$HYPE Token Faces Renewed Downside Pressure

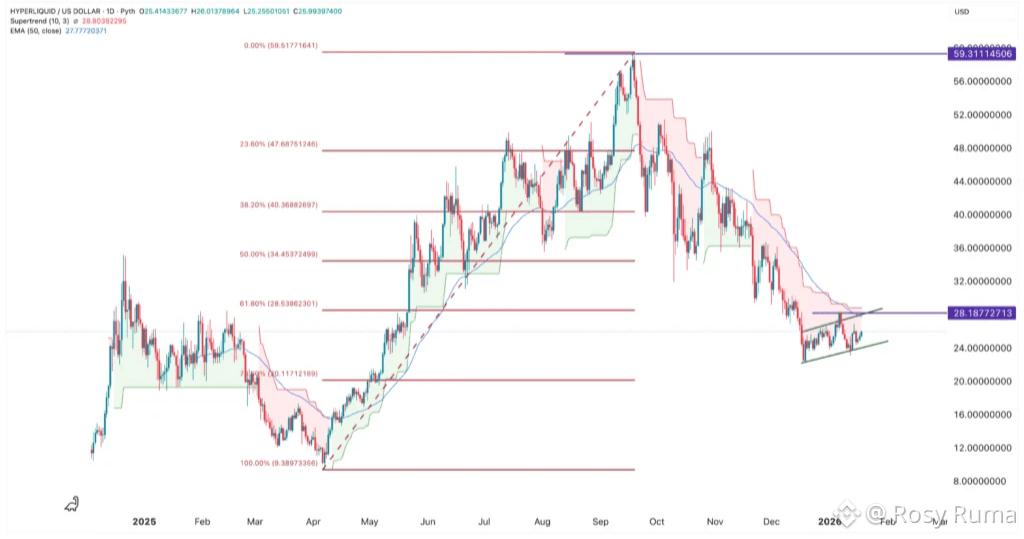

HYPE, the native token of Hyperliquid, has remained under heavy pressure over the past few months. After peaking at a record $60 in September, the token has fallen sharply to around $25.8, marking a steep 56% decline. The recent price action suggests that bearish momentum is far from over.

Beyond the broader crypto market weakness, HYPE has formed multiple high-risk technical patterns, increasing the probability of further downside in the near term.

📊 Technical Indicators Signal Bearish Continuation

On the daily chart, HYPE’s decline began shortly after forming a head-and-shoulders pattern, a classic bearish reversal signal. The sell-off accelerated once the token broke below the 61.8% Fibonacci retracement level at $28.5, reinforcing the negative outlook.

📉 The price now trades below all key moving averages, a strong indication that sellers remain firmly in control. In addition, HYPE has formed a bearish flag pattern, typically characterized by a sharp drop followed by a weak upward channel—often preceding another leg lower.

The token also continues to trade below the Supertrend indicator, further validating the bearish bias.

🔮 Outlook:

The most likely scenario points toward a drop to $20, representing roughly 22% downside from current levels. However, a sustained move above $28 would invalidate the bearish structure and signal potential trend reversal.

⚔️ Hyperliquid’s Perpetual DEX Faces Intensifying Competition

Market-wide weakness has played a key role in HYPE’s decline. Bitcoin has retreated from its October high of $126,200 to around $95,000, while major altcoins like Ethereum and Cardano have also posted significant losses.

At the same time, Hyperliquid’s on-chain metrics have weakened amid rising competition in the perpetual futures market.

📉 Data from DeFi Llama shows total perpetual futures volume has fallen from $1.32 trillion in October to $521 billion this month. Hyperliquid’s own trading volume declined sharply—from $396 billion in August to just $94 billion—dragging monthly fees down to $36 million, well below last year’s $144 million peak.

📈 Rivals Gain Ground as Hyperliquid Loses Dominance

Competition has intensified rapidly. Over the past 30 days:

• Aster processed more than $123 billion

• Lighter handled around $118 billion

• Grvt recorded roughly $40 billion

• Hyperliquid processed about $145 billion

Once the undisputed leader, Hyperliquid is now facing sustained pressure from multiple fast-growing rivals.

🔐 TVL and Stablecoin Supply Continue to Shrink

Further weakness is visible in Hyperliquid’s ecosystem metrics. Total value locked (TVL) on its layer-1 network has dropped to $2.65 billion, down from an all-time high of $8.35 billion. Meanwhile, stablecoin supply has fallen to $4.9 billion, compared with a peak of $6.2 billion.

📉 These declines directly impact HYPE token buybacks and burns, as the protocol relies on network fees to repurchase and destroy tokens—an important mechanism for reducing circulating supply.

🧠 Bottom Line

With weakening technicals, falling on-chain metrics, and rising competition, HYPE remains vulnerable in the short term. Unless key resistance levels are reclaimed and network activity rebounds, downside risks are likely to persist.