When the Federal Reserve calls an emergency meeting, markets pay attention. Not because panic is guaranteed—but because stress has reached a level that can no longer be ignored.

This isn’t routine. And it matters for crypto.

🔍 What an Emergency Fed Meeting Usually Signals

Historically, unscheduled Fed meetings tend to appear when:

Liquidity tightens faster than expected

Funding markets show early signs of strain

Volatility risk rises across equities, bonds, and FX

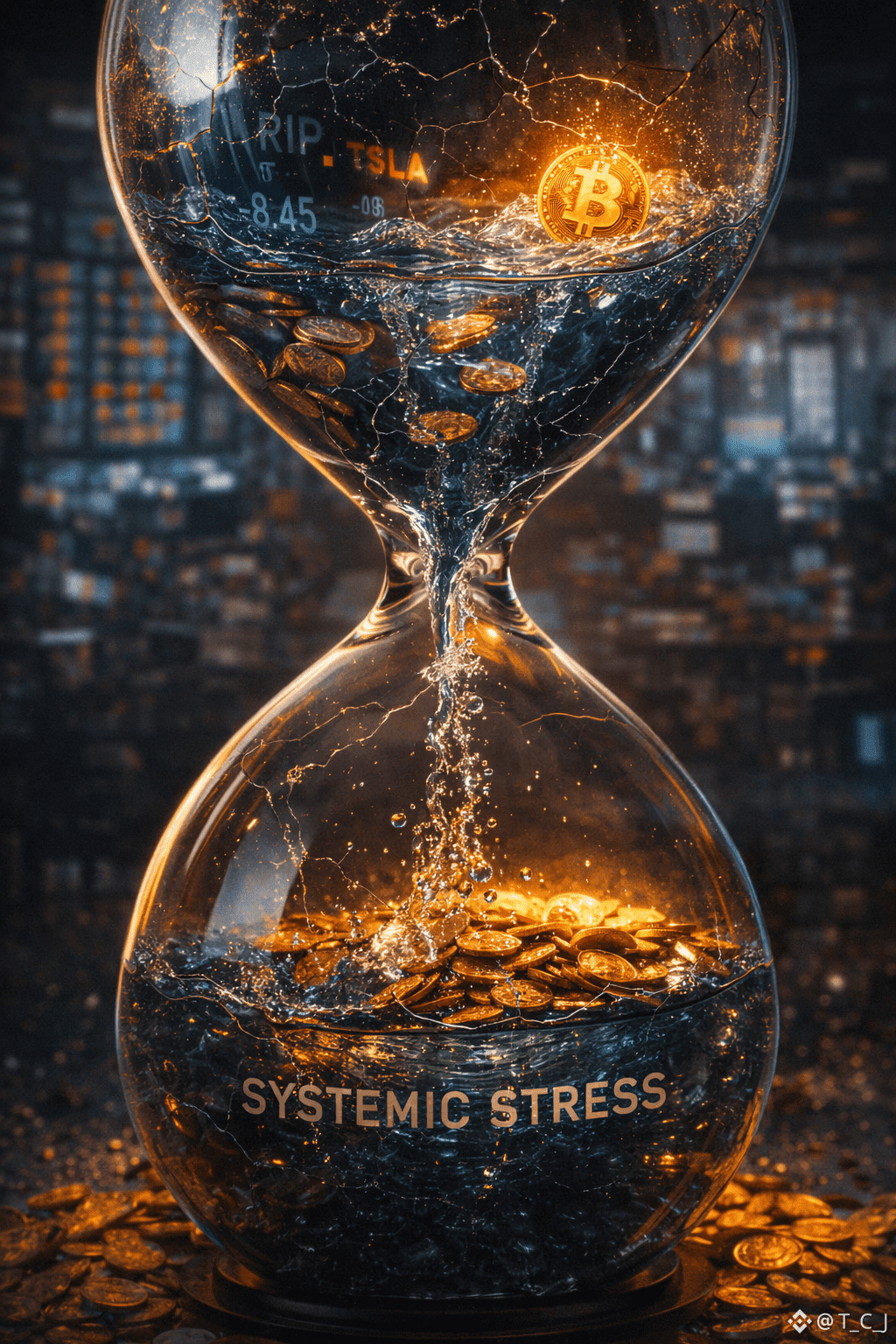

The Fed rarely reacts to price moves alone. It reacts to systemic stress.

🌊 Liquidity Is the Real Story

Markets don’t crash because of bad news—they crash when liquidity disappears.

Right now, warning lights include:

Rising short-term funding stress

Increased demand for safety in cash-like instruments

Sudden repricing across correlated risk assets

Crypto, as a high-beta liquidity asset, feels this faster than most.

📉 How Crypto Typically Responds

In early stress phases:

Risk assets can sell off together

Correlations rise (BTC trades like macro risk)

Leverage gets flushed before direction becomes clear

Later, if liquidity support follows, crypto often recovers before traditional markets.

Timing is everything.

🧠 How I’m Thinking About the Market

This is not the moment for emotional trades.

Key focus areas:

Position sizing over predictions

Cash and flexibility matter

Watch liquidity signals, not headlines

The goal is survival first, opportunity second.

🧭 Final Thought

Emergency meetings don’t mean collapse—but they do mean conditions have changed. Markets reward patience during uncertainty and punish overconfidence.

Stay sharp. Stay liquid. Let the market reveal its hand...

#Liquidity