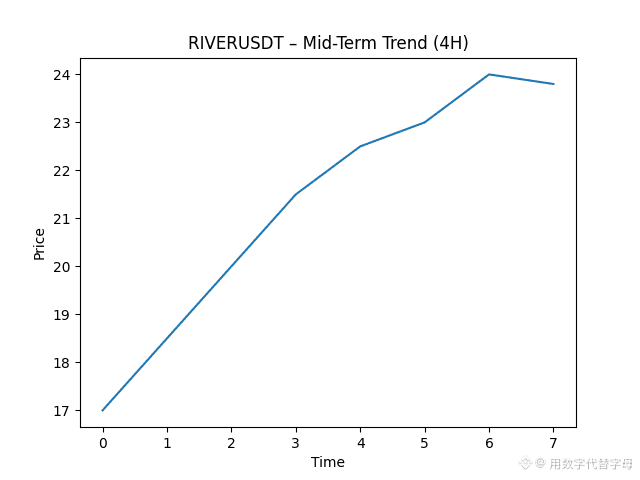

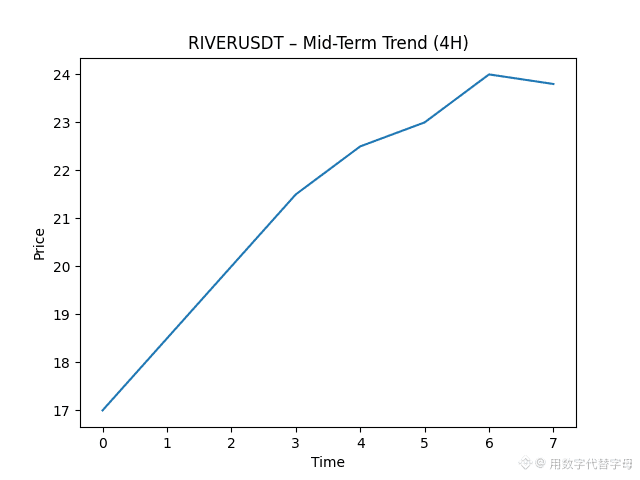

On the mid timeframe, price is slowly building a base. Instead of sharp candles, we are seeing tighter ranges and smoother movement. This often happens when the market is preparing for its next direction.

Insight

Volume has normalized compared to the earlier spike. That’s a healthy sign. No aggressive selling and no emotional buying — just steady participation. Markets often move next after this type of balance.

Multi-Timeframe Outlook (Personal View)

Short term: Mild pullbacks are possible, but structure remains positive as long as support holds

Mid term: If price stays above the base area, a gradual recovery attempt can develop

Risk zone: A break below recent support may lead to consolidation instead of continuation

Final Thought

Final Thought

This looks less like hype and more like accumulation behavior. Direction will become clearer once price commits outside the current range. Until then, patience matters more than prediction.

This is not financial advice, only personal market observation.

Crypto markets are risky — manage exposure wisely.