Ethereum is quietly entering a new structural phase that many investors are still underestimating.

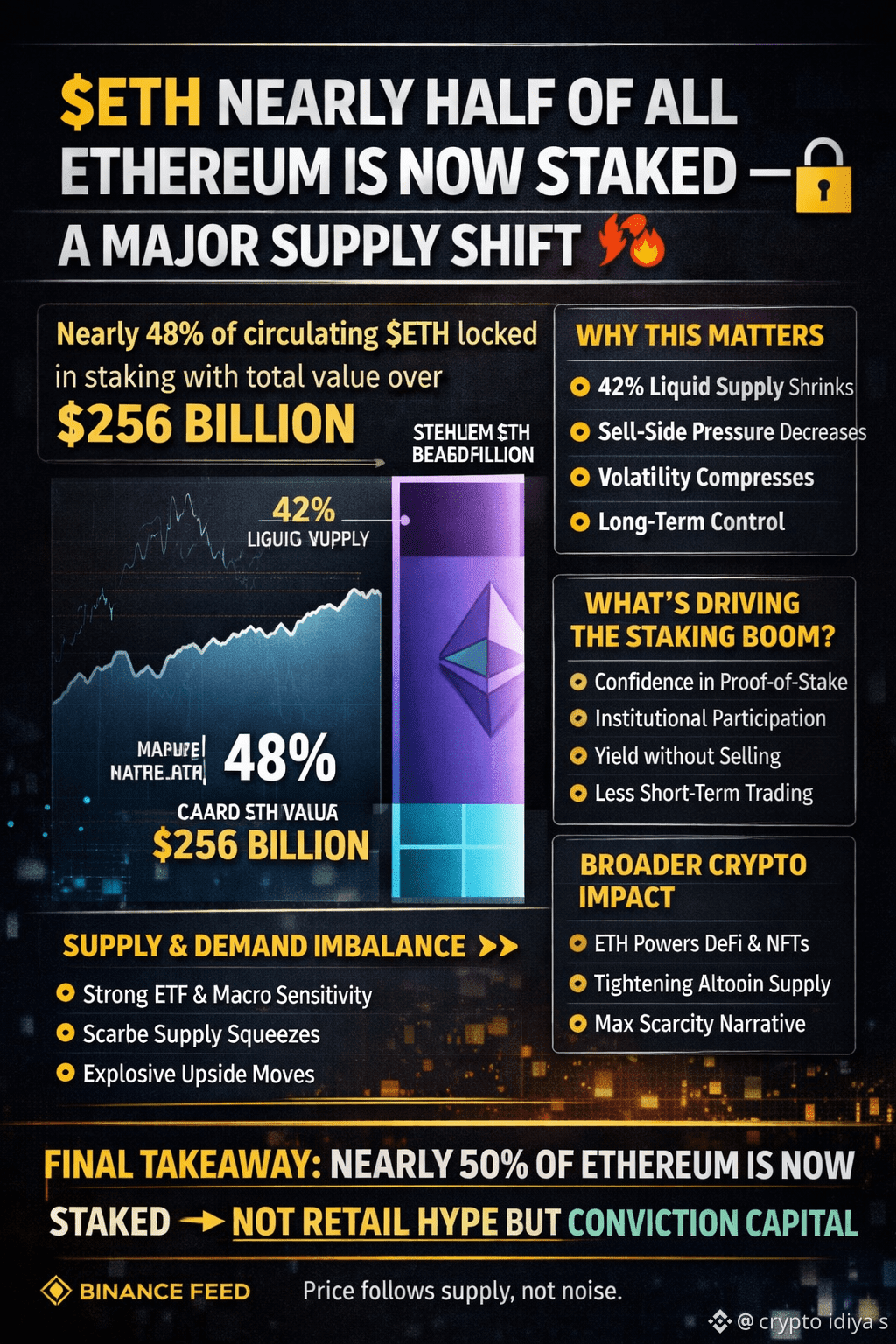

According to Ethereum Beacon Chain data, nearly 48% of the total circulating $ETH supply is now locked in staking, with the total staked value exceeding $256 BILLION. This is not just a milestone — it’s a fundamental supply shock.

🔍 Why This Matters

When almost half of a major asset’s supply is locked:

Liquid supply shrinks

Sell-side pressure decreases

Volatility compresses before expansion

Long-term holders gain control over price structure

This is one of the strongest long-term bullish signals Ethereum has seen in years.

🧠 What’s Driving the Staking Boom?

Confidence in Ethereum’s Proof-of-Stake security

Growing institutional participation

Yield generation without selling

Reduced incentive to trade short-term volatility

Simply put, investors are choosing to lock ETH, not flip it.

📉 Supply vs Demand Imbalance

With nearly half the supply illiquid, even modest increases in demand can cause:

Faster upside moves

Sharper supply squeezes

Stronger reactions to ETF and macro news

This changes how ETH responds to market catalysts.

🔗 Impact on the Broader Crypto Market

Ethereum is the backbone of DeFi, NFTs, and Layer-2 ecosystems. A tightening ETH supply:

Strengthens the entire ecosystem

Supports long-term valuation models

Increases scarcity-driven narratives across altcoins

Projects tied closely to Ethereum’s activity may benefit from this structural shift.

🧠 Final Takeaway

Nearly 50% of Ethereum is now staked — and that number keeps rising.

This is not retail hype. This is conviction capital.

When supply disappears quietly, price usually reacts loudly — just not immediately.

Smart money watches supply. Not noise.$AXS