Ethereum has dipped slightly today, pulling back after several strong sessions as the broader market cooled with a 1.5% drop in the past 24 hours.

But even with the short-term dip, ETH is still up 7% this week and 13% over the past month, holding strong while setting the stage for a bigger breakout.

Fueling this bullish momentum is a major announcement from BitMine, the largest Ethereum treasury in the market, which just invested $200 million into Beast Industries, the media company founded by YouTube icon MrBeast.

This move signals confidence in Ethereum as the foundation for the next wave of digital platforms, content economies, and Web3 media.

Ethereum remains the largest and most battle-tested layer-one network, and with institutional capital flowing in, the long-term Ethereum price prediction continues to look increasingly bullish.

Ethereum Price Prediction: MrBeast Just Got a $200M Backing From One of ETH’s Biggest Whales – What Happens Next?

As explained in the accompanying press release, BitMine – which currently holds just over 200,000 ETH (c. $13.7 billion) – has announced a $200 million equity investment into Beast Industries, with Beast CEO Jeff Housenbold indicating that there may also be collaboration between the two firms at some point.

“Their support is a strong validation of our vision, strategy, and growth trajectory and it provides additional capital to achieve our goal to become the most impactful entertainment brand in the world,” he said. “We look forward to exploring ways to further collaborate and incorporate DeFi into our upcoming financial services platform.”

This is bullish for both BitMine and MrBeast, and (by extension) it’s also bullish for the Ethereum price, although the latter hasn’t reacted all that positively to this news.

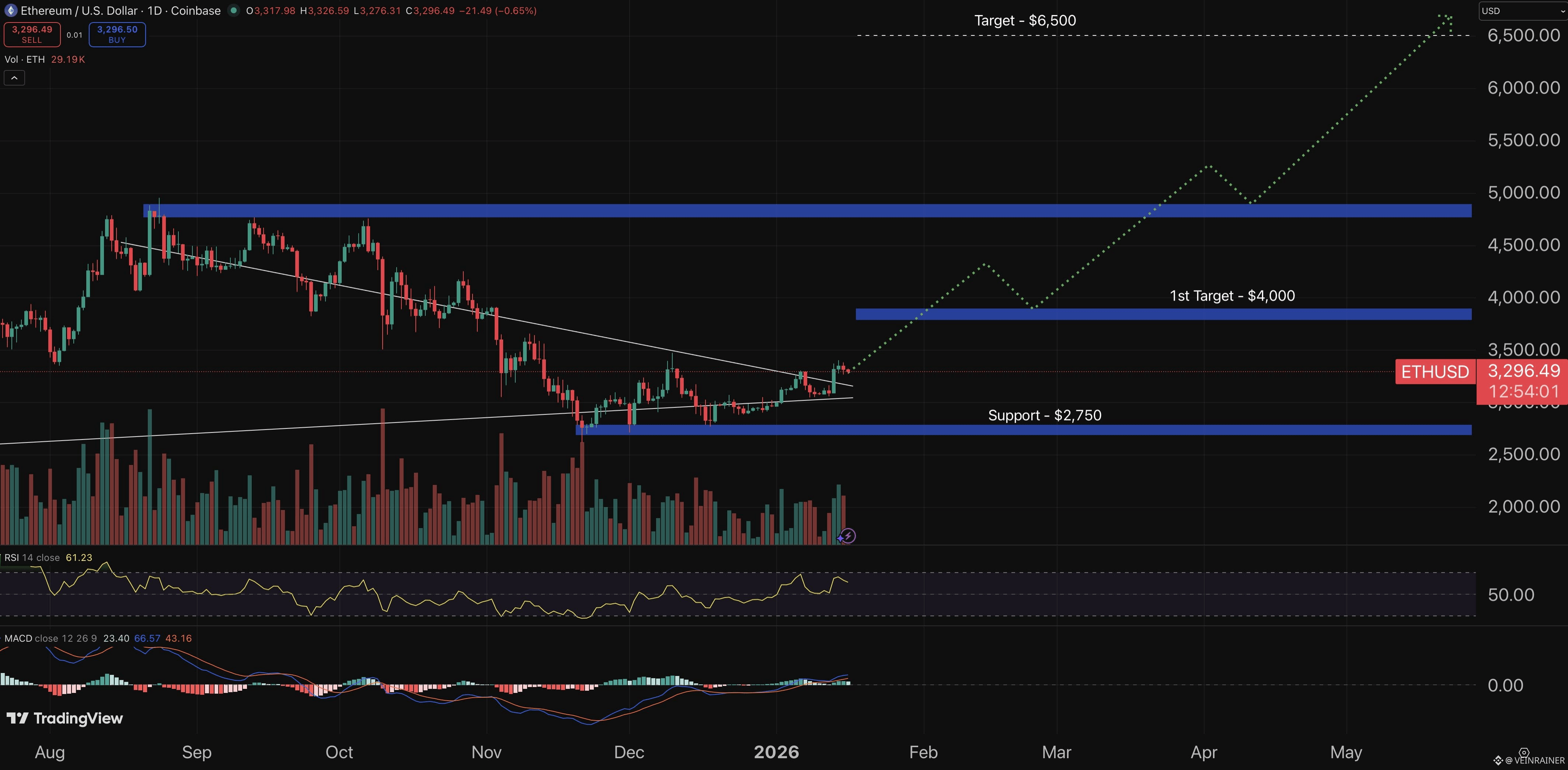

As we see from its chart below, it continues to ride some significant momentum, despite the slight correction of the past 24 hours.

It recently broke out of a bullish pennant, while its two main indicators – the relative strength index (yellow) and the MACD (orange, blue) – are still in the ascendancy, having been subdued for several months previously.

It therefore remains a very opportune time to buy Ethereum, which still remains 33% down from its ATH of $4,946, which it set in August.

And fundamentally, Ethereum is one of the most bankable cryptos in the market.

Its TVL accounts for 58% of the entire crypto ecosystem, and that’s not including Ethereum-based L2s, while Ethereum ETFs and digital funds currently sit on assets worth $25.26 billion.

The future is therefore very bright for the token, with the Ethereum price likely to reach $4,000 by the end of Q1, and then $5,000 by H2.

#MarketRebound #StrategyBTCPurchase #USJobsData #CPIWatch #BTCVSGOLD