Gold and silver prices dipped as strong U.S. job data lifted the dollar and easing Iran-U.S. tensions reduced safe-haven demand. The pullback is seen by analysts as a potential short-term buying opportunity within a still-bullish trend, with key support levels in focus for both metals. The U.S. dollar is consolidating, awaiting a breakout for its next directional move.

Major Points:

Prices Pull Back on Dual Catalysts:

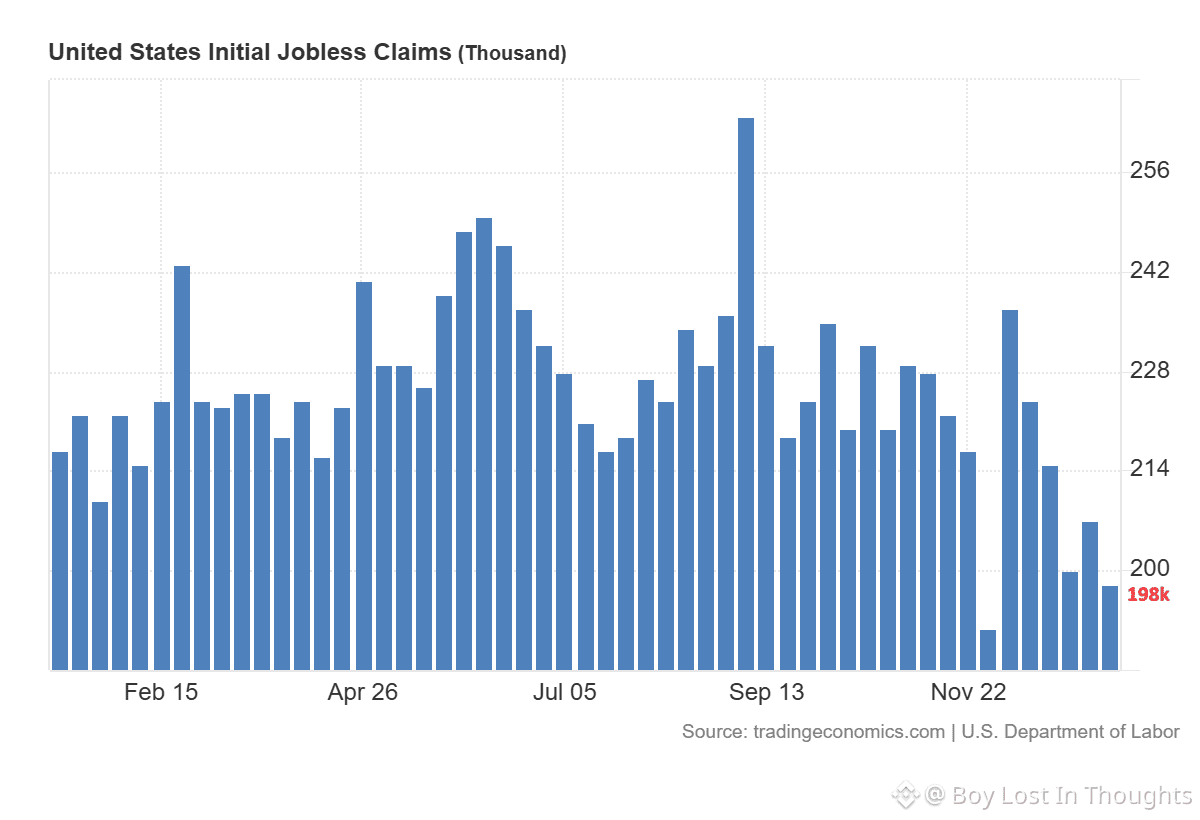

Gold and silver declined due to stronger U.S. jobless claims boosting the dollar and easing Iran–U.S. tensions reducing safe-haven demand.U.S. Data Strengthens Dollar:

Weekly jobless claims fell to 198,000, beating expectations, lifting the dollar and pressuring precious metals short-term.Geopolitical Calm Lowers Safe-Haven Appeal:

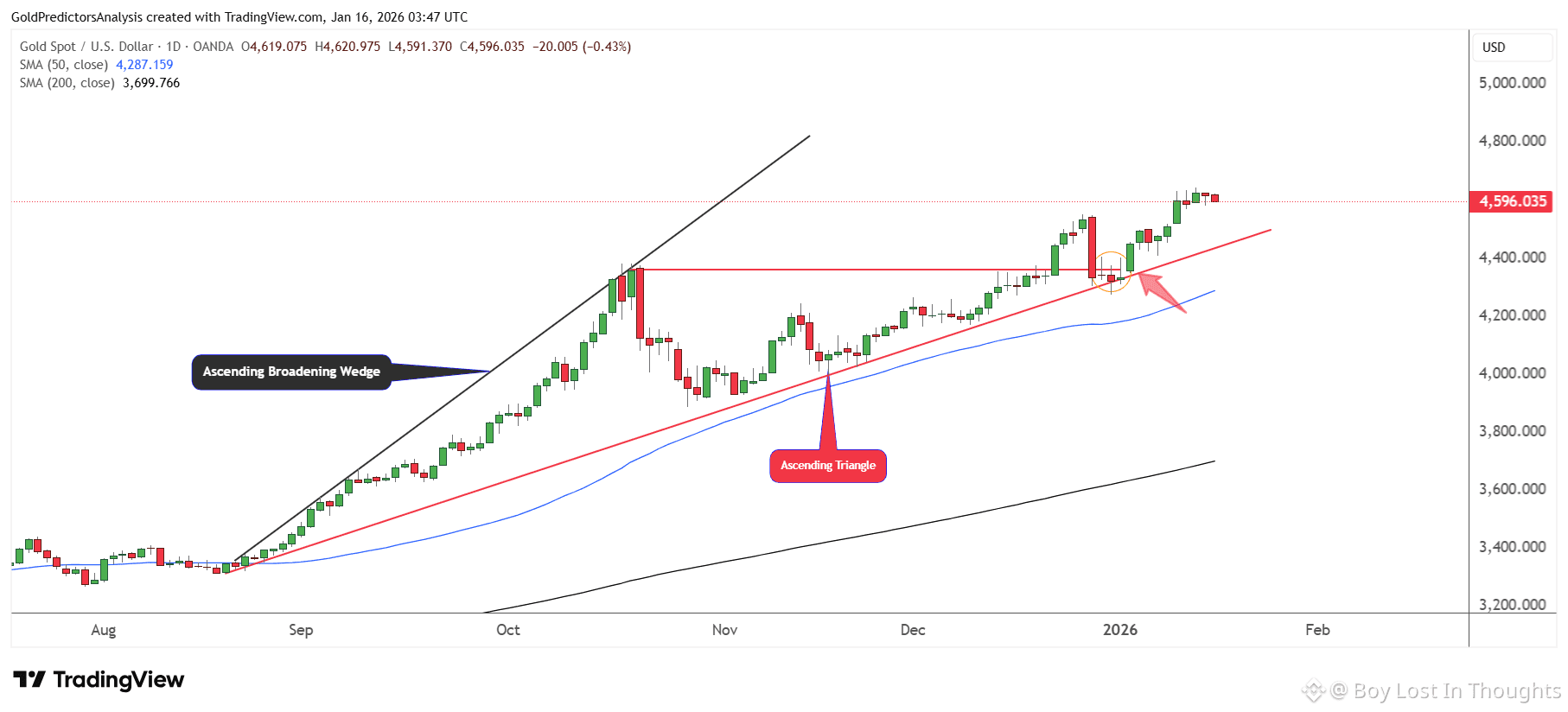

Reduced fears of escalation between Iran and the U.S. contributed to the decline in gold and silver.Gold’s Technical Outlook Stays Bullish:

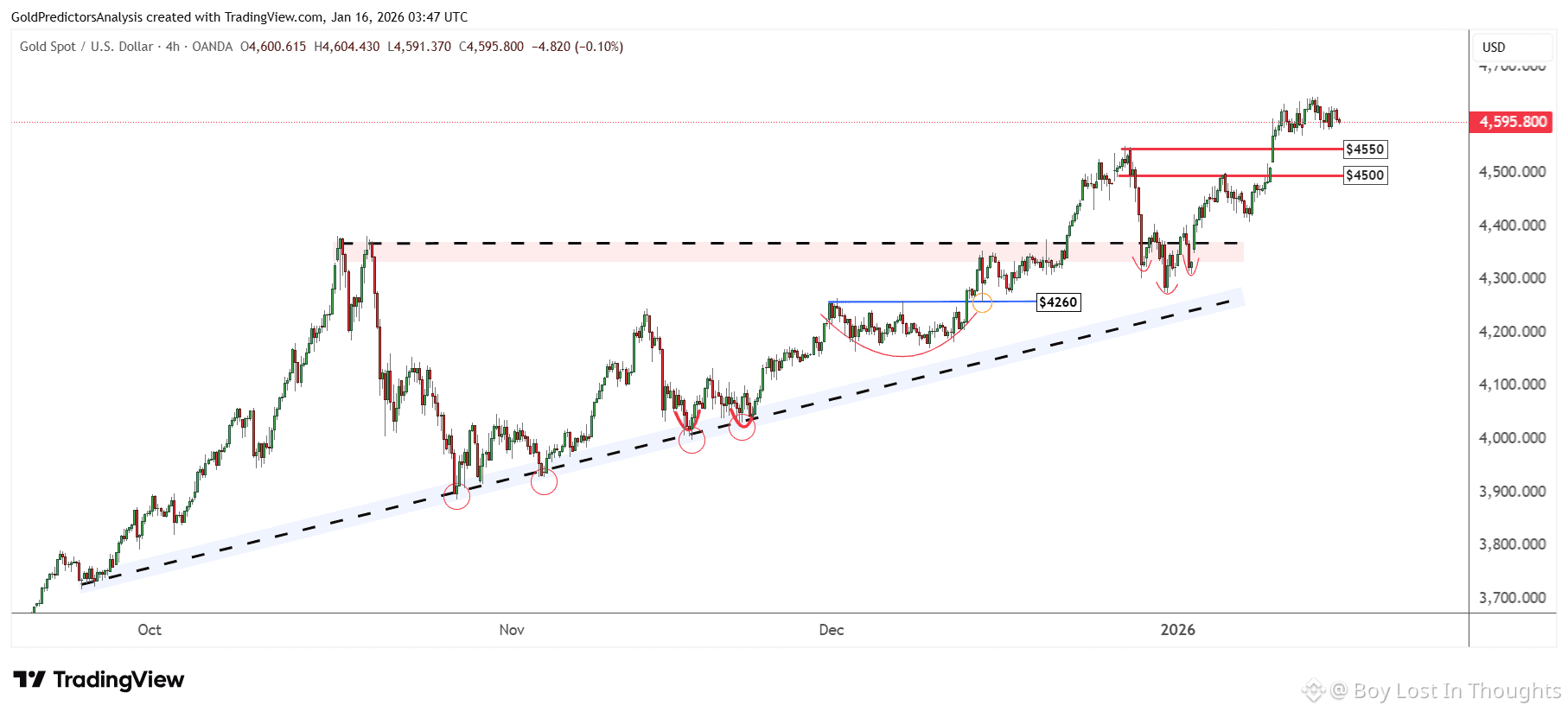

Gold is consolidating above $4,600; a rebound from $4,260 support suggests the current dip may be a short-term buying opportunity.

Key support lies at $4,500–$4,550; a break below $4,260 could trigger a deeper correction toward $4,000.

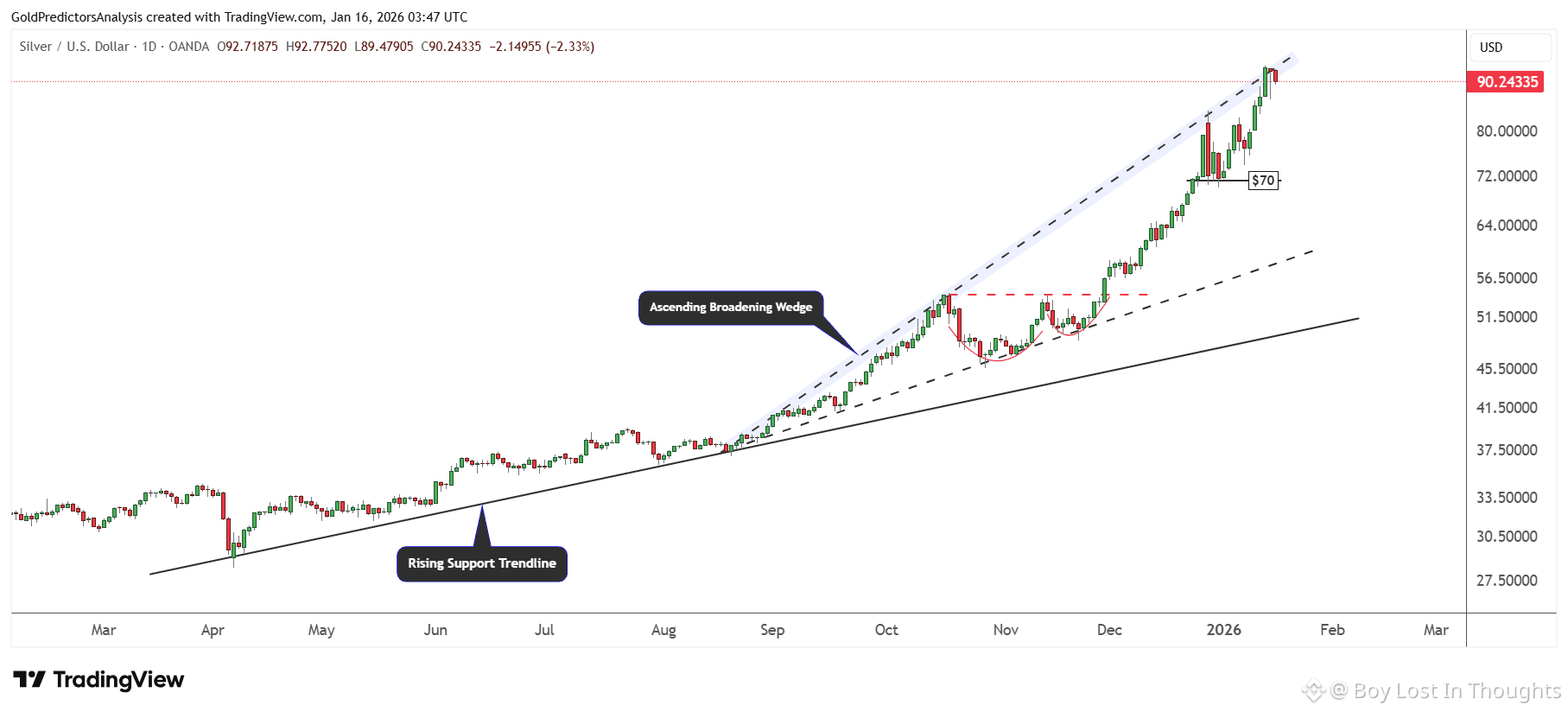

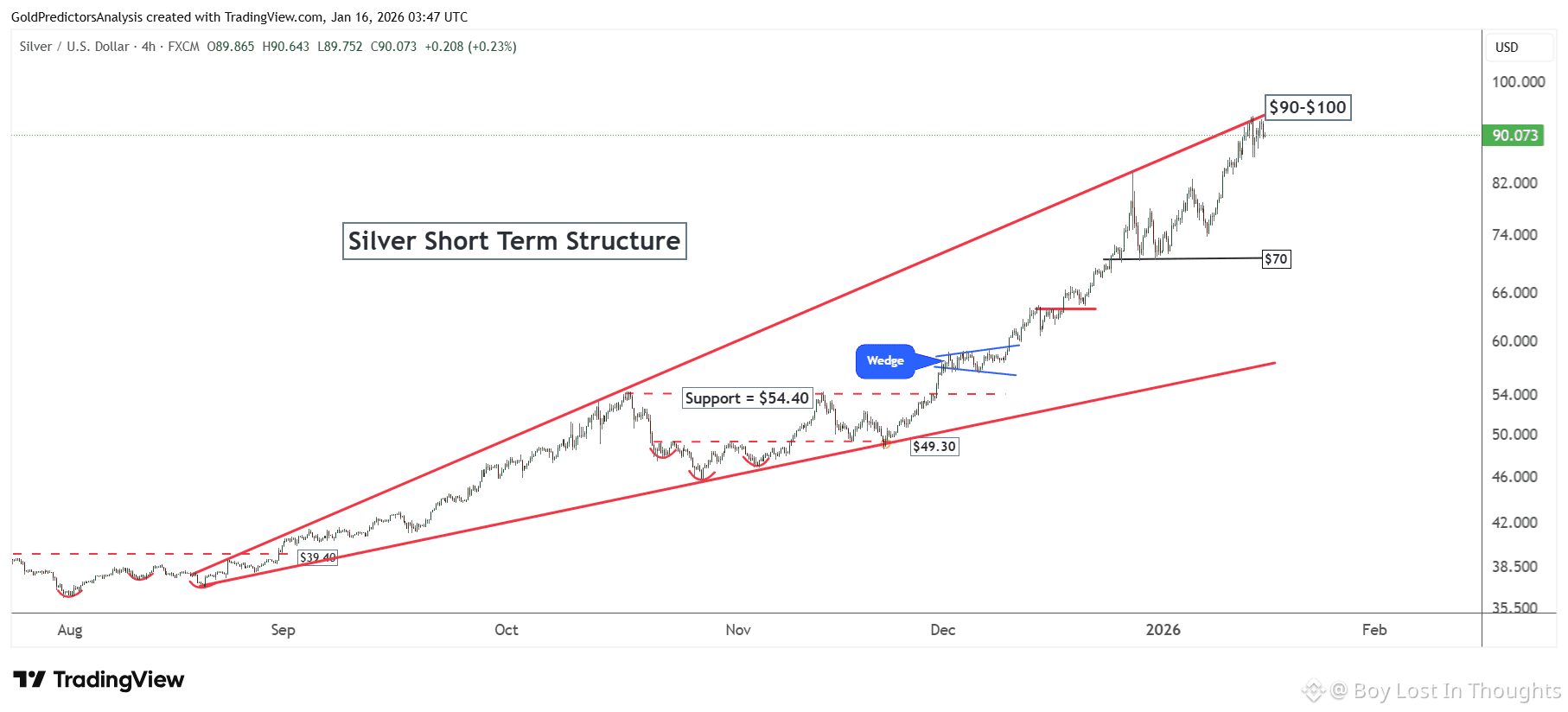

Silver Faces Key Resistance:

Silver is correcting from a strong resistance zone ($90–$100). A break above $100 could renew upward momentum, while a pullback toward $60–$70 may offer a favorable buying entry.

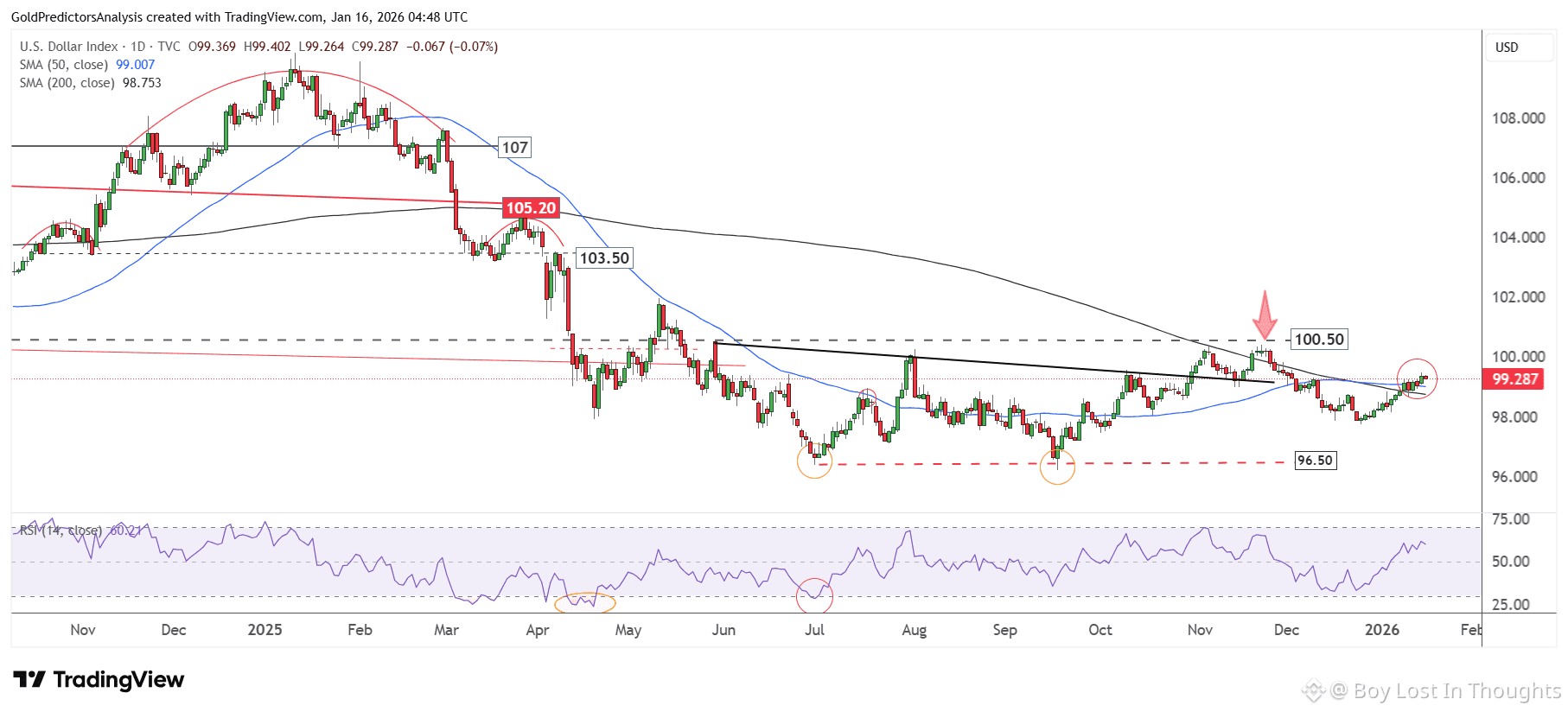

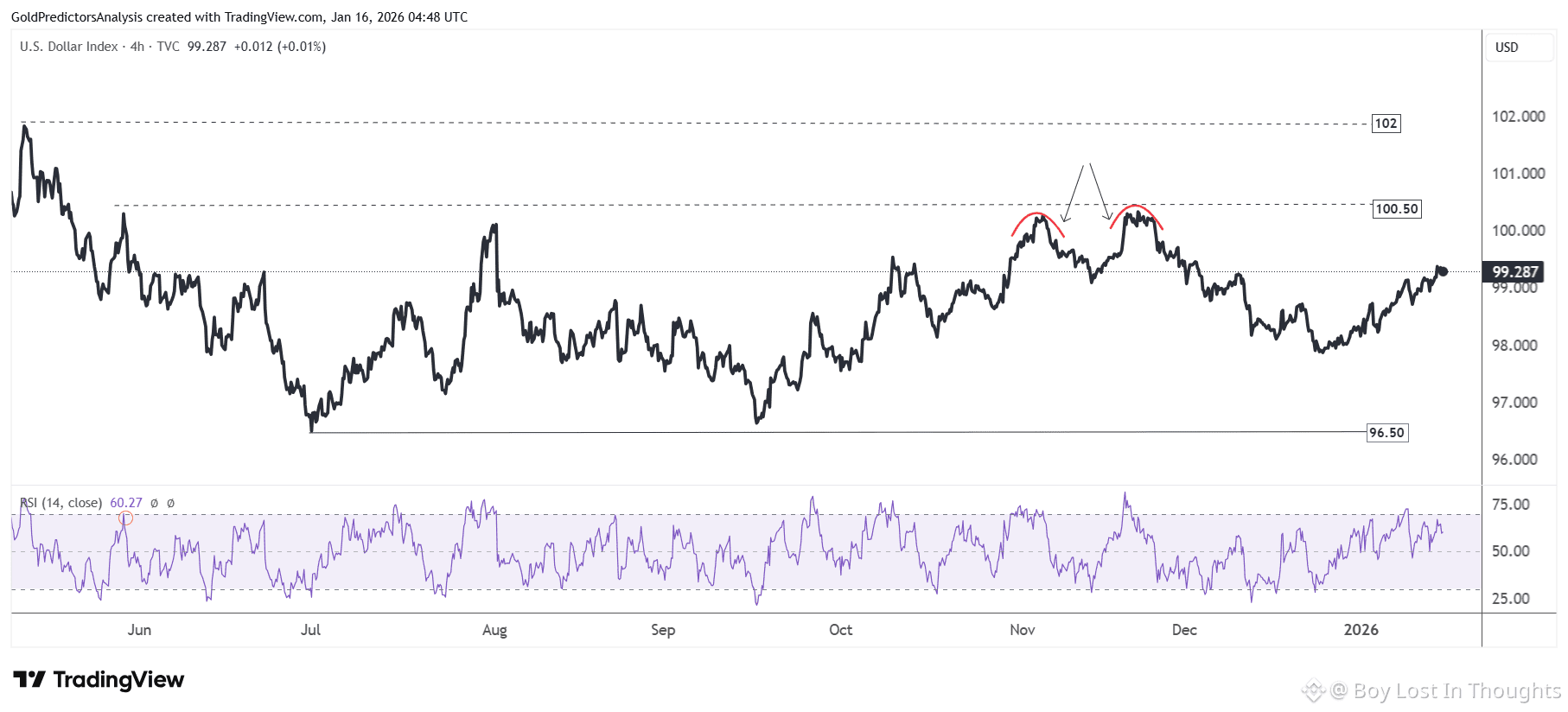

U.S. Dollar in Neutral Range:

The USD Index is consolidating between 96.50 and 100.50. A break above 100.50 could propel it toward 102, while a drop below 97.50 may lead to a test of 96.50.

Overall Market View:

The current retreat in gold and silver is seen as a potential short-term buying opportunity within a broader bullish trend, pending key support holds.