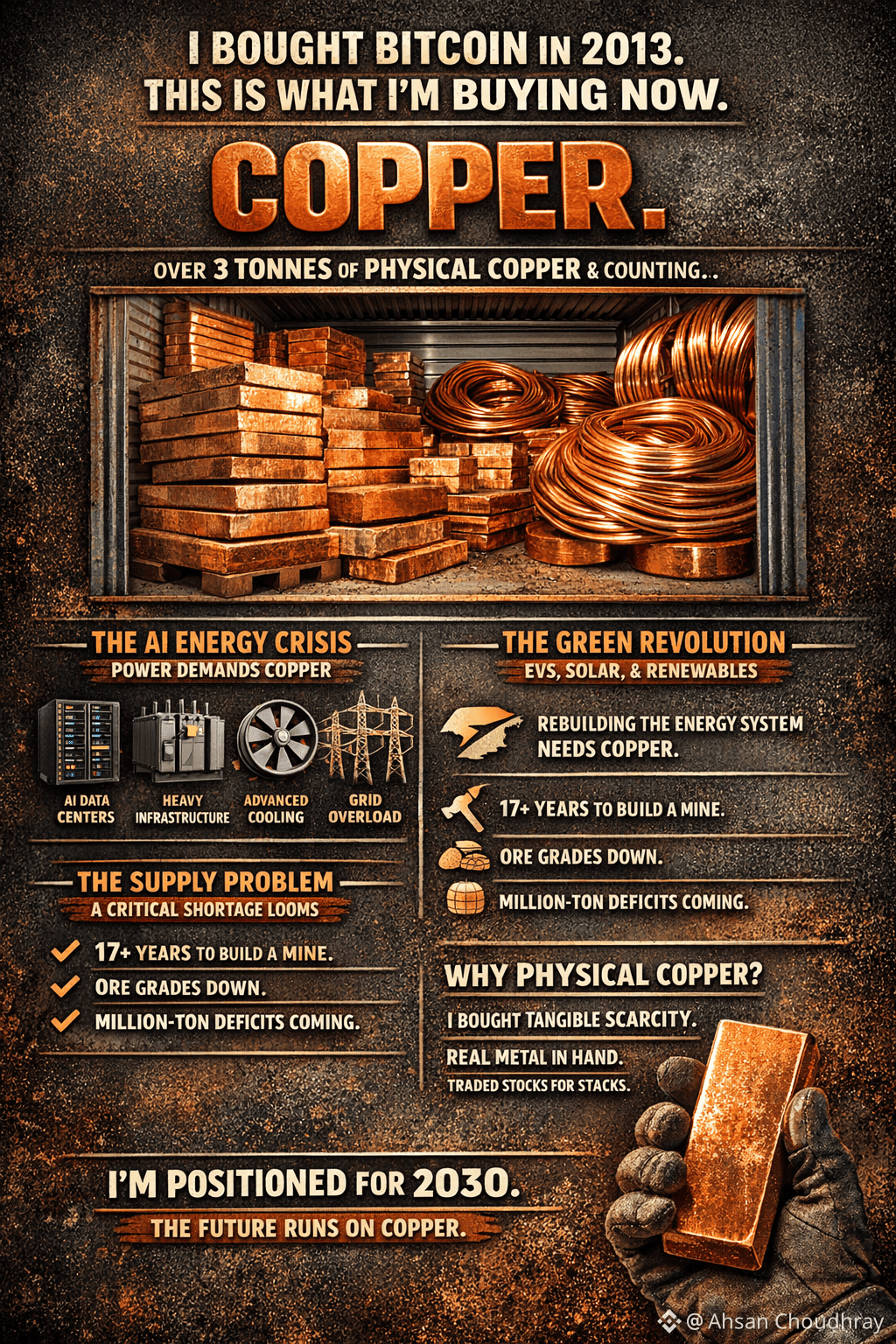

Over the past couple of months, I’ve accumulated more than three tonnes of physical copper.

Yes — real metal.

I even rented a dedicated storage space for it.

From here on out, I plan to add one tonne every month.

This isn’t a short-term play.

This is long-term positioning for the next economic cycle.

People who understand why copper matters today also understand where the world is heading tomorrow.

⚡ THE AI ENERGY CRISIS NO ONE IS TALKING ABOUT

Copper demand isn’t rising just because of electric vehicles.

It’s rising because AI runs on power — and power runs on copper.

Modern data centers are: • Energy monsters

• Heat factories

• Infrastructure nightmares

They need: • Heavy-duty wiring

• New transmission lines

• Transformers

• Advanced cooling systems built with copper tubing and plates

A recent 2026 forecast suggests global data-center capacity could expand 10x by 2040.

You can’t connect that to today’s grid.

The entire system must be rebuilt — and copper is the choke point.

🌱 THE GREEN REVOLUTION IS ACCELERATING

Even without AI, the numbers are insane:

• An electric car uses three times more copper than a gas car

• Wind farms and solar plants are copper-hungry

• Battery storage and charging networks depend on it

We’re trying to redesign the world’s energy system in 25 years

using a metal that hasn’t been mined yet.

⛏️ THE SUPPLY PROBLEM (THIS IS THE REAL EDGE)

This is where copper starts to resemble Bitcoin.

You can’t just create more supply overnight.

• It takes 17–20 years to build a major mine

• New discoveries today won’t matter until the 2040s

• Ore quality keeps dropping

• Costs keep rising

• The easy copper is already gone

By the 2030s, experts expect a multi-million-ton annual shortage.

Even higher prices won’t fix it —

because you can’t buy what doesn’t exist.

🧱 WHY I CHOSE PHYSICAL COPPER

I skipped mining stocks.

Stocks come with: • Political risk

• Share dilution

• Accounting tricks

I wanted real scarcity.

In a world of unlimited money printing,

unlimited leverage,

and unlimited digital assets —

True wealth is physical.

Copper isn’t optional.

You can’t replace it at scale.

Factories will pay any price to secure supply —

or they shut down.

When the crunch hits, copper won’t be seen as just an industrial metal.

It will be treated like a strategic resource.

🔮 MY OUTLOOK

Today’s copper price is a gift.

The fear comes later —

when warehouses are empty

and demand becomes non-negotiable.

I’m moving early.

Quietly.

Consistently.

See you in 2030. 🚀