$BTC Here’s a short analysis of Bitcoin dropping toward ~$95,000 (BTC/USDT) with context and visuals on the price action:

4

4

📉 What Happened

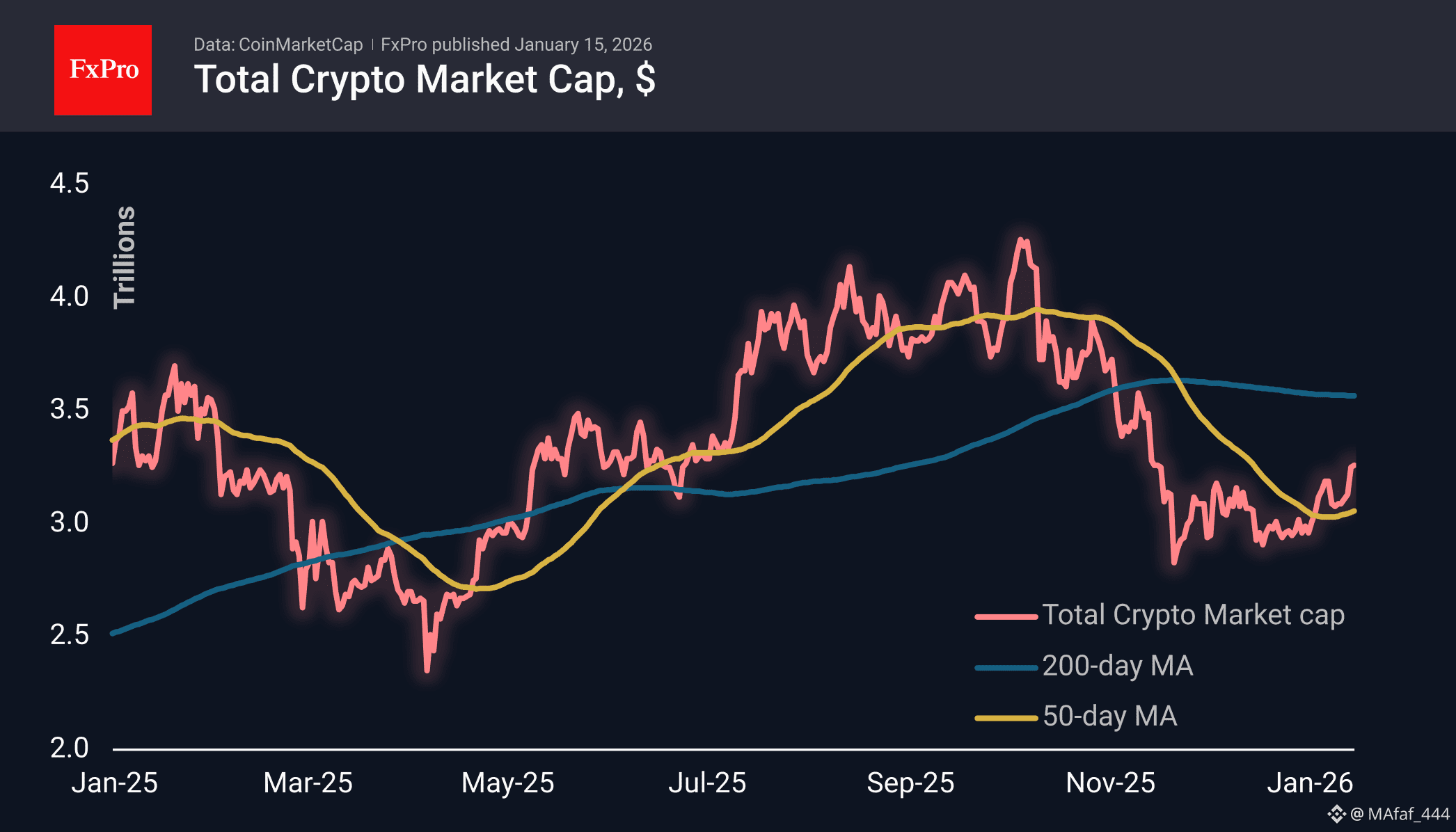

Bitcoin’s price recently dropped to around $95,000 USDT, dipping below the key psychological level that had acted as support in recent weeks. This movement reflects broad crypto market volatility and profit-taking after prior highs near $126,000 earlier.

📊 Key Drivers Behind the Drop

1. Regulatory/Policy Uncertainty

Delays in crypto-related regulatory clarity — such as a delayed US Senate crypto bill — weighed on risk sentiment, reducing bullish pressure.

2. Market Structure & Profit-Taking

After recent rallies and new highs, traders and institutions booked profits, which triggered selling pressure once key supports were tested.

3. Macro & Risk Appetite

Risk-off moods in broader financial markets can pull capital out of volatile assets like Bitcoin, pushing prices lower toward critical support ranges.

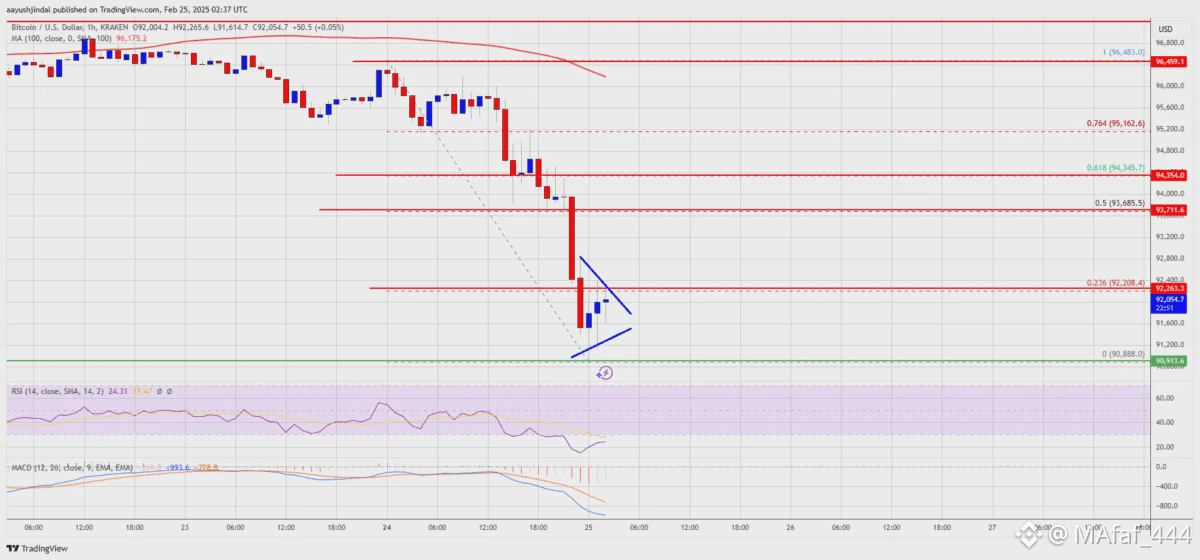

📈 Technical Context

• $95,000 is a psychological and technical support zone — losing it can open up potential moves lower or a deeper correction.

• Short-term indicators often show oversold conditions near such levels, signaling possible relief rallies if buyers step in.

🧠 What It Means

Bearish near-term tone: Price breaking below $100K and approaching $95K reflects weakening bullish momentum, with traders cautious about upside continuation.

Support and rebound potential: If markets stabilize or positive catalysts (like ETF inflows or macro supportive data) emerge, BTC could retest $100K levels again. (Price behavior is often influenced by sentiment shifts.)