Plasma Mainnet Beta Marks a New Chapter for Global Stablecoin Infrastructure

The launch of Plasma Mainnet Beta represents a major milestone in the evolution of stablecoins and onchain finance. From day one, Plasma enters the market with scale, liquidity, and a clear mission to become the foundation for global digital dollar movement.

Unlike general purpose blockchains, Plasma is engineered specifically for stablecoins. At launch, more than 2 billion dollars in stablecoins will be live on the network, instantly making Plasma one of the largest chains by stablecoin liquidity in history. This capital will be deployed across over 100 DeFi partners, including major protocols such as Aave, Ethena, Fluid, and Euler, ensuring immediate real world utility rather than idle liquidity.

The focus is simple but powerful. Preserve value, provide deep USD₮ markets, and deliver the lowest USD₮ borrowing costs in the industry. Plasma is not optimizing for speculation but for everyday financial use cases like savings, payments, and efficient capital access.

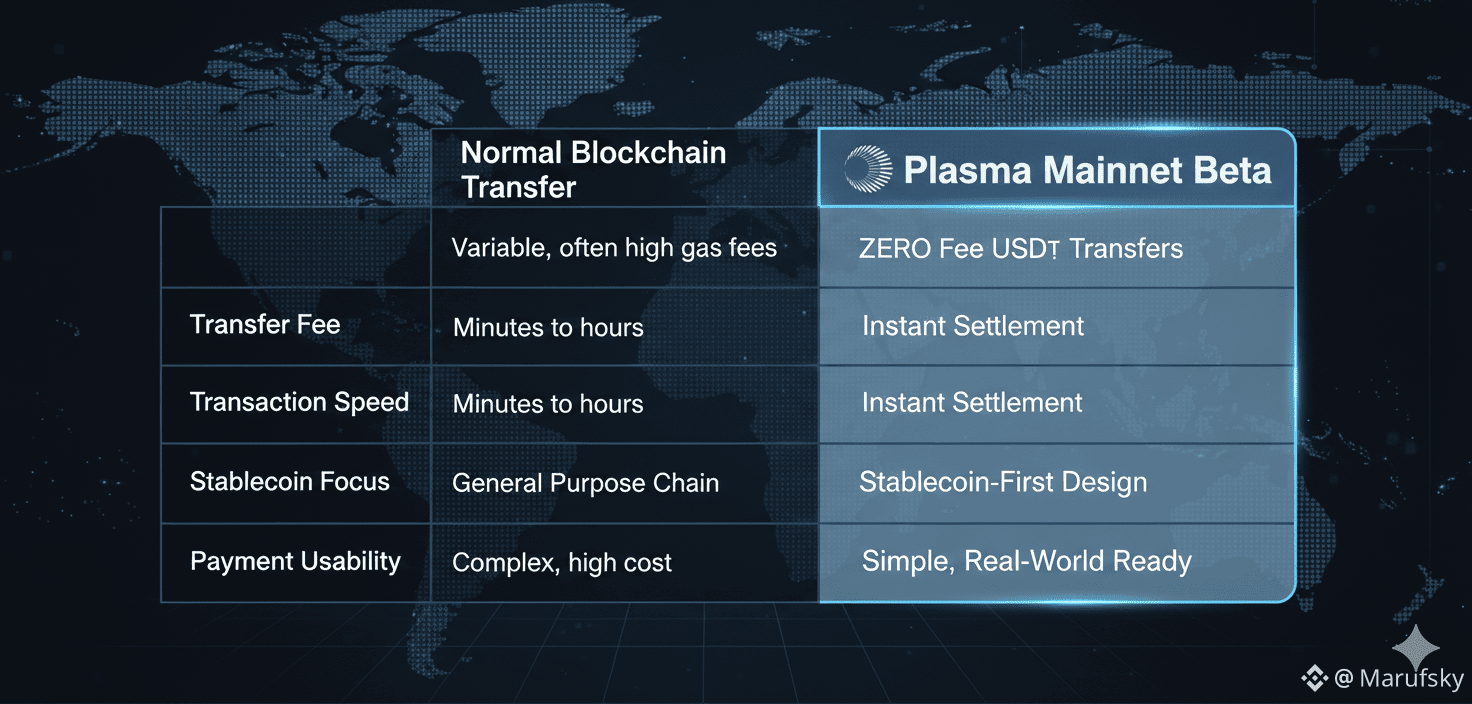

One of the most important features introduced at mainnet beta is zero fee USD₮ transfers through Plasma’s official dashboard. Users can move stablecoins without paying transaction fees, a breakthrough for practical payments and remittances. During the initial rollout, zero fee transfers will apply to Plasma’s own products, with plans to extend this capability across the ecosystem over time.

At the core of Plasma’s infrastructure is PlasmaBFT, a high throughput consensus mechanism designed specifically for stablecoin flows. This allows the network to support fast, efficient, and secure transactions at scale, something traditional blockchains struggle to achieve when handling large volumes of payments.

Plasma’s vision extends far beyond DeFi. The network is being built to support real world financial distribution, including payments, foreign exchange, card networks, and on and off ramps. By connecting onchain dollars with physical peer to peer cash networks, Plasma aims to bring digital dollars into everyday life, especially in regions underserved by legacy financial systems.

This global approach recognizes a key truth. Money runs on distribution and trust. Plasma plans to grow country by country, integrating deeply into local markets and using existing networks people already rely on. This strategy positions Plasma as more than a blockchain. It is a financial infrastructure layer for the real economy.

Powering this system is XPL, the native token of the Plasma network. XPL secures the chain, aligns validators, and ensures that ownership belongs to the community rather than a small group of insiders. Ten percent of the total supply was sold in a public sale designed for wide participation, and additional XPL is being distributed to smaller depositors, contributors, and members of the Stablecoin Collective.

The Stablecoin Collective plays a central role in Plasma’s ecosystem. What started as an educational forum has grown into an active community that supports adoption, development, and real world usage of stablecoins. By allocating tokens to contributors and early participants, Plasma reinforces its commitment to shared ownership and long term alignment.

From a broader perspective, Plasma is entering the market at a critical moment. Stablecoins are already transforming financial access in emerging markets by protecting purchasing power, reducing remittance costs, and enabling borderless payments. For hundreds of millions of people, digital dollars are no longer an alternative. They are the primary financial tool.

Plasma positions itself as the rails that make this transformation scalable, compliant, and accessible to everyone. With mainnet beta and the launch of XPL, the network takes a decisive step toward building a new global financial system where stablecoins function as everyday money.

Stablecoins represent Money 2.0. Plasma is building the infrastructure that puts them into the hands of the world.