Plasma is building a new global financial system where stablecoins serve as the foundation for payments, savings, and credit. To make this vision viable at scale, Plasma focuses on creating a reliable and efficient credit layer that can transform stablecoin deposits into predictable, market grade capital. The partnership between Plasma and Aave represents a major step toward achieving this goal.

When Aave launched on the Plasma network, the Plasma team committed an initial 10 million dollars worth of $XPL tokens as part of a broader incentive program. This commitment was designed to align liquidity providers, borrowers, and long term ecosystem participants from day one. The results were immediate. Within 48 hours of Plasma mainnet launch, deposits into Aave on Plasma reached 5.9 billion dollars, later peaking at 6.6 billion dollars. This rapid inflow of capital positioned Plasma as a core venue for stablecoin based credit.

However, Plasma’s success is not defined by total value locked alone. While TVL measures deposits, borrowing activity reflects real demand for credit. On Plasma, Aave has generated approximately 1.58 billion dollars in active borrowing. Utilization rates for key assets such as WETH and USD₮0 exceed 84 percent, showing that liquidity is actively being used rather than sitting idle.

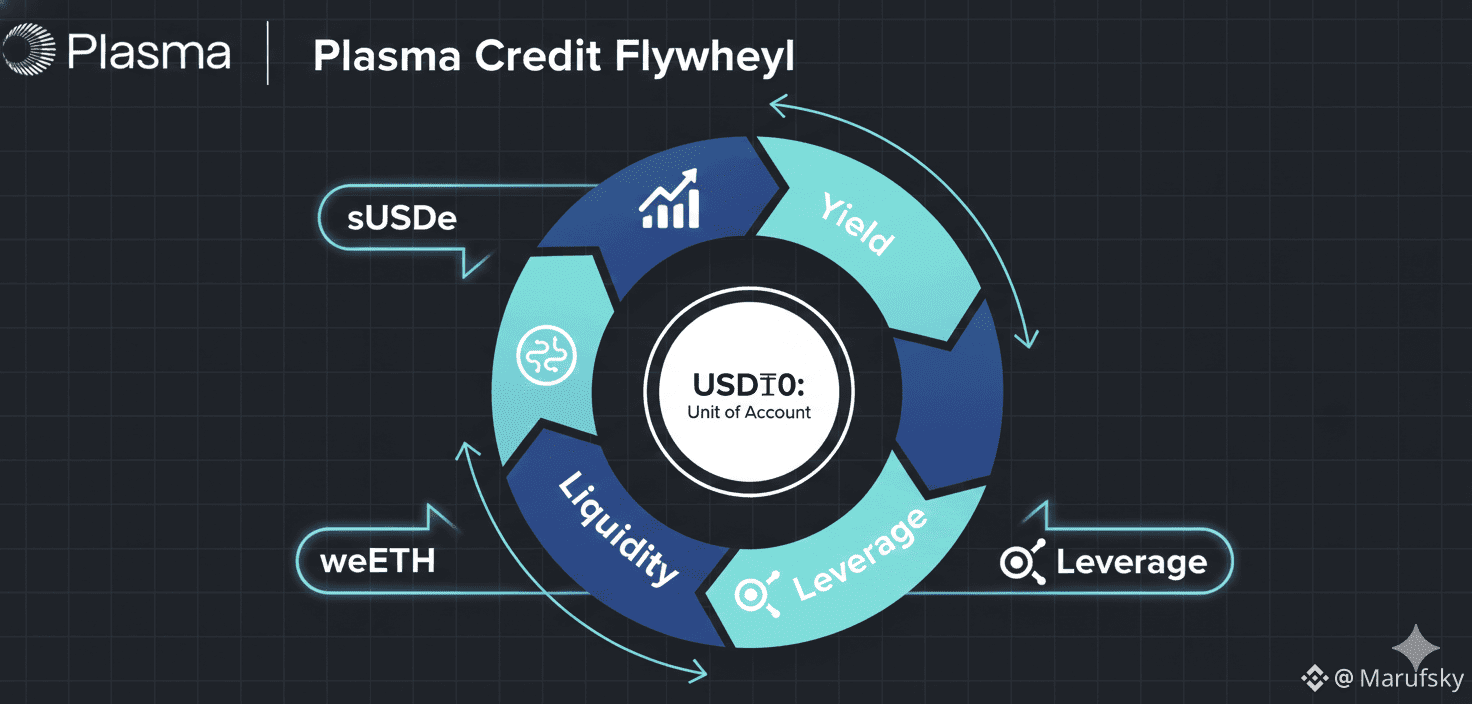

Borrowers typically access credit for two main reasons. Some aim to increase exposure to assets through leverage, while others seek to amplify yield through looping strategies. Plasma was designed with these use cases in mind. By maintaining deep liquidity and stable borrowing rates, the network enables strategies that remain viable even during periods of market volatility.

USD₮0 plays a central role in this ecosystem. It is the primary dollar denominated asset on Plasma and the main lending currency on Aave. As of November 2025, USD₮0 supply stands at approximately 1.78 billion dollars, with 1.49 billion dollars borrowed, resulting in an utilization rate of nearly 84 percent. Despite fluctuations in overall TVL, USD₮0 borrow rates have consistently remained within the 5–6 percent range. This stability is critical for institutions and advanced users who require predictable costs to manage leveraged positions responsibly.

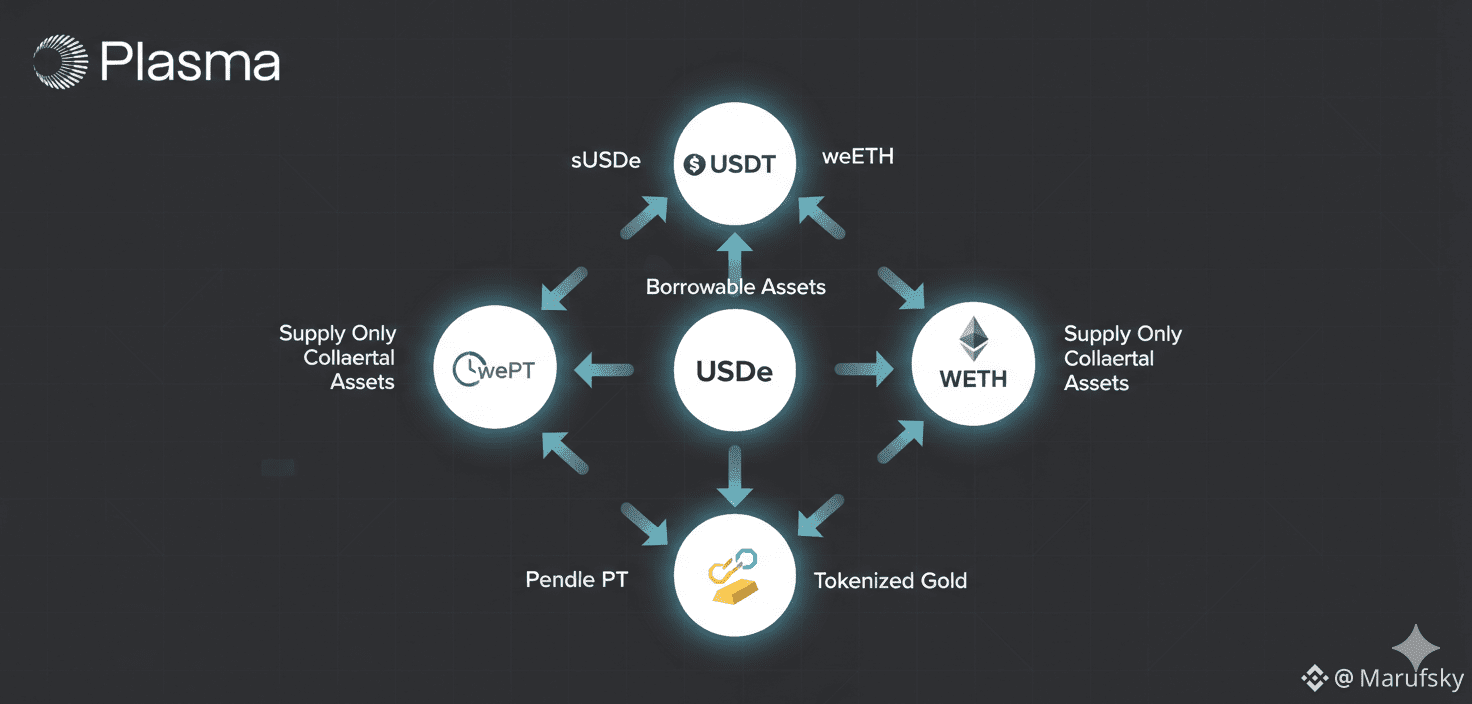

Plasma has also benefited from productive collateral integrations. Ethena’s USDe and sUSDe generate yield directly at the asset level. On Plasma, users can deposit sUSDe into Aave to earn both Ethena yield and Aave incentives, then borrow USD₮0 against that position. This design improves capital efficiency while preserving risk discipline. Similarly, Ether.fi’s weETH provides high quality collateral for users who want to borrow against restaked ETH while continuing to earn staking rewards.

As of late November 2025, Plasma has become the second largest Aave market globally, second only to Ethereum mainnet. It accounts for roughly 8 percent of all Aave borrowing liquidity worldwide. Among markets with more than 1 billion dollars in TVL, Plasma demonstrates strong capital efficiency with a market wide utilization rate of 42.5 percent. Its 1.58 billion dollars in active borrowing is nearly double that of the third largest market, highlighting the depth and effectiveness of its credit infrastructure.

Looking ahead, Plasma aims to extend this onchain credit layer beyond DeFi. The roadmap includes deeper integrations with on ramp and off ramp providers, foreign exchange services, and licensed payments and custody infrastructure. These components are essential for connecting predictable onchain credit to real world settlement, treasury operations, and cross border payments.

Over time, this approach positions Plasma as a foundational credit layer for stablecoin infrastructure. By combining disciplined risk management, productive collateral, and real world distribution, Plasma is laying the groundwork for a scalable and sustainable global financial system.

$XPL

@Plasma ma

#plasma