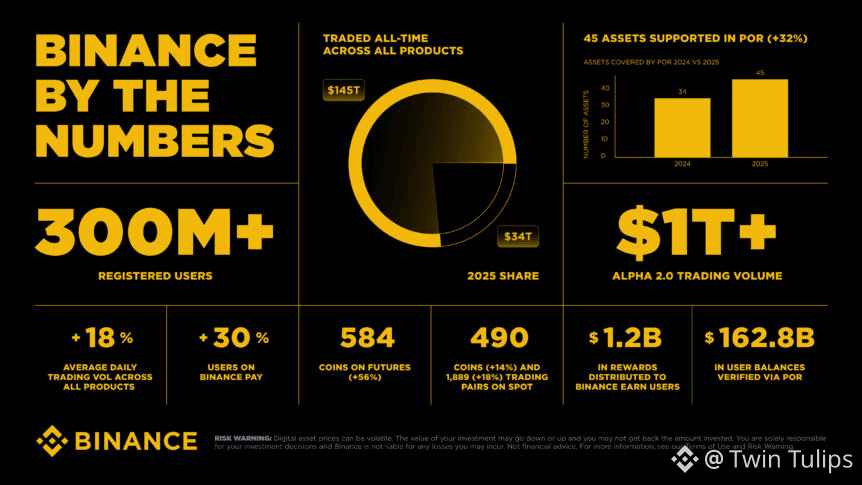

Dear Binance Family did You know that Binance Research has released its Full-Year 2025 Review & Themes for 2026, a comprehensive 133-page report built entirely on real usage data, on-chain activity, and market behavior from 2025.

Rather than relying on speculation or future assumptions, this report analyzes what actually happened in crypto throughout 2025 and uses those insights to outline where the industry is heading next.

The core conclusion is clear:

Crypto is transitioning from a speculative market into an adoption-driven financial ecosystem.

Below is a complete, point-wise breakdown of the key findings and themes.

1. 2026 Is Expected to Be an Adoption-Led Year

Based on real usage trends observed in 2025, Binance Research expects 2026 to be driven primarily by adoption rather than hype.

Throughout 2025, user activity expanded beyond trading into areas such as payments, decentralized finance, infrastructure, and data storage. This consistent growth in practical use cases signals a more mature phase for the crypto industry.

Why this matters:

• Adoption leads to sustainability, not short-term volatility

• Products with real utility tend to survive market cycles

• Long-term value creation becomes more predictable

2026 is expected to reward networks and platforms that deliver real-world solutions.

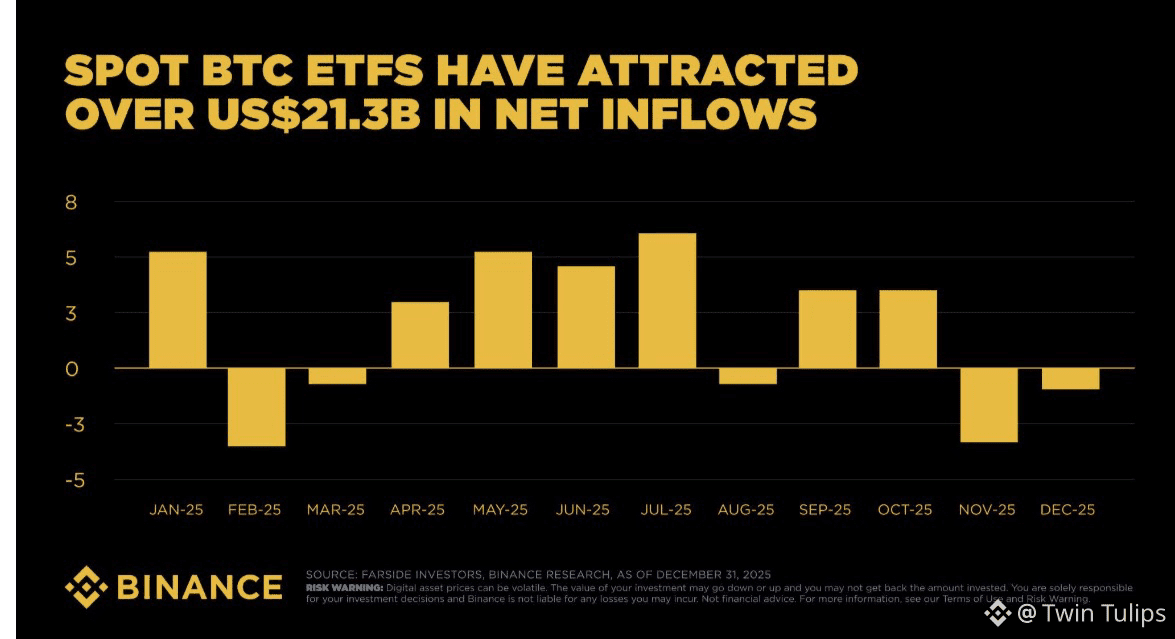

2. The Great Decoupling: Bitcoin’s Evolution into a Macro Asset

One of the most significant developments in 2025 was what Binance Research refers to as “The Great Decoupling.”

Historically, Bitcoin often moved in tandem with traditional risk assets such as equities. In 2025, however, Bitcoin demonstrated increasing price independence, signaling its evolution into a macro-relevant asset class.

Key data points:

• Bitcoin dominance closed the year at approximately 60%

• Capital concentrated into BTC during periods of macroeconomic uncertainty

• Investors increasingly treated Bitcoin as a hedge rather than a speculative trade

This shift suggests Bitcoin is becoming a long-term strategic asset within diversified portfolios.

3. Sustainable Cash Flow: DeFi Reaches Financial Maturity

A major milestone in 2025 was the rise of sustainable revenue generation across DeFi.

For years, critics argued that decentralized finance lacked real income. The data from 2025 directly challenges that narrative.

Revenue comparison:

• Top DeFi protocols generated $16.2 billion in revenue

• This surpassed the combined annual earnings of:

• Nasdaq ($7.4B)

• CME Group ($6.1B)

This shows that leading DeFi platforms are no longer experimental — they are operating at a scale comparable to major traditional financial institutions, while remaining globally accessible and permissionless.

4. Stablecoins Become Core Financial Infrastructure

Stablecoins were one of the strongest drivers of crypto adoption in 2025, acting as the backbone of on-chain finance.

Key metrics:

• Annual stablecoin transaction volume reached $33 trillion, nearly double Visa’s volume

• Total stablecoin market capitalization exceeded $300 billion

• Market cap increased by 49% year-over-year

These figures highlight the growing role of stablecoins in:

• Cross-border payments

• Remittances

• On-chain liquidity

• Settlement for decentralized applications

Stablecoins are increasingly functioning as global digital dollars, especially in emerging markets.

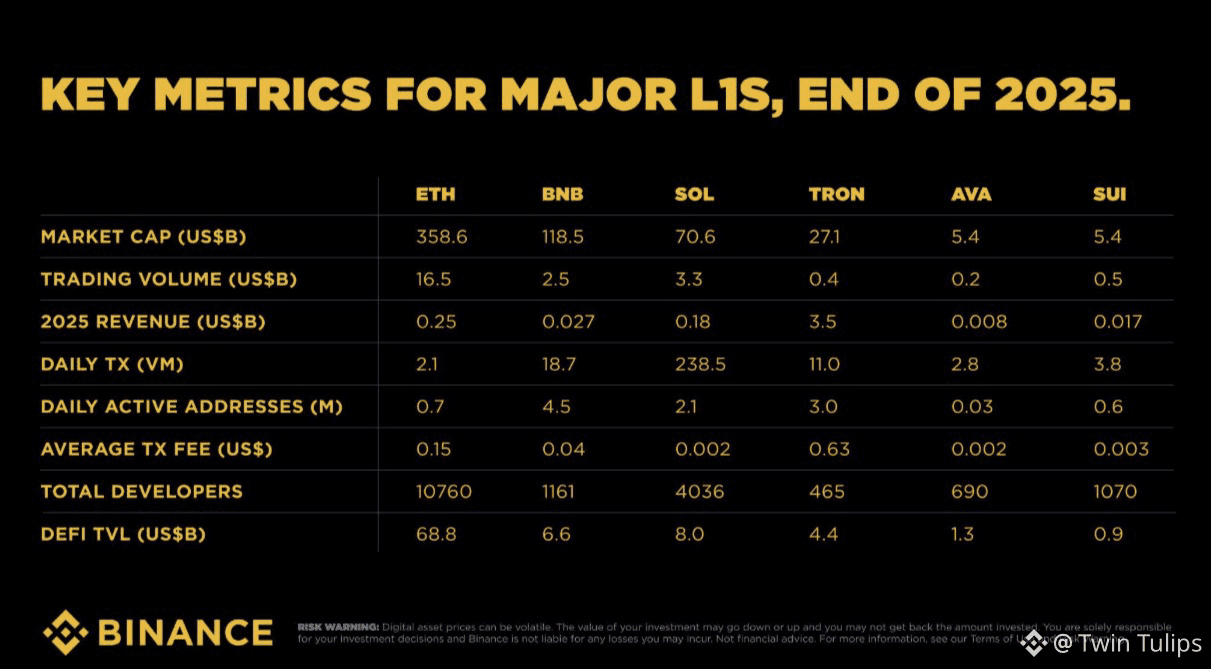

5. BNB Demonstrates Real-World Usage at Scale

The BNB ecosystem continued to show strong real-world adoption throughout 2025.

Network performance highlights:

• 15–18 million daily transactions

• Consistent, high-volume activity indicating genuine user demand

• Strong performance under sustained throughput

This level of usage reflects scalability and reliability — two critical requirements for mass adoption.

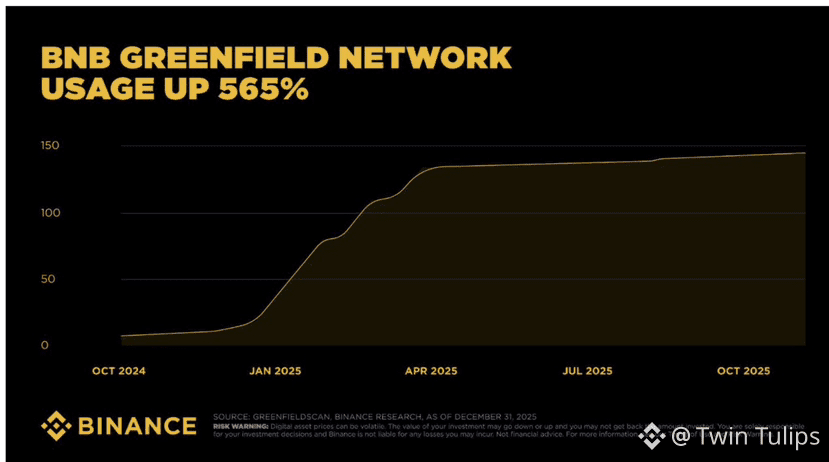

6. Rapid Growth of BNB Greenfield Network

Beyond transaction activity, BNB Greenfield experienced significant expansion in 2025.

• Network usage increased by 565% year-over-year

• Growth was driven by demand for decentralized storage and data ownership

• Indicates rising interest in infrastructure-level blockchain solutions

This positions BNB Greenfield as an important component of Web3 infrastructure going into 2026.

7. Capital Concentration Reflects Market Maturity

Another key trend observed in 2025 was capital concentration into high-conviction assets.

• Bitcoin dominance rising to ~60% reflects investor preference for resilience

• This behavior typically occurs during periods of macro uncertainty

• Markets prioritize proven assets over speculative alternatives

Rather than signaling weakness, this consolidation suggests a more disciplined and mature market structure.

8. What These Trends Signal for 2026

Based on 2025 data, Binance Research expects the following themes to define 2026:

• Adoption will outweigh speculation

• Stablecoins will remain critical financial infrastructure

• DeFi will continue focusing on profitability and efficiency

• Bitcoin’s macro relevance will strengthen further

• Networks with real usage and scalable infrastructure will lead growth

In simple terms, crypto is moving from experimentation to execution.

Final Thoughts

The Binance Full-Year 2025 report captures a pivotal moment for the industry.

Crypto is no longer proving that it can work — it is proving that it already does.

With real revenues, massive transaction volumes, and growing global usage, 2026 is set to be a defining year for adoption-driven.

📘 Full Binance Research Report:

https://www.generallink.top/en/research/analysis/full-year-2025-and-themes-for-2026/