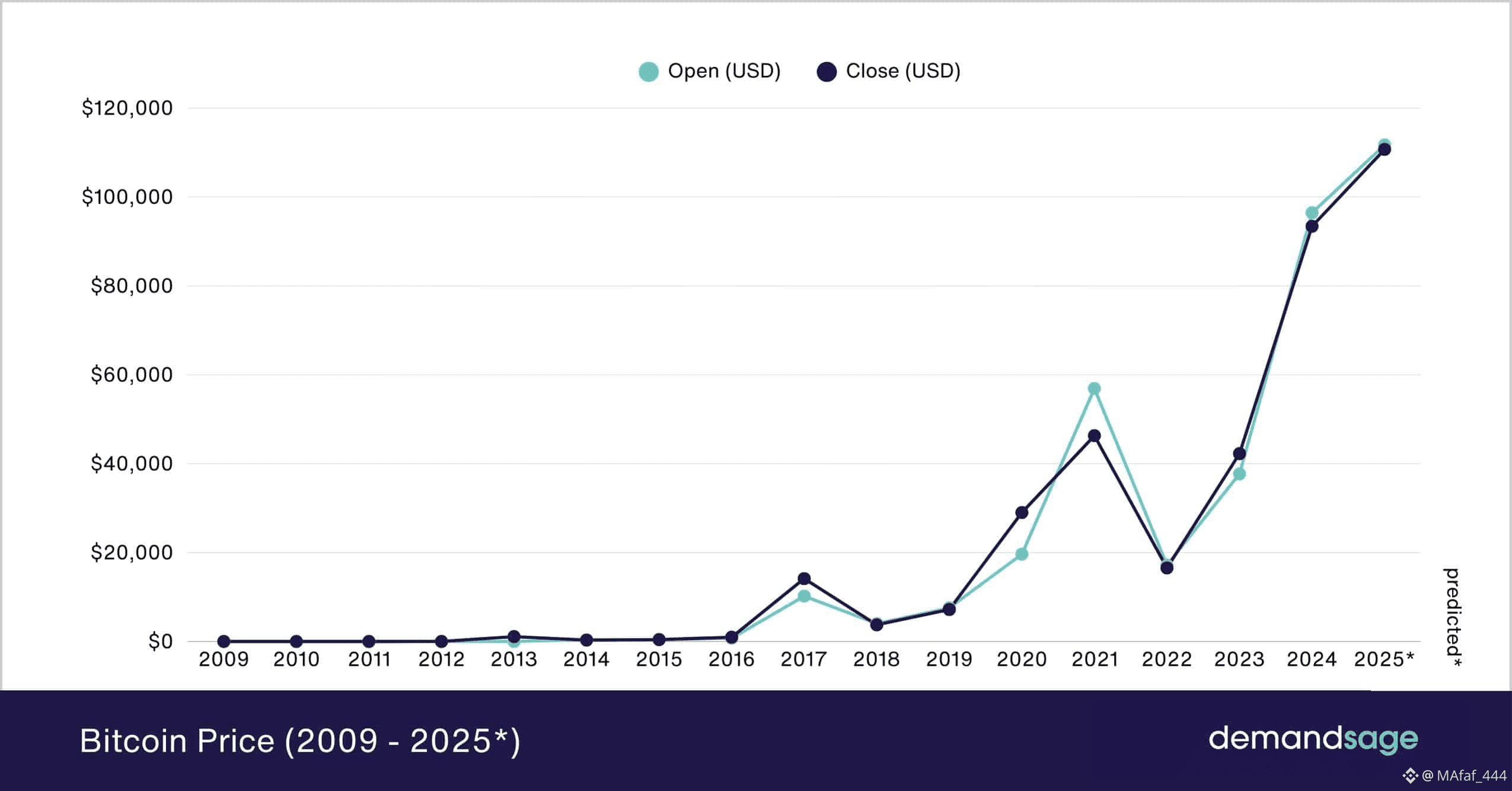

$BTC Crucial Resistance: The $101,000 level is a significant technical resistance point, coinciding with key moving averages (like the 50-week SMA). Sustained trading below this level indicates that Bitcoin remains in a bear market or a consolidation phase, according to some analyses.

Bullish Signals: Despite the resistance, several technical indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD), show bullish divergence and strength. This suggests a potential market bottom and a build-up of momentum for an upward movement.

Institutional Demand: Strong institutional demand, particularly through spot Bitcoin ETFs, is a major positive catalyst, with inflows consistently absorbing more supply than miners produce. This creates a supply squeeze that is fundamentally supportive of higher prices.

Macroeconomic Factors: The potential for easing inflation and future interest rate cuts in 2026 could create a "risk-on" environment favorable to assets like Bitcoin. However, overall macroeconomic uncertainty and a strong U.S. dollar could pose risks.

BTC89,640.45+0.56%

BTC89,640.45+0.56%Price Outlook: A decisive daily close above $101,000 or the slightly higher $106,000 resistance would confirm a potential breakout into a new price discovery phase. Failure to hold crucial support levels below the $100,000 mark, however, could lead to a deeper correction.

For live prices and detailed charts, you can visit financial platforms such as Binance or TradingView.