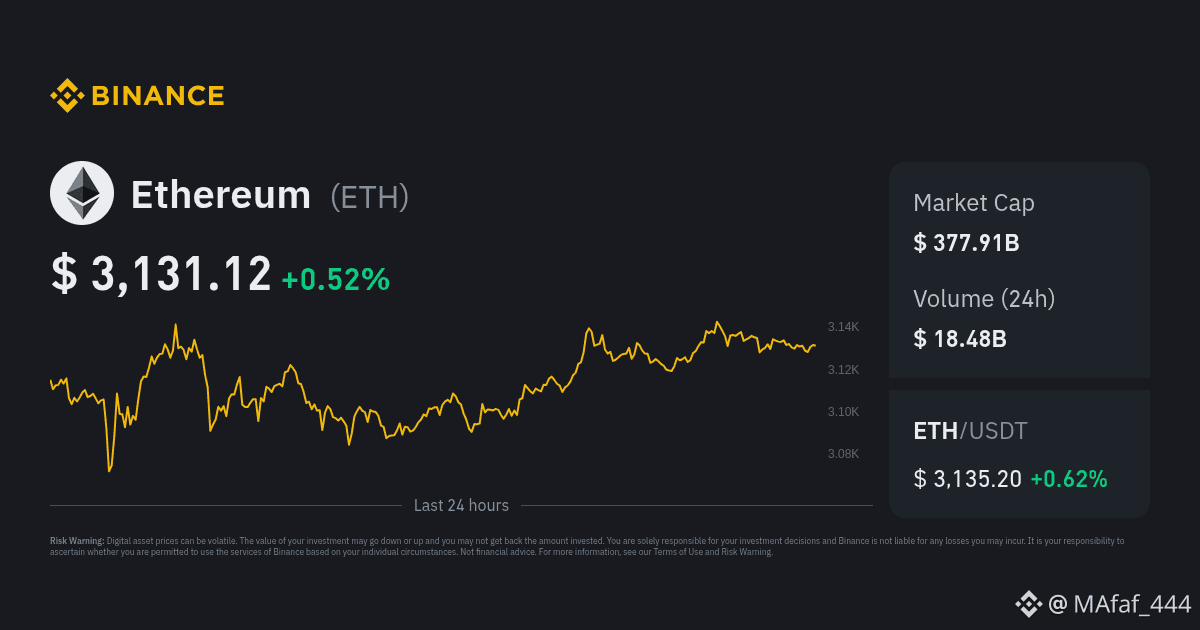

$ETH Ethereum (ETH) is a decentralized platform enabling smart contracts and dApps, with its native cryptocurrency, Ether, trading at approximately $3,294.82 as of January 17, 2026. Analysts are broadly bullish on its long-term prospects due to institutional interest, network upgrades, and its core role in decentralized finance (DeFi), though short-term volatility and regulatory uncertainty remain key risks.

Key Insights

Price Performance: ETH has risen by about 5.47% over the last week and 10.51% over the last month, but is down slightly, by 0.24%, over the last year. Its all-time high of approximately $4,955.3 was reached in August 2025.

Institutional Adoption: Institutional interest is a major driver, with spot Ethereum ETFs seeing positive inflows and large firms accumulating significant amounts of ETH.

Network Activity: Network activity is increasing, with the number of new addresses doubling monthly and record levels of ETH locked in staking contracts, tightening the circulating supply. Over 50% of the total ETH supply is now staked.

Price Predictions: While some technical analysis suggests a short-term bearish outlook, many analysts project significant long-term growth, with some forecasts for 2026 ranging from $7,000 to $10,000 or higher, driven by mainstream adoption and the growth of tokenized assets.

Key Risks

Volatility: The price of ETH is highly volatile and subject to rapid fluctuations.

Regulatory Uncertainty: The evolving legal status and potential for new regulations could impact demand and value.

ETH2,971.19-1.56%

ETH2,971.19-1.56%Competition: Other blockchains offering faster or cheaper services pose a competitive threat to Ethereum's dominance.

Technical Complexity/Security: The complexity of software upgrades and the potential for smart contract vulnerabilities introduce risks.