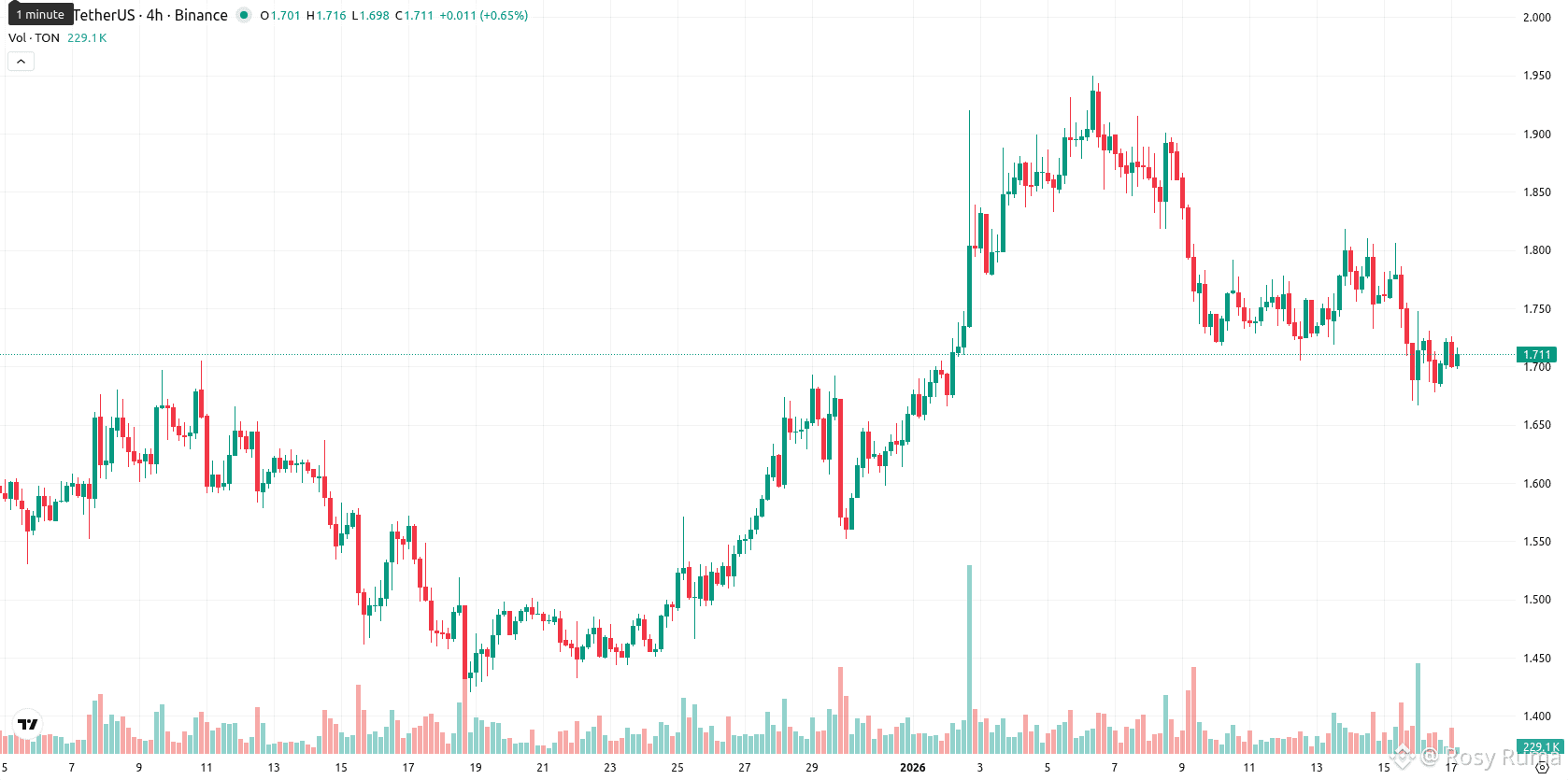

Toncoin ($TON ) is trading near $1.71, posting a 2.02% weekly decline as selling pressure continues to outweigh bullish momentum. The pullback remains orderly, confined within a relatively tight $0.154 weekly range, suggesting controlled downside rather than panic-driven selling.

Despite this stability, TON remains firmly below its weekly moving averages, with the MA-20 at $2.123 and MA-50 at $2.797, reinforcing a bearish medium- and long-term structure.

📊 Market Snapshot & Short-Term Outlook

🔸 24H forecast: −0.47% → $1.71

🔸 48H forecast: +1.16% → $1.73

🔸 7-day forecast: −0.87% → $1.70

🔸 1-month forecast: +12.57% → $1.93

While short-term bounces remain possible, broader projections continue to reflect elevated downside risk if key levels fail.

🚀 Telegram Integration Fuels Ecosystem Growth

One of the strongest bullish undercurrents for Toncoin remains its deep integration with Telegram. On-chain data shows active addresses up nearly 300% year-over-year, driven largely by increased adoption following the WhatsApp ban in Russia, which accelerated user migration to Telegram.

📈 This shift boosted activity across TON-based crypto services, reinforcing the network’s relevance even as price action struggles to recover from last year’s Telegram-linked rally.

⚠️ Technical Indicators Confirm Bearish Momentum

From a technical perspective, signals remain decisively negative:

▪️ Price stays below MA-20 and MA-50

▪️ Ichimoku Kijun resistance at $2.149 remains intact

▪️ MACD & CCI show persistent downtrends

▪️ ADX confirms strong selling pressure

▪️ RSI near 37 signals weakness without oversold relief

Meanwhile, Stoch RSI hints that recent rebounds may lack sustainability, while neutral readings on the Awesome Oscillator suggest no imminent trend reversal.

🔄 Sideways Bias With Downside Risk

📌 For the coming week, TON is expected to trade sideways between $1.66 and $1.76, reflecting bearish dominance paired with moderate volatility.

🔻 A break below $1.66 would expose the asset to deeper losses.

🔺 A sustained move above $1.76 could open a path toward the $2.15 Ichimoku resistance, though current probabilities remain low.

🧠 Expert View

Anton Kharitonov, analyst at Traders Union, notes that Toncoin continues to display a clear bearish structure, despite constructive ecosystem news:

“As long as TON remains below $1.76 and sellers control momentum, short-term rallies should be treated defensively rather than as trend reversals.”

He adds that while volatility remains moderate, there is no confirmation of a durable support base at current levels.

🧾 Final Takeaway

🔍 Toncoin’s fundamentals show growth, but price action tells a different story.

Telegram-driven adoption is strengthening the ecosystem, yet technicals continue to favor consolidation or further downside unless a decisive breakout occurs.

Until then, $1.66 remains critical support — and $1.76 the line bulls must reclaim.