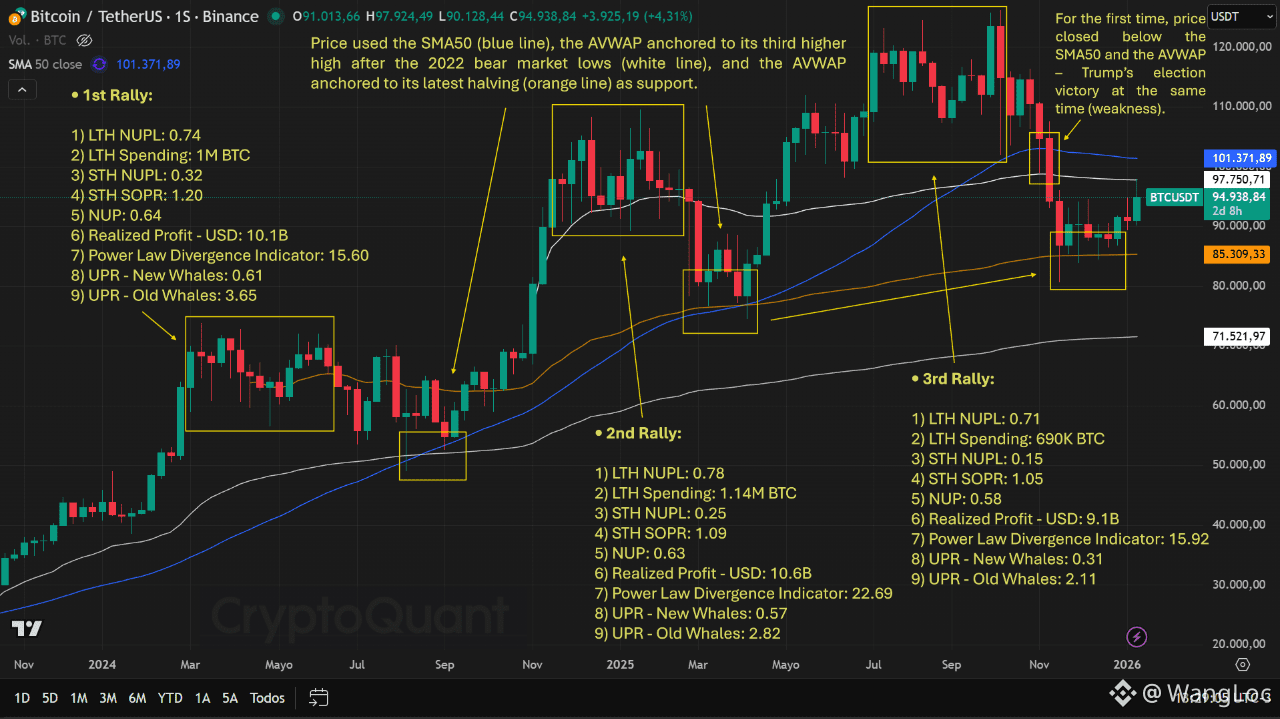

Not all Bitcoin rallies are created equal. Looking back at this cycle through on-chain profit indicators, one thing becomes very clear:

👉 Different cohorts made money at very different times.

Here’s what the data actually shows.

🔹 Long-Term Holders (LTH)

The 2nd rally was their golden phase.

LTH NUPL peaked at 0.78

LTH spending hit ~1.14M BTC

This was when veterans had the largest unrealized gains and distributed the most supply.

Interestingly, in the most recent rally, LTHs distributed 35–40% less BTC a clear sign of reduced conviction to sell at higher prices.

🔹 Short-Term Holders (STH)

The story flips.

1st rally was peak euphoria for STHs

STH NUPL: 0.32

STH SOPR: 1.20

By the 3rd rally, gains were heavily compressed

STH NUPL dropped to 0.15

SOPR barely above breakeven at 1.05

Translation: late-cycle traders were chasing upside with far less margin for error.

🐋 Whales: New vs Old

The largest unrealized whale profits occurred in the 1st rally

Profit margins declined steadily afterward

New whales even dipped into negative unrealized profit during the latest drawdown

This suggests capital entered at progressively worse prices as the cycle matured.

🔥 The Most Euphoric Phase?

Undoubtedly the 2nd rally.

Realized Profit peaked at $10.6B

Power Law divergence hit 22.69

NUP stayed elevated at 0.63, meaning most participants were still in profit

That was the moment when price was most stretched relative to its long-term structure and where profit-taking was most aggressive.

🧠 The Takeaway

Bitcoin cycles don’t peak when everyone is euphoric they peak when profits compress, risk shifts to late entrants, and experienced capital quietly steps back.

Price tells a story. But on-chain profit distribution tells the truth.

Which cohort do you think is carrying the risk right now?